This week’s best investing news:

Greenlight’s David Einhorn on Value Investing, Inflation (Bloomberg)

Legends of Market History: Abraham van Ketwich (Jamie Catherwood)

‘Don’t Always Bet On Up’ with Ray Dalio (Best New Ideas in Money Festival)

The Sages of Wall Street (Verdad)

Ariel Investments’ John W. Rogers, Jr. on Finding Value in Volatility (Bloomberg)

Exclusive: Carl Icahn talks about his Twitter investment (Fortune)

Dimon: S&P could yet fall by ‘another easy 20%’ from current levels (CNBC)

Little Rules About Big Things (Collab Fund)

Transcript: Michael Levy (Barry Ritholz)

There Will Be Drawdowns (Compound Advisors)

Aswath Damodaran The market right now has little to do with value (CNBC)

Carrying On (Humble Dollar)

Michael Mauboussin – Return on Invested Capital (MS)

Long Term Investing is Hard (Safal)

Cathie Wood Warns Fed of Policy Error as Rate Hikes Hit ARK (Bloomberg)

Citadel’s Funds Gain Double-Digits During Volatility (Validea)

We are getting ready to deploy our recession playbook, says legendary investor Paul Tudor Jones (CNBC)

Daniel Kahneman | Wellbeing Research & Policy Conference 2022 (Oxford University)

Jeffrey Gundlach on UBS Market Moves Podcast (DoubleLine)

Bill Nygren Market Commentary | Q3 2022 (Oakmark)

David Giroux: Stocks Are Cheap: Contrarian Stock Buys (WeathTrack)

The Fed was wrong about inflation and wrong about how to fix it, says Charles Bobrinskoy (CNBC)

How to Make Peace With Your Stock Market Losses (WSJ)

There Will Be Drawdowns (Compound Advisors)

Wedgewood Partners Third Quarter 2022 Client Letter (Wedgewood)

This week’s best value Investing news:

GMO: Value vs Growth: The Unwind Continues (GMO)

A Tidy Logic For Value Investing (Verdad)

David Einhorn: Not Sure Value Investing Will Come Back (Bloomberg)

TIP482: How Warren Buffett Became the Greatest Investor to Ever Live (Part 1) (TIP)

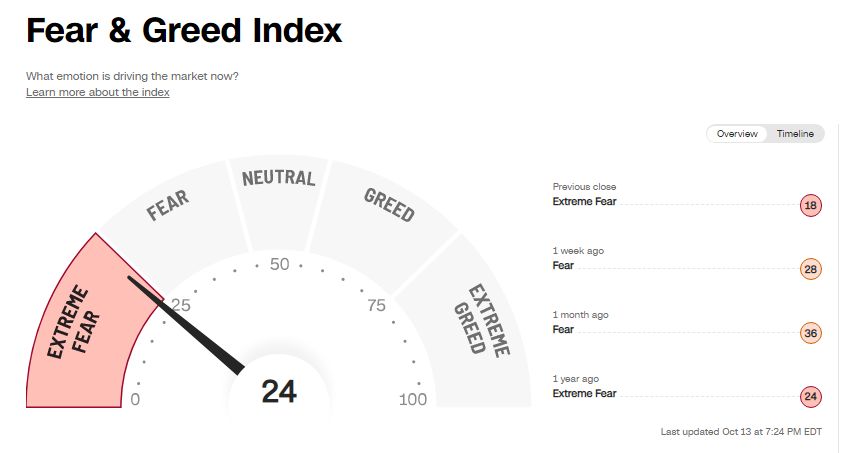

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Episode #449: Jim Rogers – The Adventure Capitalist’s View of Global Markets (Meb Faber)

TIP482: How Warren Buffett Became the Greatest Investor to Ever Live (TIP)

The Rewind: Global Financial Crisis (Howard Marks)

Ep. 246 – Durable Growth: Investing in the Eye of the Storm Right Now (Planet MicroCap)

Show Us Your Portfolio: Dr. Daniel Crosby (Excess Returns)

David Senra — Pick The Right Heroes (Infinite Loops)

Madhavan Ramanujam – How to Price Products (Invest Like The Best)

How to Prepare the World for a Peaking China (Hidden Forces)

Louis-Vincent Gave – The Case for Emerging Markets (Capital Allocators)

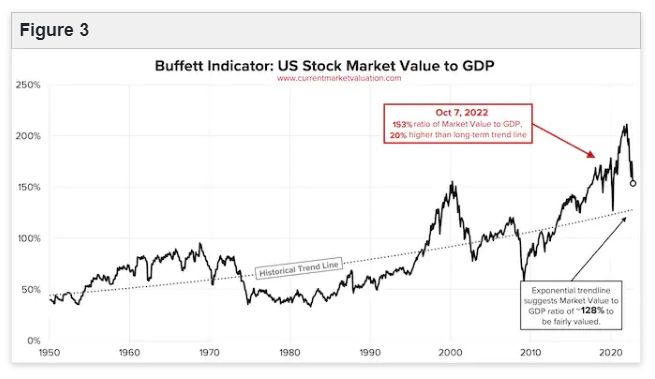

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

What is the Story Behind Trend Following? (AlphaArchitect)

Tricks of the Private Equity Trade, Part 1: Value Drivers (CFA)

Enhancing Growth and Income Potential with Convertible Bond ETFs (AllAboutAlpha)

This week’s best investing tweet:

This week’s best investing graphic:

Investors have been trained to welcome financial crises (Strategas)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: