During his recent interview with Value Investing With Legends, Bill Nygren discusses idea generation for value investors. Here’s an excerpt from the interview: Nygren: I think it would be an overstatement to say that it’s a systematic process. Our idea generation I think is very similar to a lot of … Read More

Tom Gayner: Finding Bargains On The New High/New Low Lists

During his recent interview with The Business Brew, Tom Gayner discussed finding bargains on the new high/new low lists. Here’s an excerpt from the interview: Gayner: Let me clarify. So that new high and new low list statement, what I said was, in my earlier life I used to read … Read More

Warren Buffett – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E8): Bumper Buffett Berkshire Letter, $HD And The Economy, Housing Slowdown

In their latest episode of the VALUE: After Hours Podcast, Alex Morris, Jake Taylor, and Tobias Carlisle discuss: $HD And The Economy Is BNSF A Proxy For The U.S Economy? Dairy Queen – The Company That Keeps Giving To Berkshire Warren Buffett’s Masterful Use Of Debt Berkshire’s Next YOLO Trade … Read More

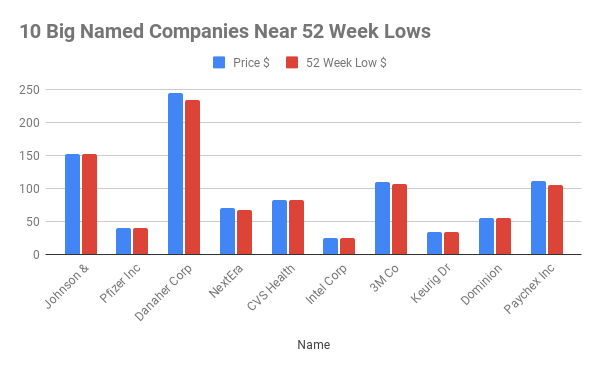

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ JNJ Johnson … Read More

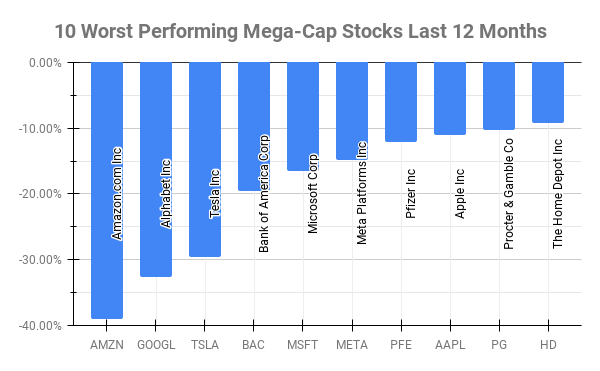

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) AMZN Amazon.com Inc -39.02% GOOGL Alphabet Inc -32.60% … Read More

Stock In Focus – TAM Stock Screener – Encore Wire Corp (WIRE)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Encore Wire Corp (WIRE) Encore Wire Corp is engaged in manufacturing … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (3/3/2023)

This week’s best investing news: Berkshire Hathaway 2022 Annual Report (BH) Greenlight’s David Einhorn says there are two types of buybacks (CNBC) Howard Marks – Global Investment: Are We Witnessing a Sea Change? (Asia Society) A History of Market Panics (Jamie Catherwood) Berkshire Hathaway Q4 2022 Earnings Report (BH) Burry … Read More

Stocks In A ‘Death Zone’

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Stocks In A ‘Death Zone’. Here’s an excerpt from the episode: Tobias: This is from John Rotonti, mike Wilson on the death zone. Have you heard this? He’s talking about the low in October versus … Read More

This Acquirers Multiple Stock Appearing In Einhorn, Druckenmiller, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

David Einhorn: Good Buybacks vs Bad Buybacks

During his recent interview with CNBC, David Einhorn discussed the difference between good buybacks vs bad buybacks. Here’s an excerpt from the interview: Einhorn: There’s two types of buybacks, right? There’s the buybacks where the company has extra profits and they want to return it to shareholders, and they want … Read More

Howard Marks: A Soft Landing Is Extremely Unlikely

During his recent interview with the Asia Society, Howard Marks explained why a soft landing is extremely unlikely. Here’s an excerpt from the interview: Marks: It was a great investment sage called Peter Bernstein, and he wrote me once, that the market is not an accommodating machine, it will not … Read More

Warren Buffett’s Uncanny Ability To Predict The Future

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Warren Buffett’s Uncanny Ability To Predict The Future. Here’s an excerpt from the episode: Tobias: When you look at what is predictive, there’s a lot of luck and beta just in holding pretty good stocks, … Read More

François Rochon: Building A Portfolio, Trimming, Position Size

During this interview with Best Anchor Stocks, François Rochon discussed building a portfolio, trimming, and the right position size. Here’s an excerpt from the interview: Rochon: Probably in my younger years I was more confident in my decisions. So probably I could start with 4 or 5 or 6% in that … Read More

Mohnish Pabrai: Which Berkshire Businesses Will Be Around In 200 Years

During this Q&A session with The London School of Economics, Mohnish Pabrai discussed which Berkshire Hathaway businesses will be around in 200 years. Here’s an excerpt from the session: Pabrai: I was having a conversation with Charlie Munger a few weeks ago, and I told him Charlie the one thing … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Would Munger Have Done Equally Well In LA Real Estate?

During their latest episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discuss Would Munger Have Done Equally Well In LA Real Estate?. Here’s an excerpt from the episode: Tobias: Yeah, Munger [crosstalk] about Daily Journal. Munger made a mistake with Alibaba. Do you think that was a … Read More

Cliff Asness: The One Lesson Investors Need To Learn Multiple Times

During his recent interview with Bloomberg, Cliff Asness discussed the one lesson investors need to learn multiple times. Here’s an excerpt from the interview: Asness: We started our firm about an hour and a half before the 1999-2000 tech bubble. If your viewers can’t tell I’m pretty old. I know … Read More

Warren Buffett: The Secret Sauce of Investing

In his most recent Berkshire Hathaway 2022 Annual Letter, Warren Buffett discusses the secret sauce of investing. Here’s an excerpt from the letter: In August 1994 – yes, 1994 – Berkshire completed its seven-year purchase of the 400 million shares of Coca-Cola we now own. The total cost was $1.3 … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More