During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed How To Avoid Blowing Up Your Portfolio. Here’s an excerpt from the episode: Jake: A few approaches that make sense with respecting all this uncertainty that can exist with how fat are the tails. One … Read More

VALUE: After Hours (S05 E27): Precautionary Principle; Value Spread Closes; Market And Economy Disagree

In their latest episode of the VALUE: After Hours Podcast, Bill Brewster, Jake Taylor, and Tobias Carlisle discuss: How To Avoid Blowing Up Your Portfolio When Warren Buffett Saw The Terror Threat Value Spread Closes – What It Means Uncertainty And The Precautionary Principle What Is Going On At Disney? … Read More

Nasdaq To Reweight Big Tech Dominance

During their latest episode of the VALUE: After Hours Podcast, Collins, Daniel, Taylor, and Carlisle discussed Nasdaq To Reweight Big Tech Dominance. Here’s an excerpt from the episode: Tobias: Otavio Costa had this tweet about, the amount of market capitalization that whatever we’re calling them now, the Magnificent Seven Fan … Read More

The Intuitive Investor

During their latest episode of the VALUE: After Hours Podcast, Collins, Daniel, Taylor, and Carlisle discussed The Intuitive Investor. Here’s an excerpt from the episode: Jake: I prepared a special little piece for you, guys, specifically that’s all about intuition, because I feel like you guys have pretty amazing record … Read More

We’re In A Stock-Pickers Market

During their latest episode of the VALUE: After Hours Podcast, Collins, Daniel, Taylor, and Carlisle discussed We’re In A Stock-Pickers Market. Here’s an excerpt from the episode: Porter: Again, we’re doing our usual dumpster diving in places where we like, where there are a couple of different financials, which there’s … Read More

Will We See Another ‘Big Short’?

During their latest episode of the VALUE: After Hours Podcast, Collins, Daniel, Taylor, and Carlisle discussed Will We See Another ‘Big Short’?. Here’s an excerpt from the episode: Jake: Is there anything like with the Big Short, where there was a catalyst with a known date to it, where like, … Read More

VALUE: After Hours (S05 E26): Seawolf’s Vincent Daniel And Porter Collins On Financials, Energy, Rates

In their latest episode of the VALUE: After Hours Podcast, Vincent Daniel, Porter Collins, Jake Taylor, and Tobias Carlisle discuss: Will We See Another ‘Big Short’? We’re In A Stock-Pickers Market The Intuitive Investor Nasdaq To Reweight Big Tech Dominance Rivian Up 50% For No Good Reason Employment – The … Read More

Small-Caps Ready To Rip

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Small-Caps Ready To Rip. Here’s an excerpt from the episode: Tobias: Yeah. It’s very, very hard to know. I don’t know, I think it looks pretty nasty, but there are plenty of people out there … Read More

Zuck vs Musk – Who Would Win In The Octagon?

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Zuck vs Musk – Who Would Win In The Octagon?. Here’s an excerpt from the episode: Jake: Yeah. Well, anytime your CEO is distracted with wanting to fight other billionaires in the Octagon, you know, … Read More

AI Has The Animal Spirits Going Again

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed AI Has The Animal Spirits Going Again. Here’s an excerpt from the episode: Bill: I think what’s closer to reality is that AI got some animal spirits going again. Jake: Yeah, that’s true. Bill: I … Read More

ChatGPT Heading The Same Way As NFTs

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed ChatGPT Heading The Same Way As NFTs. Here’s an excerpt from the episode: Tobias: I tracked NFTs for a while, but it just got too sad. I tracked the search term, NFT, but NFT, it’s … Read More

Puffery: Carlill v Carbolic Smoke Ball Co 1893

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Puffery: Carlill v Carbolic Smoke Ball Co 1893. Here’s an excerpt from the episode: Jake: When was the timeline on that one, by the way? When did they say that was–? Well, I guess, when … Read More

Zooming Out On Berkshire Hathaway

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Zooming Out On Berkshire Hathaway. Here’s an excerpt from the episode: Bill: Jake, let’s do the veggies. Jake: Yes, sir. Bill: Hopefully, it’s about how all of the processing in electronic vehicles is in China … Read More

The Fed Is Hurting My Stocks

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed The Fed Is Hurting My Stocks. Here’s an excerpt from the episode: Bill: My wife said that when I was in Scotland, the amount of leftovers that were in the house were like asinine. She … Read More

Warren Buffett’s Superhuman Calculations

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Warren Buffett’s Superhuman Calculations. Here’s an excerpt from the episode: Tobias: Well, there was a little video doing the rounds yesterday on Twitter of this lady saying– Sorry, I didn’t catch who it was, but … Read More

Why is Berkshire Hathaway Buying More Oxy?

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Why is Berkshire Hathaway Buying More Oxy?. Here’s an excerpt from the episode: Tobias: Berkshire still seems to be buying Oxy? Recently, I saw- Bill: Buff Dawg loves it. Tobias: -last seven days or so. … Read More

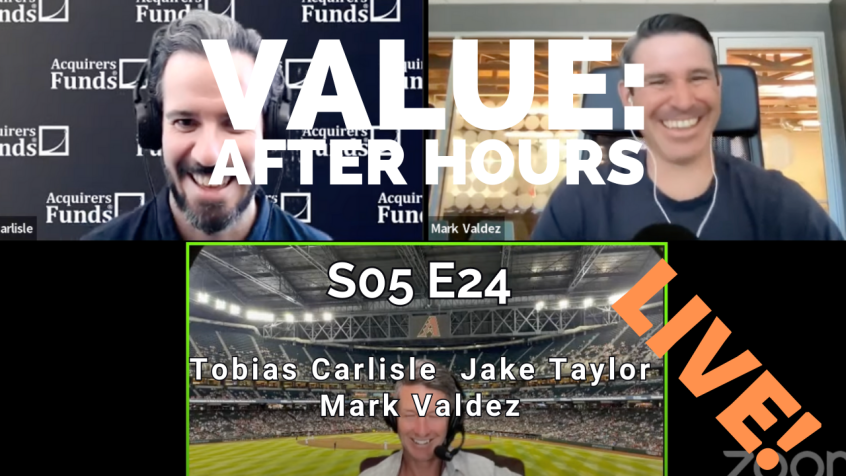

VALUE: After Hours (S05 E25): Half-Year Prediction Update; Small Cap Value; Scale, Buffett And $BRK

In their latest episode of the VALUE: After Hours Podcast, Mark Valdez, Jake Taylor, and Tobias Carlisle discuss: The Fed Is Hurting My Stocks Why is Berkshire Hathaway Buying More Oxy? Warren Buffett’s Superhuman Calculations Investing Lessons From Deep Forces That Shape The Universe Carlill v Carbolic Smoke Ball Co … Read More

Investing Lessons From Earthworms

During their latest episode of the VALUE: After Hours Podcast, Valdez, Taylor, and Carlisle discuss Investing Lessons From Earthworms. Here’s an excerpt from the episode: Tobias: JT, do you have any veggies for today? Jake: Of course, I do. I wouldn’t want to– Tobias: We do this Mark on the … Read More

Warren Buffett – Taking The Dagger Off The Steering Wheel

During their latest episode of the VALUE: After Hours Podcast, Valdez, Taylor, and Carlisle discuss Warren Buffett – Taking The Dagger Off The Steering Wheel. Here’s an excerpt from the episode: Tobias: It was funny that the conglomerates they said they had the wrong incentive model, because the managers weren’t … Read More

What Makes Modern Day Conglomerates Great!

During their latest episode of the VALUE: After Hours Podcast, Valdez, Taylor, and Carlisle discuss What Makes Modern Day Conglomerates Great!. Here’s an excerpt from the episode: Tobias: What do you think distinguishes the Constellation, Danaher, Berkshire, Vista, like that modern day conglomerate or whatever it is? The conglomerate to … Read More