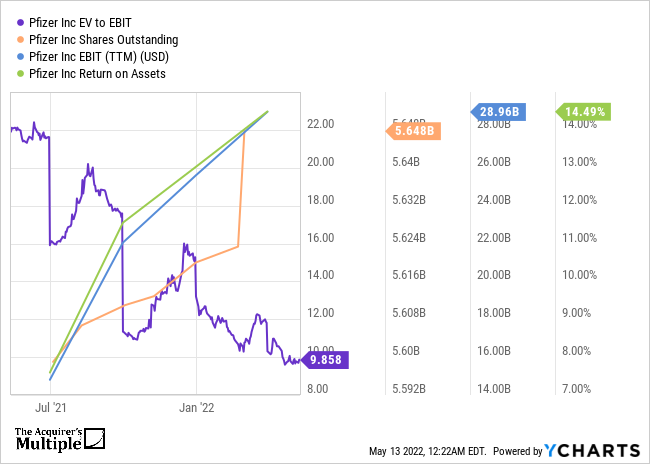

Based on the improved performance metrics, which we recently added to our stock screens, Pfizer Inc (PFE) could be a great value stock: Pfizer is one of the world’s largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 vaccine sales). While it historically sold many types of healthcare … Read More

This Acquirers Multiple Stock Appearing In Simons, Grantham, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Arnold Van Den Berg: Everyone’s A Financial Genius In A Rising Market

In his recent interview on the Richer, Wiser, Happier Podcast, Arnold Van Den Berg discussions some of the lessons he learned from Ben Graham that are still very valuable today. Here’s an excerpt from the interview: Van Den Berg: There was a couple of things that I had to learn … Read More

Jeremy Grantham: The First Sign That A Bubble Is About To Pop

In his recent interview with CNBC, Jeremy Grantham discusses the first sign that a bubble is about to pop. Here’s an excerpt from the interview: Grantham: I only specialize in what I call the really great bubbles. If you go back to 1929, to 2000, to Japan and the housing… … Read More

During Drawdowns – Add A New Position Or Buy More Of What You Have?

In their recent episode of the VALUE: After Hours Podcast, Cassel, Taylor, and Carlisle discussed During Drawdowns – Add A New Position Or Buy More Of What You Have?. Here’s an excerpt from the episode: Ian: Maybe a good place to start and I’ll pose this question to Jake first. … Read More

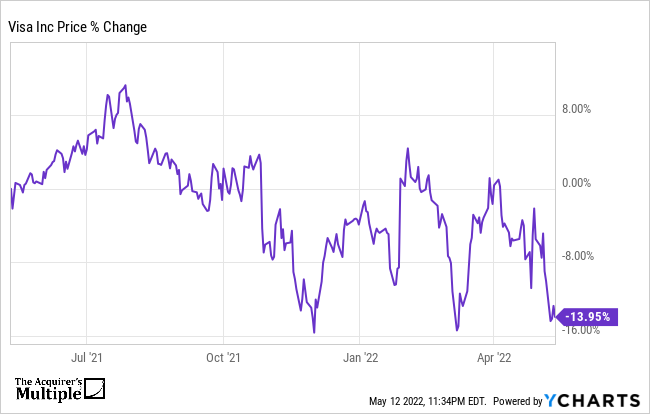

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

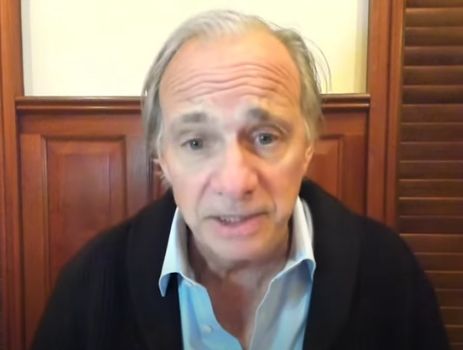

Ray Dalio: Investors Should Have ‘Good Times’ & ‘Bad Times’ Portfolios

In his recent interview with Jordan Harbinger, Ray Dalio explains why investors should have two portfolios, one for the good times, and one for the bad times. Here’s an excerpt from the interview: Dalio: Some of the things we talked about and a lot of them, we didn’t that are … Read More

Howard Marks: You Only Find Out Who The Good Investors Are During Bad Times

In his recent presentation to the Wharton School, Howard Marks explains why you only find out who the good investors are during bad times. Here’s an excerpt from the presentation: Marks: I also believe that risk is hidden and deceptive. This is really important. Loss is what happens when risk, … Read More

Don’t Break Your Own Investing Rules

In their recent episode of the VALUE: After Hours Podcast, Cassel, Taylor, and Carlisle discussed Don’t Break Your Own Investing Rules. Here’s an excerpt from the episode: Ian: Yeah. Maybe a couple of things that I also wrote down were some keeping track of some of the unforced errors I … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Miller Value: How To Exploit Short-Term Volatility

In their latest Q1 2022 Letter titled, Exploiting Volatility to Outmaneuver the Market, Miller Value explain how to exploit short-term volatility. Here’s an excerpt from the article: We have great conviction in our process, which is both time-tested and unique. We are patient, long-term value investors. We value businesses and think like … Read More

Francis Chou: The Difference Between Having Conviction & Being Reckless

In his latest presentation to the Ivey Value Investing Classes, Francis Chou discusses his value investing strategy and the difference between having conviction and being reckless. Here’s an excerpt from the presentation: Chou: One advantage I had was because I’ve been in the market, been in the bond market and … Read More

Michael Burry Top 10 Holdings – Q1 2022, Buys AAPL, BKNG, DISCK, GOOGL, CI

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

The Market Loves To Destroy Hubris

In their recent episode of the VALUE: After Hours Podcast, Cassel, Taylor, and Carlisle discussed The Market Loves To Destroy Hubris. Here’s an excerpt from the episode: Ian: I find with investing especially, I think, we talked about before we came on live. I think this industry and finance and … Read More

Michael Mauboussin: Warren Buffett Says – When You Find Yourself In A Hole, The First Thing You Do Is Stop Digging

In his recent interview with WHG Clube do Livro, Michael Mauboussin discussed one example of how companies destroy wealth. Here’s an excerpt from the interview: Mauboussin: The third observation is that if you’re not earning your cost of capital, growth is bad. The faster you grow the more wealth you’re … Read More

Jeffrey Gundlach: Why A Recession Is Likely In 2023

In his recent interview with Fox Business, Jeffrey Gundlach explained why a recession is likely in 2023. Here’s an excerpt from the interview: Gundlach: We’re starting to see the real reasons to believe that… maybe not here in 2022, but in 2023, we may see a real recession because let’s … Read More

Seth Klarman Top 10 Holdings – Q1 2022, Buys ENC, FISV, GOOG, DBX, GTN

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S04 E018): Warren Buffett v Cathie Wood, Small Cap Value and Growth, Dopamine

In their latest episode of the VALUE: After Hours Podcast, Ian Cassel, Jake Taylor, and Tobias Carlisle discuss: The Market Loves To Destroy Hubris Warren Buffett vs Cathie Wood During Drawdowns – Add A New Position Or Buy More Of What You Have? Keep Track Of Your Unforced Errors One … Read More

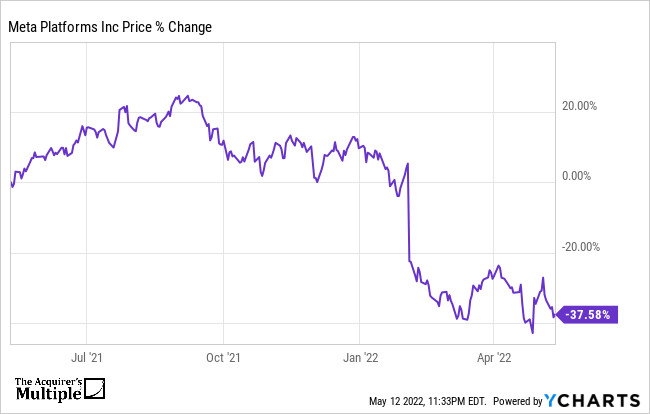

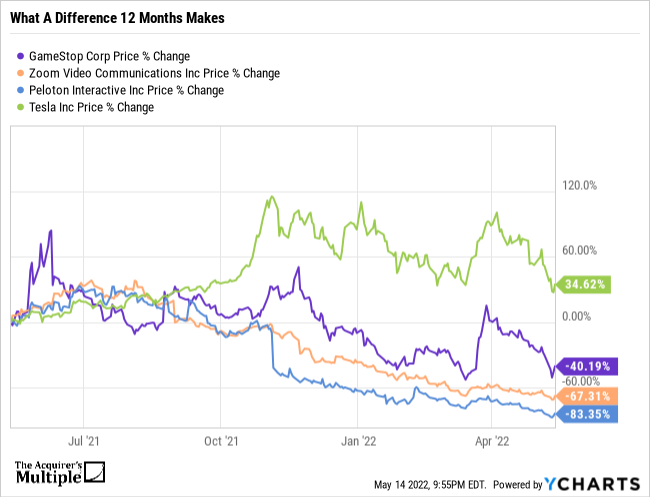

What A Difference 12 Months Makes @ycharts

Here’s a list of some of the most popular names just 12 months ago. What a difference 12 months makes. Peloton Interactive Inc (PTON) – Down 83.35% Zoom Video Communications Inc (ZM) – Down 67.31% GameStop Corp (GME) – Down 40.19% Telsa Inc (TSLA) – Down 34.62% GME data by … Read More

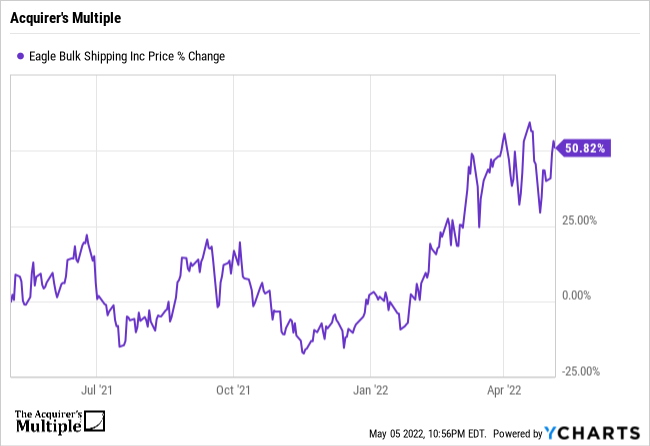

Stock In Focus – TAM Stock Screener – Eagle Bulk Shipping Inc (EGLE)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Eagle Bulk Shipping Inc (EGLE) Eagle Bulk Shipping Inc. operates in … Read More