During the 2018 Daily Journal Annual Meeting, Charles Munger was asked about the talent of Li Lu. Here’s an excerpt from the meeting: Munger: The second question was Li Lu. What was unusual about Li Lu. Li Lu is one of the most successful investors. Imagine him, he just popped … Read More

Soft Landing Or Big Flush Coming?

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Soft Landing Or Big Flush Coming? Here’s an excerpt from the episode: Tobias: I don’t want to misquote Chanos here, but he said something like he never seen a market bottom as high as this … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

GMO: 2022 – U.S. Large Caps – The Value/Growth Spread Was A Stunning 24% In Favor Of Value

In their recent Q4 2022 Letter, GMO highlighted that in 2022 within U.S. large caps, the value/growth spread was a stunning 24% in favor of value. Here’s an excerpt from the letter: Even within at least one strategy that looks to have been perfectly JOMO – the value versus growth … Read More

Michael Burry: Investors Who Turn Over The Most Stones Will Find The Most Success

In his 2001 Scion Capital Letter, Michael Burry says investors who turn over the most stones will find the most success. Here’s an excerpt from the letter: When evaluating an options compensation program, one must weigh the net value creation from (a) the issuance of excess options-related stock at prices … Read More

Where Are All The Bankruptcies?

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Where Are All The Bankruptcies? Here’s an excerpt from the episode: Tobias: Yeah, that’s a good idea. Well, I was going to say I saw Chanos– Chanos said that the market had never bottomed this … Read More

David Herro: Value Opportunities In International Investing

During his latest presentation, David Herro discusses value opportunities in international investing. Here’s an excerpt from the presentation: Herro: When you look at the world today, we could divide it, the world outside the United States into Asia, Japan, Emerging Markets, and Europe and the UK. When you look at … Read More

Howard Marks: Finding Bargains In The ‘Uninvestable’

During his recent interview with The Motley Fool, Howard Marks discussed which areas will benefit from the ‘New World Order’, and finding bargains in the ‘Uninvestable’. Here’s an excerpt from the interview: Marks: Well, it’s basically everything on the lending side of the equation. That’s one, so ranging from cash which … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Which Industries Will ChatGPT Disrupt?

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Which Industries Will ChatGPT Disrupt? Here’s an excerpt from the episode: Bill: A short idea I saw on Twitter, somebody just threw it out and I think it’s pretty interesting to think on is Chegg. … Read More

Warren Buffett: There’s A Very Simple Formula For Building A Multinational Conglomerate Holding Company

During the 2008 Berkshire Hathaway Annual Meeting, Warren Buffett outlined his very simple formula for building a multinational conglomerate holding company. Here’s an excerpt from the meeting: WARREN BUFFETT: Well, Berkshire was a small business at one time. I mean, it just takes time. I mean, it’s the nature of … Read More

Joel Greenblatt: Investors Can Get Completely Blindsided Through No Fault Of Their Own

In this interview with William Green, Joel Greenblatt explains how investors can get completed blindsided through no fault of their own. Here’s an excerpt from the interview: Greenblatt: I wanted to do a good job and I saw this opportunity where Florida Cypress Gardens was being taken over and there … Read More

Dan Loeb – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E4): Value Beaten In January, Bears And Rate Cuts, Richard Hamming’s Research

In their latest episode of the VALUE: After Hours Podcast, Bill Brewster, Jake Taylor, and Tobias Carlisle discuss: Which Industries Will ChatGPT Disrupt? Where Are All The Bankruptcies? Soft Landing Or Big Flush Coming? Who’s Winning The Streaming War? Investing Lessons From Richard Hamming – You And Your Research Animal … Read More

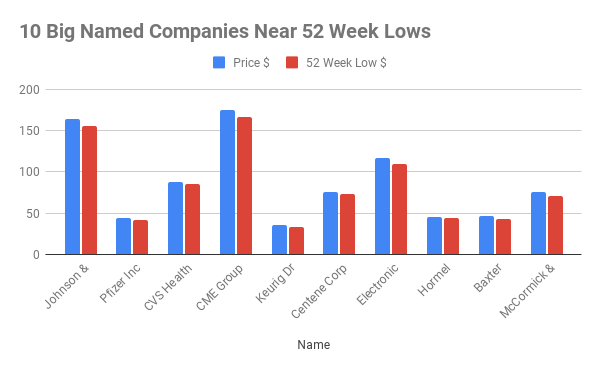

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ JNJ Johnson … Read More

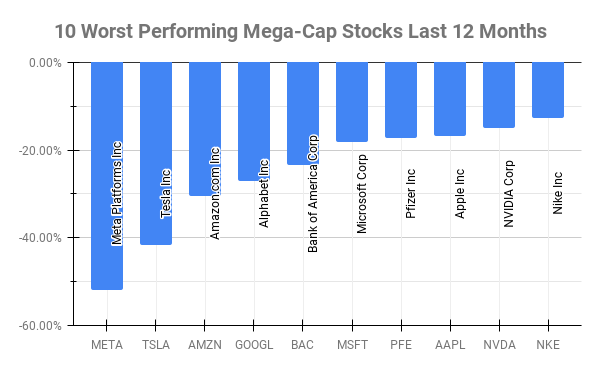

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) META Meta Platforms Inc -52.00% TSLA Tesla Inc … Read More

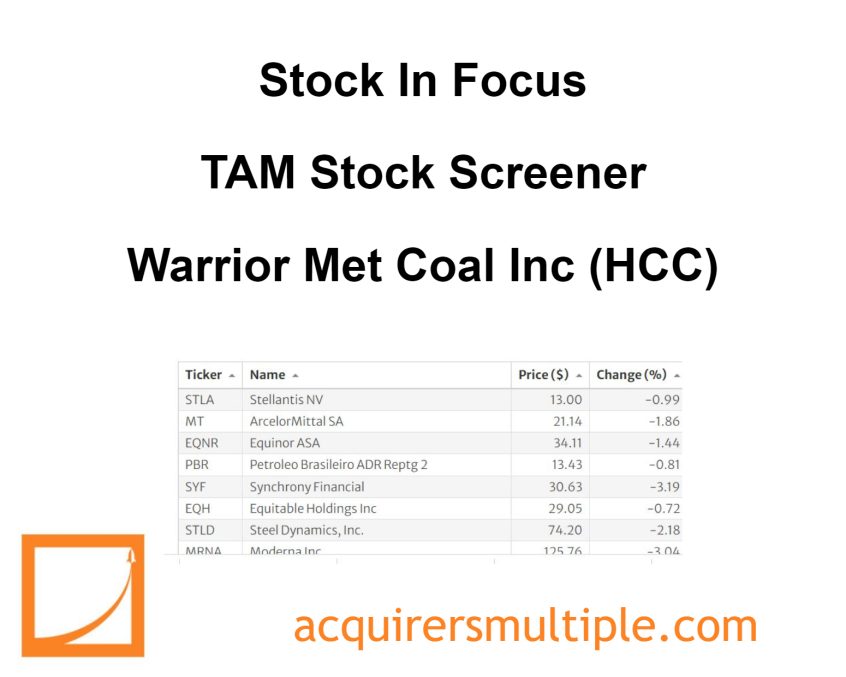

Stock In Focus – TAM Stock Screener – Warrior Met Coal Inc (HCC)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Warrior Met Coal Inc (HCC) Warrior Met Coal Inc is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (2/3/2023)

This week’s best investing news: “Invest or Enlist”: The Liberty Bond Story (Jamie Catherwood) Charlie Munger says the U.S. should follow in China’s footsteps and ban cryptocurrencies (CNBC) Bill Ackman says Hindenburg’s Adani report ‘highly credible’ (Reuters) Terry Smith – Fundsmith Equity Fund (medirectalk) After the Darkest Hour Comes the … Read More

Housing Crisis Porn

In their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Housing Crisis Porn. Here’s an excerpt from the episode: Tobias: There’s some great housing crash porn on YouTube. You can go down a rabbit hole there. I’ve gone right down that rabbit hole. According to … Read More

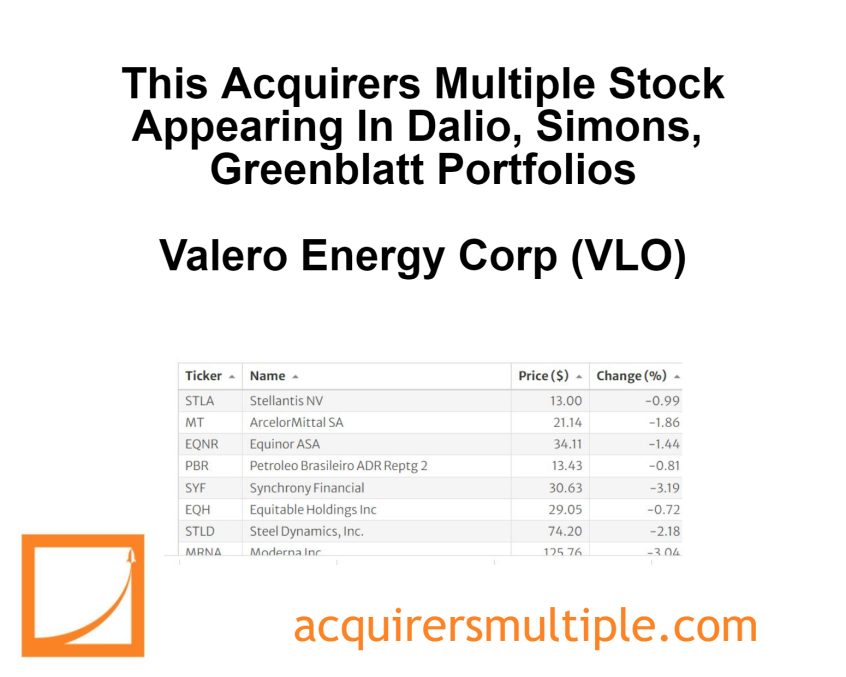

This Acquirers Multiple Stock Appearing In Dalio, Simons, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More