Here’s a list of this week’s best investing news:

Charlie Munger – Caltech Webinar (Caltech)

Siren Songs: IPOs & SPACs (Jamie Catherwood)

Earnestness (Paul Graham)

Capturing Excess Returns from Rating Changes (Verdad)

Last Man Standing (Collaborative Fund)

Warren Buffet on Saving American Small Business Full Interview (CNBC)

Find The Courage To Act (Felder)

Stephen Mandel – A Virtual Conversation (Family Centers)

Akre Capital: What Do We Mean By Reinvestment? (Akre)

Tribalism in Investing Might Leave You Broke (Vitaliy Katsenelson)

Challenges facing big tech firms (Whitney Tilson)

Would you have become a millionaire in the last bull market? (csinvesting)

Here’s how Oakmark’s Bill Nygren is looking for value in the market (CNBC)

The Cult of Ignorance (Barry Ritholz)

Morgan Stanley Global Outlook 2021 (Morgan Stanley)

The ZIRP Paradox (Epsilon Theory)

An Investor’s Guide to Short Selling (w/ Jim Chanos and Jim Grant) (Real Vision)

Robert Shiller calls stocks ‘highly priced,’ but wouldn’t cash out (CNBC)

John Rogers: This is eerily reminiscent of the 1970s (CNBC)

Highlights From 2020’s Farnam Street “Ask Me Anything” Sessions (Farnam Street)

A Short Tale of a Stock Promoter (Novel Investor)

The Unicorn Decade is over and everyone is a winner (I’m Late To This)

The Impact of Misaligned Incentives (NonGAAP)

Thoughts on the search for alpha (Stock Market Generalist)

The Long-termism of the Stock Market (Tanay)

Roblox and the Dispersal of Creativity (Scott Galloway)

The most overused number in investing (Real Returns)

Lost Money on Stocks? Have No Shame (Safal Niveshak)

How to categorise stocks as quality, defensive and/or value (UK Value)

The risks investors worry about (EB Investor)

The Big Ideas Fintech Will Tackle in 2021 (Andreessen Horowitz)

The Last 10 Years and the Next 10 (Compound Advisors)

Should Value Investors Diversify or Concentrate Their Portfolios? (VVI)

Weekly Earnings Calls 12.14.20 (The Transcript)

To paraphrase Yogi Berra, what can we observe by watching gold and copper? (Brinker)

Inflation Was Sooo 1970s! Will It Roar Back in the 2020s? (Dr Ed)

Value in Emerging Markets (Investment Innovation)

Delusion, fraud and the role of the SEC – the General Electric long-term care case (Bronte)

Individualism and The Unbundling of The Stock Market Indexes (Howard Lindzon)

This week’s best value investing news:

Value Funds Demise: U.S Financial Reporting Is Stuck in the 20th Century (HBR)

Value investing is neglected, not broken (Schroders)

Why value investing is back in vogue (AFR)

Why the Future Now Looks Brighter for Value Investing (T Rowe Price)

First Eagle: While you’re buying value stocks for your portfolio, add some diversity too (Market Watch)

The Value Factor’s Pain: Are Intangibles to Blame? (Factor Research)

This week’s best investing tweet:

If I could advise my younger self, I would say to avoid such confrontational interactions and to treat everyone with kindness and respect. Lewis was clearly not a cultural fit for me or my firm, but there was no need to engage like that or share. Seems immature in hindsight.

— Daniel S. Loeb (@DanielSLoeb1) December 17, 2020

This week’s best investing research:

Placement Agents In Private Equity, Are They Any Good? (Alpha Architect)

Naïve Stock Market Forecasts (PAL)

Will Easy Financial Conditions Reverse? (UPFINA)

Semiconductor Manufacturing In The U.S. (GMM)

Trend-following and market inefficiency – It is in the mean reversion (DSGMV)

Hedge Fund Battle: Discretionary vs Systematic Investing (All About Alpha)

This week’s best investing podcasts:

Episode #272: Best Idea Show – Tobias Carlisle, Acquirers Fund (Meb Faber)

Chris Davis – A Lesson in ‘Value vs Price’ (Stansberry)

#Neversell | Subscription Business Models | Financial Services Disruption (Intelligent Investing)

Sam Hinkie – Find Your People (Invest Like the Best)

295- Luck vs. Skill in Investing with Jake Taylor (InvestED)

TIP327: COVID-19, Vaccine, and the US Economy with Ed Harrison (TIP)

#105: Party like it’s 1999: IPOs Surge as Valuations No Longer Matter (Absolute Returns)

Ed Hyman – Record Monetary Stimulus + Vaccines = Economic Growth [2021] (WealthTrack)

With Fewer Choices, Chasing the Right Stocks to Buy is Critical (Validea)

Jan Hummel – The Rare Advantage of Real-World Experience (Value Investing with Legends)

104 – Terminal Value and Why Intrinsic Value grows over time (DIY Investing)

Twin Momentum: Combining Fundamental and Price Momentum Together In One Quantitative Model (Excess Returns)

Alex Danco – Shopify, SPACs & Status (EP.27) (Infinite Loops)

This week’s best investing graphic:

The Year in Review: 2020 in 20 Visualizations (Visual Capitalists)

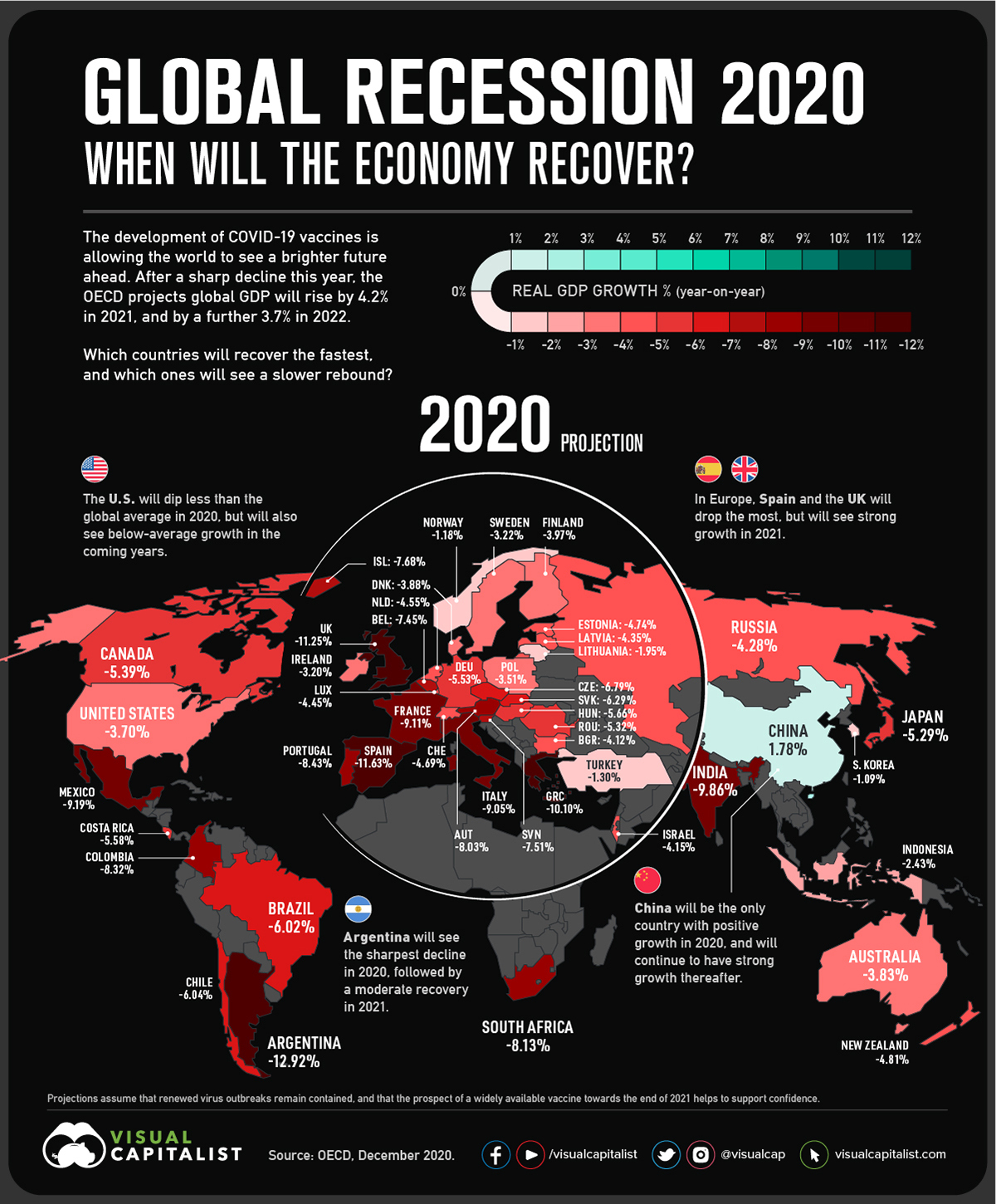

Animation: Mapping the Recovery from the Global Recession of 2020 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: