In a recent article at the Financial Times, Cliff Asness explains why his firm is positioned for one of the most robust recoveries for factor investing since the tech bubble of 1999. Here’s an excerpt from the article: A computer-powered investment fund run by AQR posted double-digit gains in the … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Value is the Widowmaker Trade

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Value is the Widowmaker Trade. Here’s an excerpt from the episode: Tobias: There’s nothing particularly stunning about this article. They’ve gone and interviewed a whole lot of fund managers and said, “What do you think’s … Read More

Bill Miller: How To Find Value In Companies That Are Not Making A Profit

In his recent interview on WealthTrack, Bill Miller explained how to find value in companies that are not making a profit. Here’s an excerpt from the interview: Miller: What the theoretical literature and what the value investing, empirical literature taught and concluded that… that those accounting based metrics were as … Read More

Aswath Damodaran: It Is Moneyball Time!

In his latest Data Update 1 for 2022, Aswath Damodaran says – It is Moneyball Time! He also provides four reasons why you should not always trust big data. Here’s an excerpt from the update: The Moneyball Question When I first started posting data on my website for public consumption, … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Warren Buffett Schools ARK’s Cathie Wood

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Warren Buffett Schools ARK’s Cathie Wood. Here’s an excerpt from the episode: Tobias: Let’s talk about Ark-Berkshire. Because Ark topped out at 156 bucks in February last year, and it closed out the year like … Read More

Albert Bridge Capital: When Growth Stocks Get Annihilated Value Doesn’t Participate In The Downside

This latest article from Albert Bridge Capital discusses some historical evidence that shows that when growth stocks get annihilated, value doesn’t participate in the downside. Here’s an excerpt from the article: If Growth Stocks Sell Off Will They Bring Value Stocks Down with Them? Well, that’s a good question, and … Read More

Bill Nygren: How To Apply Value Investing To Growth Stocks

In his latest Q4 2021 Market Commentary, Bill Nygren discusses how to apply value investing to growth stocks. Here’s an excerpt from the commentary: Oakmark was one of the first value managers to acknowledge that accounting rules overly penalize the companies investing to grow their businesses. Thirty years ago, we … Read More

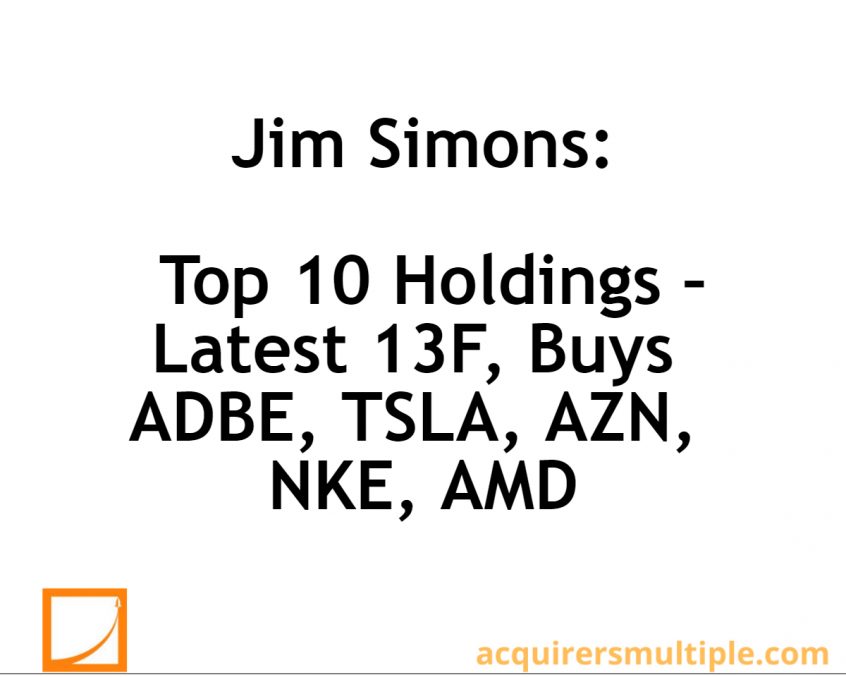

Jim Simons Top 10 Holdings – Latest 13F, Buys ADBE, TSLA, AZN, NKE, AMD

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S04 E01): Value is the Widowmaker Trade, EO Wilson, Tobacco Stocks for Divvies

In this episode of the VALUE: After Hours Podcast, Jake Taylor, Bill Brewster, and Tobias Carlisle chat about: Warren Buffett Schools ARK’s Cathie Wood Value is the Widowmaker Trade E O Wilson – Of Ants and Men Jeremy Grantham – My Sister’s Pension Find A Way To Stay Invested Why … Read More

Stock In Focus – TAM Stock Screener – ArcelorMittal SA (NYSE: MT)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: ArcelorMittal SA (NYSE: MT) ArcelorMittal SA is involved in the steel … Read More

Jeremy Grantham: Our Children Will Be Talking About This Market In 50 Years Time. Here’s Why…

In an interview at the end of last year on the Citywire Podcast, Jeremy Grantham explained why our children will be talking about this market in 50 years time. Here’s an excerpt from the interview: Grantham: If I thought it was crazy in June/July of last year. Oh my God! … Read More

This Week’s Best Value Investing News (1/07/2022)

This week’s best investing news: Stock Market History, Illuminated (AB) Picking Funds & Indices (Verdad) Cheap Stocks Will Have Their Day In 2022 (Validea) How to Invest When There’s Nowhere to Hide (Vitaliy) The Market Is Sending A ‘Loud, Clear Signal’ That Oil Prices Are Headed Higher (Felder) Betting Against Buffett (CA) Ford vs Ferrari Tesla … Read More

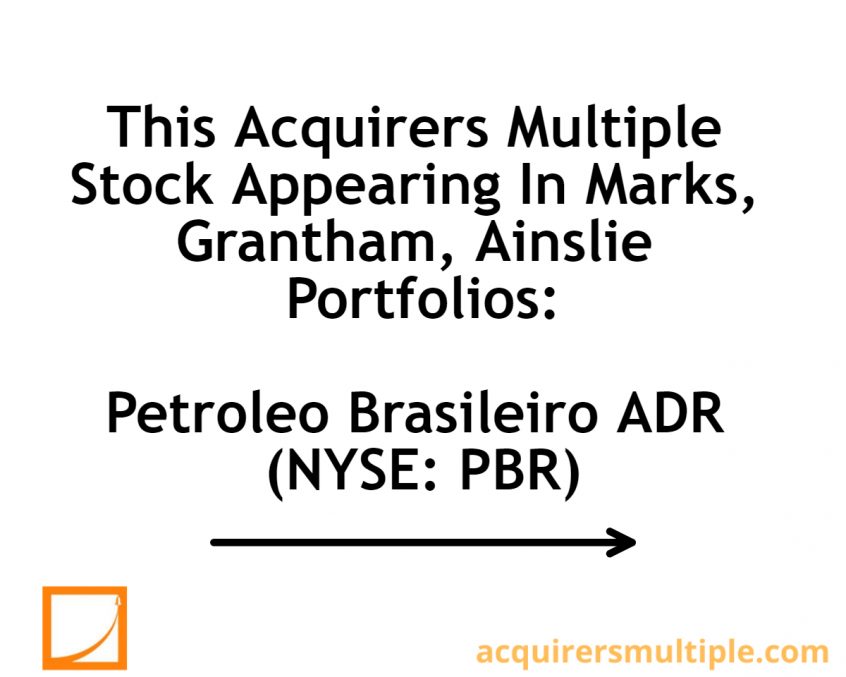

This Acquirers Multiple Stock Appearing In Marks, Grantham, Ainslie Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Roger Lowenstein: Liquidity Is A ‘Straw Man’

In his book – When Genius Failed: The Rise and Fall of Long-Term Capital Management, Roger Lowenstein discusses why liquidity is a ‘straw man’. Here’s an excerpt from the book: With traders scrambling to pay back debts, Neal Soss, an economist at Credit Suisse First Boston, explained to the Journal, … Read More

Bruce Greenwald: Investors Should Search For Concealed Value In Assets Under A Rock

In his book – Value Investing: From Graham to Buffett and Beyond, Bruce Greenwald recommends investors search for concealed value in assets under a rock. Here’s an excerpt from the book: It may pay to strain the eyes and devote hours in the examination of a company’s financial accounts, searching … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Charles Munger Doubles Down On Alibaba (NYSE: BABA)

According to the lastest Q4 2021 13F for Daily Journal Corp, Charles Munger has increased his position in Alibaba Group Holding (NYSE: BABA) by 99%. Munger purchased the shares at an estimated average price of $155. He now holds 602,060 shares, up 300,000 from the previous quarter. Alibaba now represents … Read More

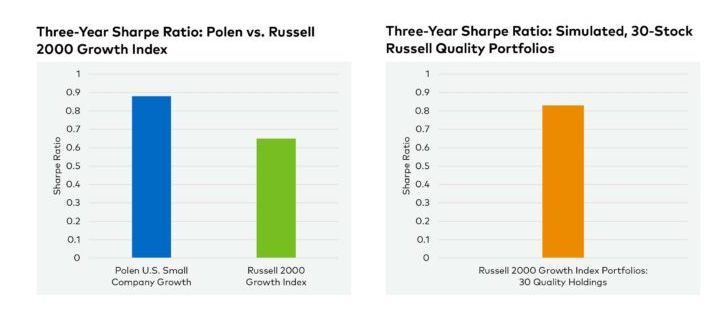

Polen Capital: The Benefits Of Concentrated Investing In Quality Small Caps

Here’s a great recent article by Polen Capital which discusses the benefits on concentrated investing in quality small caps. Here’s an excerpt from the article: Trade-Offs Between Quality, Diversification, and Risk While we recognize that diversification should be part of constructing an investment portfolio, our primary goal is to be … Read More