This week’s list is 10 Of The Best Stock Market Investing Books Of All Time. This list is by no means complete and is certainly not in any particular order. If you’re an investor take some time to check out the books on this list, they’ll provide you with an … Read More

Stock In Focus – TAM Stock Screener – Gulfport Energy Corp (GPOR)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Gulfport Energy Corp (GPOR) Gulfport Energy Corp is an independent exploration … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (9/1/2023)

This week’s best investing news: Steven Romick – Mastering Market Volatility (WealthTrack) Put Down the Dividends and Slowly Back Away (Validea) Warren Buffett, who turns 93, is at the top of his game as he pushes Berkshire Hathaway to new heights (CNBC) Aswath Damodaran – Toys for Billionaires: Sports Franchises as … Read More

Investing Lessons From Unintended Consequences

During their latest episode of the VALUE: After Hours Podcast, Hoffstein, Taylor, and Carlisle discussed Investing Lessons From Unintended Consequences. Here’s an excerpt from the episode: Jake: So, we are going to be talking about the SS Eastland. And I changed my background as a little foreshadowing. But everybody knows … Read More

Mohnish Pabrai: The Starting Point In Assessing Any Business

In his article titled – On Avoiding Enron-itis!, Mohnish Pabrai discussed his starting point in assessing any business. Here’s an excerpt from the article: When I am beginning to look at a company, my starting point is Item 1 in the 10-K which describes the business. If this description does … Read More

Warren Buffett: Inflation Acts As A “Gigantic Corporate Tapeworm”

In his 1981 Berkshire Hathaway Annual Letter, Warren Buffett used the metaphor of a “gigantic corporate tapeworm” to describe how inflation preempts a portion of a company’s investment dollars, regardless of its profitability. Here’s an excerpt from the letter: What makes sense for the bondholder makes sense for the shareholder. … Read More

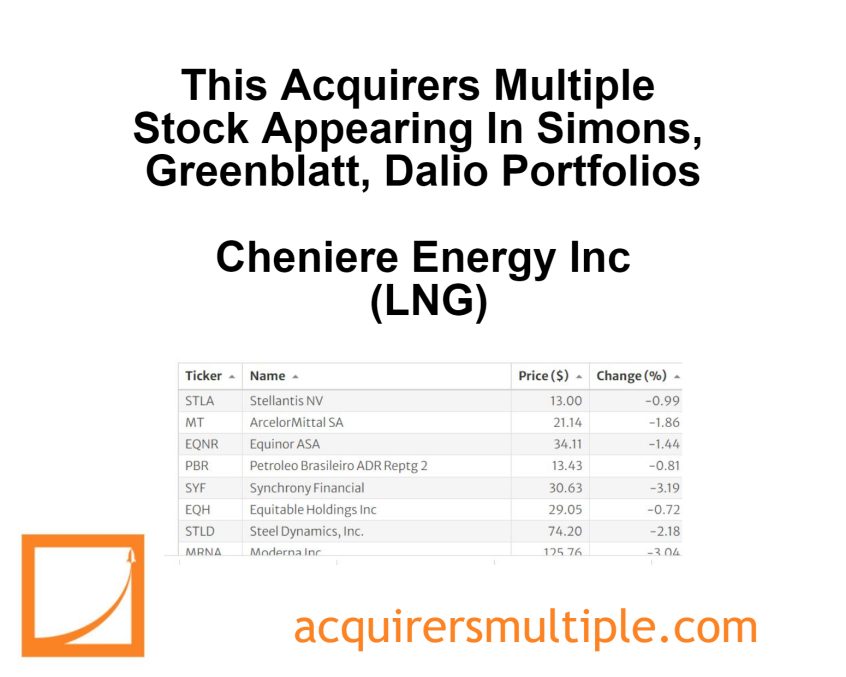

This Acquirers Multiple Stock Appearing In Simons, Greenblatt, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Value Is Not A Defensive Factor

During their latest episode of the VALUE: After Hours Podcast, Hoffstein, Taylor, and Carlisle discussed Value Is Not A Defensive Factor. Here’s an excerpt from the episode: Corey: I think this is maybe one of the, I don’t want to say, fundamental problems some people fall into, but value did … Read More

Charles Munger: The Cost Cutting Phenomenon

In Charles Munger’s famous speech at USC Business School in 1994 entitled A Lesson on Elementary Worldly Wisdom, he discussed the cost cutting phenomenon. Here’s an excerpt from the speech: Munger: In all cases, the people who sell the machinery—and, by and large, even the internal bureaucrats urging you to … Read More

Warren Buffett: There’s A Good Reason Why We Don’t ‘Talk Up’ Our Investments

During the 2015 Berkshire Hathaway Annual Meeting, Warren Buffett explained why he doesn’t ‘talk up’ Berkshire’s investments. Here’s an excerpt from the meeting: WARREN BUFFETT: Incidentally, there’s one thing I always find interesting. We get asked questions about investments we own, and people think we want to talk them up, … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Timing Luck In Investment Strategies

During their latest episode of the VALUE: After Hours Podcast, Hoffstein, Taylor, and Carlisle discussed Timing Luck In Investment Strategies. Here’s an excerpt from the episode: Tobias: One of the things I learned from you, Corey, that I was very grateful for was that the timing luck idea, which is … Read More

Bill Nygren: Growth In Passive Investing Creates Opportunities For Value Investors

During his recent presentation at Natixis, Bill Nygren explained how the growth of passive investing and popularity of low-beta stocks have created attractive value opportunities for active, research-driven investors. Here’s an excerpt from the presentation: Nygren: In a market cycle like we’re in today, we’re dealing with more passive investors than … Read More

Joel Greenblatt: Turn Over A Lot Of Rocks To Find The ‘Easy’ Investments

During this interview with Investors’ Chronicle, Joel Greenblatt explained why investors need to turn over a lot of rocks to find the ‘easy’ investments. Here’s an excerpt from the interview: Greenblatt: I think everything is hard. The market is emotional in the short term, but eventually gets it right. And … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Free Lunch – The Government Has Removed Left Tail Risk

During their latest episode of the VALUE: After Hours Podcast, Hoffstein, Taylor, and Carlisle discussed Free Lunch – The Government Has Removed Left Tail Risk. Here’s an excerpt from the episode: Tobias: When you look at the way that strategies work in other countries, It’s been one of the– Japan, … Read More

Li Lu: Do You Have The Insight & Temperament To Be A Great Investor?

During his 2010 Columbia University Lecture, Li Lu discussed the insight and temperament required to be a great investor. Here’s an excerpt from the lecture: When I started in the business in 1997, it was in the middle of the Asian Financial Crisis. A few years later there was the … Read More

Steven Romick: The Evolution Of A Value Investor

During this interview with WealthTrack, Steven Romick discusses his evolution as a value investor. Here’s an excerpt from the interview: Host: Steven, for the seventh edition of the investment classic Graham and Dodd Security Analysis, you were asked to write an introduction to a chapter about your evolution as a … Read More

Warren Buffett – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E31): Corey Hoffstein on Value, Return Stacking, 60/40 Stocks and Bonds

In their latest episode of the VALUE: After Hours Podcast, Corey Hoffstein, Jake Taylor, and Tobias Carlisle discuss: Free Lunch – The Government Has Removed Left Tail Risk Timing Luck In Investment Strategies Value Is Not A Defensive Factor Investing Lessons From Unintended Consequences The Episodic Nature of Value Investing … Read More