In their recent article titled, Is the Value Run Over? – When “All Else Equal” Is Rarely True, the team at Brandes explain why the tailwind for value investors continues. Here’s an excerpt from the article:

The world’s events in the past few months have had a binary effect: on one hand, it deflated hope of a sustained economic recovery—replacing it with concerns about a slowdown or even recession; on the other hand, it amplified worries about continued inflation.

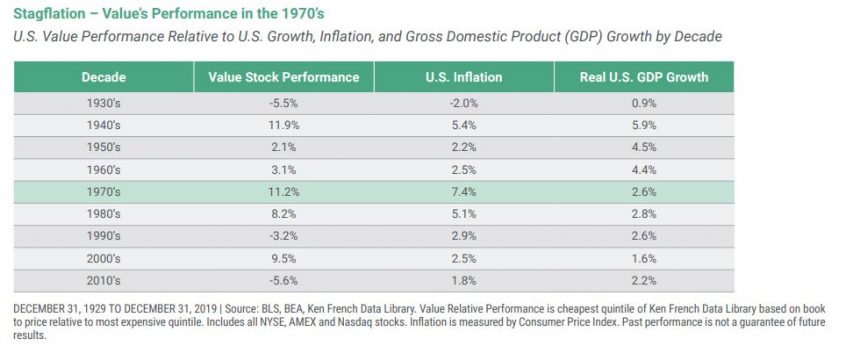

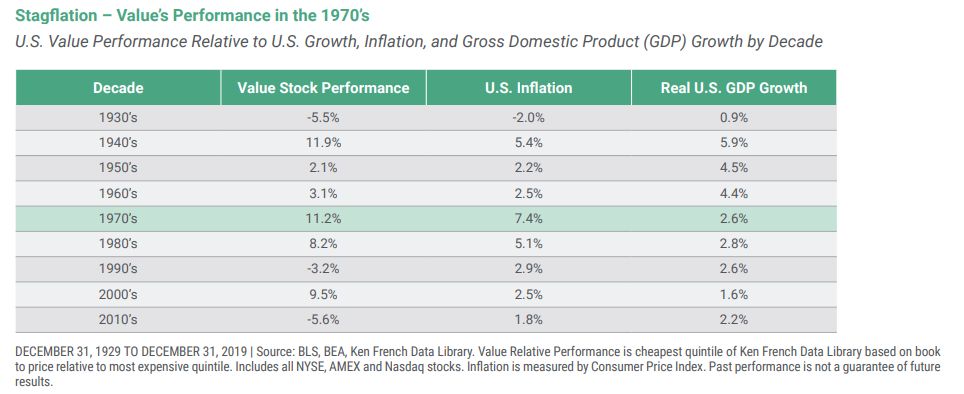

The term “stagflation” (a period marked by low economic growth and high inflation) resurfaced. Amid this environment, our clients and prospects have asked: Wouldn’t slower economic growth be “bad” for value? Is the value run over? The short answer to the first question is: yes, low economic growth has tended to be a headwind for value—all else being equal.

However, “all else” is hardly ever equal. In fact, two of the best periods for value’s performance relative to growth were in the 1970s post-Nifty Fifty era (when the term stagflation was first widely used) and during the post-tech bubble market correction in the early 2000s.

These two periods shared common factors that culminated in a very favorable environment for value: the general market had been in a state of elevated valuations and the valuation spreads between value and growth were at historic levels.

We observe the same attributes in today’s environment. Even after value’s overall outperformance relative to growth in the past 18 months, valuation spreads remain historically high. The general market also continues to exhibit what we consider elevated valuations.

Furthermore, despite concerns about slower economic growth, post-COVID recovery potential persists, as do other market characteristics that have tended to be favorable for value—namely rising inflation and interest rates. In our opinion, these factors outweigh the prospect of slower economic growth, and we are as bullish on value as we have been in over a decade.

You can read the entire article here:

Brandes: Is the Value Run Over? – When “All Else Equal” Is Rarely True

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: