This week’s best investing news: Full recording of Berkshire Hathaway 2022 annual meeting (CNBC) EM Crisis Investing, a Deep(er) Dive (Verdad) Why Am I Reading This Now? 05.02.22 (Epsilon Theory) Markets Are At Risk Of Another Major Deleveraging Event (Felder Report) Buffett: Markets Becoming A “Gambling Parlor” (Validea) Ray Dalio Demystifies Debt (WTI) The power of … Read More

Fragility Everywhere

In their recent episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Tobias Carlisle discussed Fragility Everywhere. Here’s an excerpt from the episode: Tobias: “How long until we think the supply chain starts to heal? We’ll build more homes, and that’ll slow the craze.” I don’t know. A while, … Read More

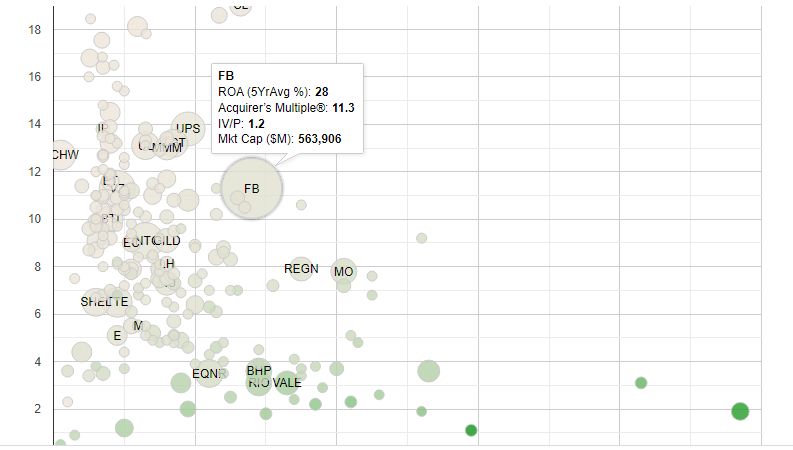

Is Meta Platforms Inc (NASDAQ: FB) A Great Value Stock?

Based on the improved performance metrics, which we recently added to our stock screens, Meta Platforms Inc (NASDAQ: FB) could be a great value stock: Meta is the world’s largest online social network, with 2.5 billion monthly active users. Users engage with each other in different ways, exchanging messages and sharing … Read More

This Acquirers Multiple Stock Appearing In Grantham, Marks, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Tom Russo: Warren Buffett’s #1 Strength

In his recent interview with Yahoo Finance, Tom Russo discussed Warren Buffett’s number one strength. Here’s an excerpt from the interview: Russo: It’s been amazing. Ever since I started to come, Warren, early days decried the inability for his investment style to embrace technology because of its inherent short shelf life … Read More

Tom Gayner: The Similarities Between Markel & Berkshire

In his recent interview with GabelliTV, Tom Gayner discussed the similarities between Markel and Berkshire. Here’s an excerpt from the interview: Gayner: Tactically, just to clarify. So yeah, we have a lot of names and people obviously… Buffett’s talked about the twenty punches and concentration and all that sort of … Read More

Tesla On Path To Dominate S&P 500 By 2030

In their recent episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Tobias Carlisle discussed Tesla On Path To Dominate S&P 500 By 2030. Here’s an excerpt from the episode: Tobias: There’s a presentation doing the rounds that predicts Tesla will be a very significant part of the S&P … Read More

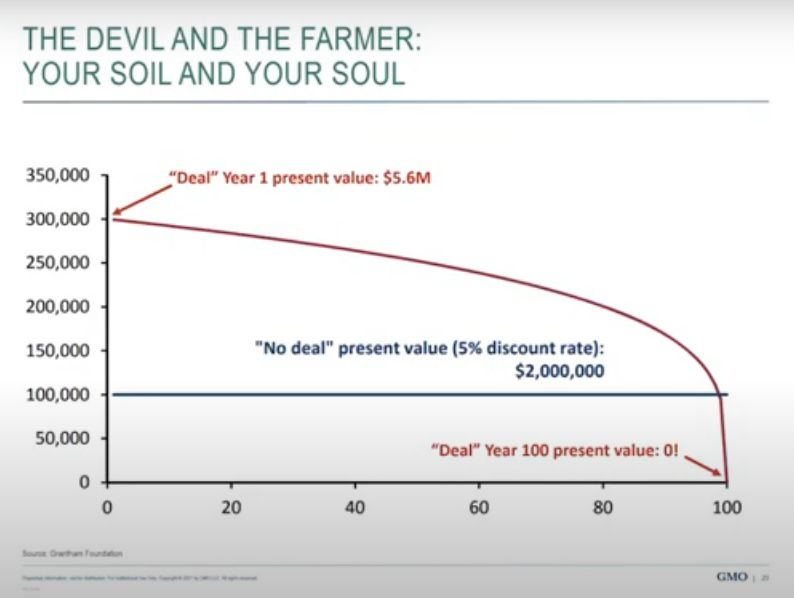

Jeremy Grantham: The Trouble With Capitalism – The Devil & The Farmer

In his recent Oxford Lecture, Jeremy Grantham illustrates the trouble with capitalism using his story of the devil and the farmer. Here’s an excerpt from the lecture: Grantham: This is my story of the devil and the farmer. The devil goes to a midwestern farmer and says, I will give … Read More

Jeffrey Gundlach: Growth Has Stopped Outperforming, The Tailwind Is For Value

In his recent Macro Overview Presentation, Jeffrey Gundlach says growth has stopped outperforming, the tailwind is for value. Here’s an excerpt from the overview: Gundlach: Growth has stopped outperforming. It’s exactly the same trend of course, the Nasdaq up from the S&P and growth outperforming value. But now value has … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Bubbles Are Rational

In their recent episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Tobias Carlisle discussed Bubbles Are Rational. Here’s an excerpt from the episode: Bill: My buddy said that, “It’s so algo driven now that if he puts in an actual bid, he can watch the entire market respond … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Howard Marks: Proof That Risk Is Counter-Intuitive

In his recent presentation at The Wharton School, Howard Marks provides some great examples of proof that risk is counter-intuitve. Here’s an excerpt from the presentation: Marks: Now, let’s talk a little more about risk. I believe that risk is counter-intuitive. So they did an experiment in the town of … Read More

Warren Buffett: Cash Is Like Oxygen, If It Disappears For A Few Minutes It’s All Over

During his recent Berkshire Hathaway Annual Meeting, Warren Buffett explains why he always holds cash. Here’s an excerpt from the meeting: Buffett: Going back to Q2 is we will always have a lot of cash on hand. And when I say cash I don’t mean commercial paper. When 2008 and … Read More

How Cobweb Theory Affects Markets

In their recent episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Tobias Carlisle discussed How Cobweb Theory Affects Markets. Here’s an excerpt from the episode: Jake: Well, there’s this idea in economics called cobweb effects and what it is that, if there’s a lag at all in supply … Read More

Warren Buffett: Looking Back, We Have Bought At Some Really Dumb Times

In his latest Berkshire Hathaway Annual Meeting, Warren Buffett discusses how looking back, they have bought during some really dumb times. Here’s an excerpt from the meeting: Buffett: The interesting thing is you know obviously we haven’t the faintest idea what the stock market is going to do when it … Read More

Charles Munger: Stocks Are Being Traded On A Casino Basis

In the latest Berkshire Hathaway Annual Meeting, Charles Munger discusses how stocks are being traded on a casino basis just like your favorite online casinos. Everyone agreed that the budget process was vital, and that some type of financial planning and record keeping was also required for every casino. The … Read More

Chase Coleman Top 10 Holdings – Latest 13F, Buys NU, SNOW, JD, XPEV, DDOG

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

One Way To Avoid Getting Wiped Out!

In their recent episode of the VALUE: After Hours Podcast, Brewster, Taylor, and Tobias Carlisle discussed One Way To Avoid Getting Wiped Out! Here’s an excerpt from the episode: Bill: Down 80 is bad. You pretty much wiped out? Jake: Down 80 is bad. Bill: I don’t think we talked … Read More

Stock In Focus – TAM Stock Screener – Children’s Place Inc (NASDAQ: PLCE)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Children’s Place Inc (NASDAQ: PLCE) Children’s Place Inc is a specialty … Read More