Here’s a list of this week’s best investing news: Times of Fraud, Mania & Chicanery (Jamie Catherwood) The Rise and Fall of Commodity Indices (Verdad) Icahn on Inflation, Investing, and What He Misses About NYC: Q&A (Bloomberg) Inflation and Investing: False Alarm or Fair Warning? (Aswath Damodaran) Investors Are No Longer Bearish Bank … Read More

Carl Icahn: What It Takes To Be A Truly Successful Activist

In his latest interview with Bloomberg, Carl Icahn discusses a number of topics including what it takes to be a truly successful activist. Here’s an excerpt from the interview: Q: You have been a shareholder activist for as long as anyone on Wall Street. There seems to be a trend … Read More

This Acquirers Multiple Stock Is Appearing In Gabelli, Simons, And Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Will The Small Value Rally Continue?

In their recent episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Carlisle discussed Will The Small Value Rally Continue? Here’s an excerpt from the episode: Tobias: Everybody knows small cap value has had this terrible run until recently, and it started running. So, the question that I get a … Read More

VALUE: After Hours (S03 E20): Will the Small Value Rally Continue? Markel and The Body Keeps the Score

In this episode of the VALUE: After Hours Podcast, Jake Taylor, Bill Brewster, and Tobias Carlisle chat about: Will The Small Value Rally Continue? Hanging Out With Tom At The Markel Annual Meeting Breathing Can Help Your Investing When Does Value Work Best? Which Business Has Surprised You Most? The … Read More

Buffett’s Strategy Of Having No Strategy

During his recent interview on The Acquirers Podcast with Tobias, Adam Mead, author of The Complete Financial History of Berkshire Hathaway discussed Buffett’s Strategy Of Having No Strategy. Here’s an excerpt from the interview: Tobias: As an investor, having conducted this extensive research on the great industrialist of our age, what … Read More

One Stock Superinvestors Are Buying Or Holding

While doing this research we’ve also uncovered a number of common stocks that investing gurus have recently bought, or continuing to hold in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Buying Or Holding’. This week we’ll … Read More

Value Becoming Momentum

In their recent episode of the VALUE: After Hours Podcast, Braziel, Hoffstein, and Carlisle discussed Value Becoming Momentum. Here’s an excerpt from the episode: Corey: And then you get that glimmer of hope. That glimmer of hope, which you don’t need it to actually go up, you just need that … Read More

Berkshire Hathaway: The World’s Greatest Conglomerate

During his recent interview on The Acquirers Podcast with Tobias, Adam Mead, author of The Complete Financial History of Berkshire Hathaway discussed Berkshire Hathaway: The World’s Greatest Conglomerate. Here’s an excerpt from the interview: Tobias: You’ve got a chapter, World’s Greatest Conglomerate. Why’s Berkshire the world’s greatest conglomerate? Adam: If I … Read More

Buffett’s Mastery In Capital Allocation

During his recent interview on The Acquirers Podcast with Tobias, Adam Mead, author of The Complete Financial History of Berkshire Hathaway discussed Buffett’s Mastery In Capital Allocation. Here’s an excerpt from the interview: Tobias: I just want to take you back a little bit to the BNSF. I remember reading … Read More

Growth Got Crushed!

In their recent episode of the VALUE: After Hours Podcast, Braziel, Hoffstein, and Carlisle discuss how Growth Got Crushed. Here’s an excerpt from the episode: Tobias: I’ve been saying this more and more recently, but I’ve been completely, totally bamboozled by this market just because the trends is that top … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Bill Ackman: Creating Our Own Berkshire Hathaway

In his latest interview with the Fifth Avenue Synagogue, Bill Ackman discusses how he’s structured Pershing Square to be the same as Berkshire Hathaway. Here’s an excerpt from the interview: Ackman: One of the great advantages that Warren Buffett has is he manages a public company. Doesn’t have to worry … Read More

Dan Sundheim: Shorting Against Aggressive Retail Gamblers

In his latest interview at Sohn 2021, D1 Capital’s Dan Sundheim discussed the difficulty of shorting in a market where retail investors are aggressively gambling on stocks. Here’s an excerpt from the interview: Sundheim: From a risk management standpoint I think that anybody who’s transacting in the market with a … Read More

Matt Levine: The Boredom Markets Hypothesis

In his recent article on Bloomberg, Matt Levine discussed the current craziness in markets citing Gamestop, Non-fungible tokens, and the surge in crypto. He also discussed his ‘boredom markets hypothesis’ to help explain why this may be happening. Here’s an excerpt from the article: In the last dumb, dumb year I … Read More

(Ep.115) The Acquirers Podcast: Adam Mead – History Buffett: The Complete Financial History Of Berkshire Hathaway

In this episode of The Acquirers Podcast, Tobias chats with Adam Mead, author of The Complete Financial History of Berkshire Hathaway. During the interview Adam provided some great insights into: Buffett’s Mastery In Capital Allocation Berkshire Hathaway: The World’s Greatest Conglomerate Buffett’s Strategy Of Having No Strategy Buffett Used The … Read More

Michael Burry’s Top 10 Holdings (Q1 2021)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Stock In Focus – TAM Stock Screener – SciPlay Corp (NASDAQ: SCPL)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is SciPlay Corp (NASDAQ: SCPL). SciPlay Corp develops, markets and operates … Read More

Royce: What To Look For In Dividend-Paying Small Caps

In this interview, Chuck Royce and Miles Lewis from Royce Investment Partners discuss a number of topics including, refining their dividend value approach, what they look for in dividend-paying small caps, and where the current opportunities lie. Here’s an excerpt from the interview: What factors are among the most important … Read More

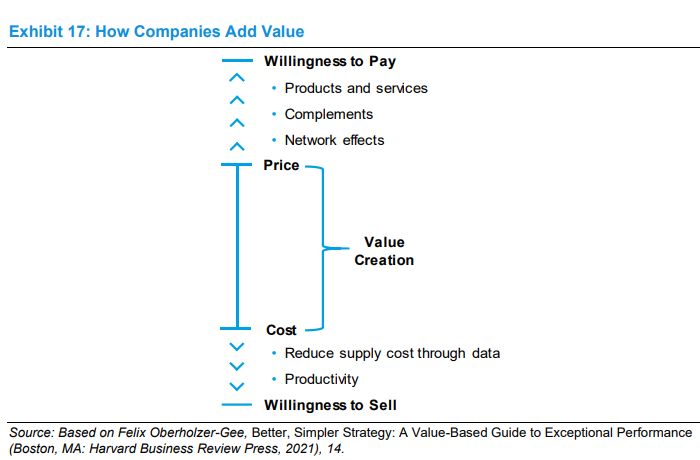

Michael Mauboussin: The Economics of Customer Businesses

In his latest paper titled – The Economics of Customer Businesses, Calculating Customer-Based Corporate Valuation, Michael Mauboussin discusses a robust framework called ‘customer based corporate valuation’ (CBCV), which was developed by professors of marketing, Daniel McCarthy and Peter Fader, that links customer economics to corporate value. This allows investors to … Read More