This week’s best investing news:

Warren Buffett Interview – Charlie Rose (Charlie Rose)

Mohnish Pabrai’s Q&A session with Doctors Investing Group (MP)

Panic Series: 1907 (Jamie Catherwood)

Heresy (Paul Graham)

Risk-Reward in a Hiking Cycle (Verdad)

Staying Put (Collaborative Fund)

Four Experts Help Us Understand Inflation – And What It Means for Investors (Validea)

NGMI (Epsilon Theory)

Wrong Number (Humble Dollar)

Stanley Druckenmiller, Part 3: The Crash of 1987 (Insecurity Analysis)

Michael Mauboussin – Intangibles And Earnings – Improving The Usefulness of Financial Statements (MS)

Loss aversion across the ages (Klement)

Transcript: Jonathan Lavine (MIB)

@elon (Scott Galloway)

April Views from First Eagle Global Value Team (FEIM)

700+ reasons why S&P 500 index investing isn’t very ‘passive’ (TKer)

Ron Insana: Peter Thiel’s ‘sociopaths’ know something he doesn’t (CNBC)

The Inverted Yield Curve Omen (Compound Advisors)

Investing Amid Market Volatility and Global Tensions (Weitz)

Stock Splits Actually Work—Just Not for the Reason Everyone Thinks (Barron’s)

All Active Investment Decisions Are About Valuation or Price (Behavioural Investment)

Let’s Hope Bill Ackman Doesn’t Mellow Too Much (Washington Post)

The Boyar Value Group 1st Quarter Client Letter (Boyar)

International Premier Quality Strategy—1Q22 Update and Outlook (Royce)

Twitter & Elon Musk (Brian Langis)

You Work for a Company. Should You Own It, Too? (Jason Zweig)

Warren Buffett’s Berkshire Hathaway announced $22 billion of investments last quarter — marking a huge increase in its spending (Markets Insider)

Billionaire Trader Ken Griffin Navigates A Flock Of Black Swans (Forbes)

Meet 2022’s Hedge Fund Rising Stars (institutional Investor)

Wharton professor Jeremy Siegel says we’re going to see a choppy market (CNBC)

Inflation Is Here to Stay. Here’s How to Adjust Your Portfolio (Barron’s)

Buffett’s $11.6 Billion Deal Started With a Dinner in New York (Bloomberg)

Mohamed El-Erian’s Argument Against Market-Timing (Morningstar)

A Few Things We Learned (Octahedron Capital)

Bill Nygren Market Commentary | 1Q22 (Oakmark)

Sequoia Fund Q1 2022 (Sequoia)

Oakmark Select Fund: First Quarter 2022 (Oakmark)

This week’s best value Investing news:

The Turn In Value Is Just Getting Started (GMO)

Long-Only Value Investing: Does Size Matter? (papers.ssrn)

Deep value: three reasons for investors to be cheerful (Larry Swedroe)

Style-Box Update: No Surprise That Value Investing Has Returned (investing.com)

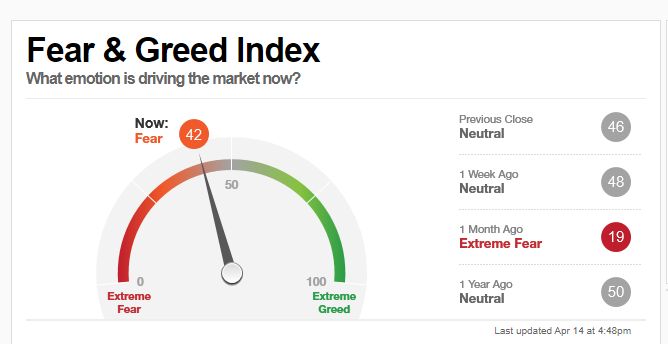

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Alexandr Wang – A Primer on AI (Invest Like The Best)

Diego Parrilla On The Three Levels Of The Investment Game (Felder)

RWH004: Intelligent Investing w/ Jason Zweig (TIP)

How Scott Hanson Grew Allworth Financial From $10M Into a $15B RIA (Barron’s)

364- Pricing Power (Part 1) (InvestED)

Sebastian Mallaby – The Making of the New Future in Venture (Capital Allocators)

Kunik – A Conversation About Culture (Business Brew)

#276 – Michael Saylor: Bitcoin, Inflation, and the Future of Money (Lex Fridman)

Moats & Meme Stocks ft. return of Speccy Magee (Equity Mates)

Using Emotions to Make Better Decisions and Deliver Results with ReThink’s Denise Shull (RCM)

Episode #406: Dylan Grice, Calderwood Capital (Meb Faber)

Four Experts Help Us Understand Inflation – And What It Means for Investors (Excess Returns)

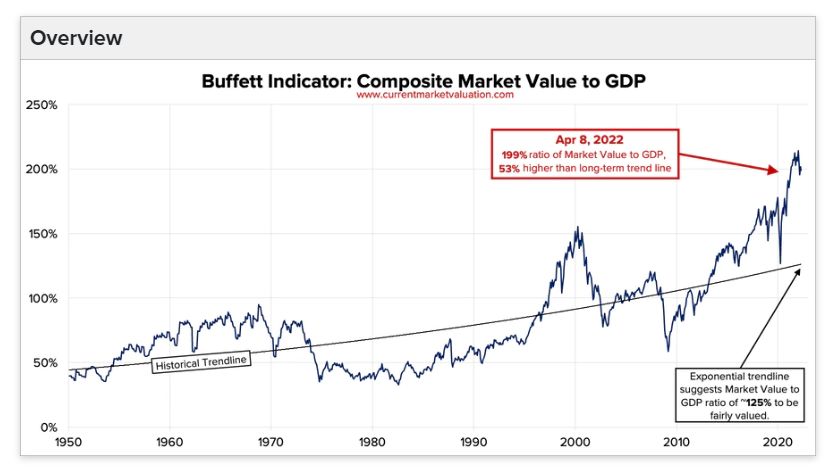

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Bond Investing in Inflationary Times (AlphaArchitect)

Portfolio Diversification: Harder Than It Used to Be? (CFA)

Reputation risk matters – Do investors focus on these risks? (DSGMV)

Diversification … It’s a good thing … up to a point (Slack)

High Yield Slides Lower (AllStarCharts)

Trend Following & Factor Investing – Unexpected Cousins? (AllAboutAlpha)

This week’s best investing tweet:

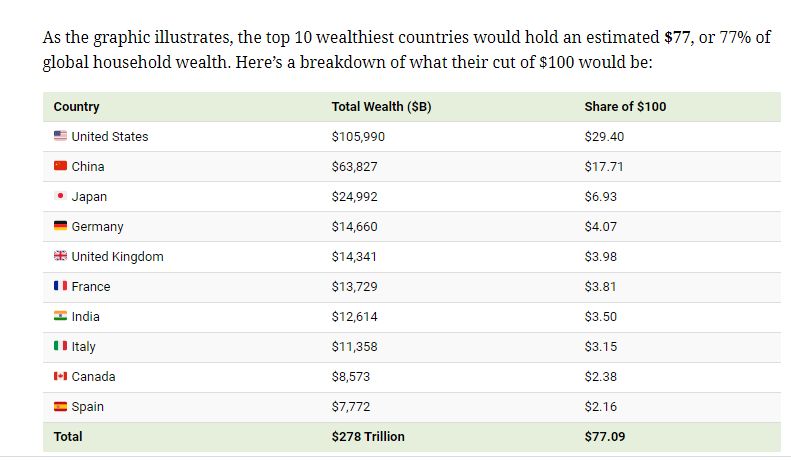

This week’s best investing graphic:

Visualizing the Distribution of Household Wealth, By Country (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: