This week’s best investing news:

In conversation with Howard Marks (SJP)

Terry Smith – FUNDSMITH Annual Shareholders’ Meeting February 2023 (FS)

Bill Nygren – Fundamental Investing From A Generalist’s Perspective (VIWL)

Tom Gayner – A Discussion with Markel’s CEO (Business Brew)

Jim Chanos – The Golden Age of Fraud in Finance (New Economic Thinking)

Mohnish Pabrai’s Q&A session at the SumZero Top Stocks Investor Summit (MP)

JPMorgan CEO Jamie Dimon on Ukraine, Russia, China, China, Fed, Economy (Bloomberg)

Michael Mauboussin Interview – Tim Ferris (TF)

Mark Leonard – The Best Capital Allocator You’ve Never Heard Of (TIP)

Aswath Damodaran – Dividends, Buybacks and Cash Flows (AD)

Citadel’s Ken Griffin on the Fed, Chicago crime, Debt Limit, ChatGPT (Bloomberg)

Cathie Wood’s flagship Ark fund tops $300mn in fees despite losses (FT)

Fed policy looks very misguided right now, says Wharton’s Jeremy Siegel (CNBC)

Berkshire Hathaway resumes Occidental purchases, stake reaches 22.2% (Reuters)

The Rich List: The 22nd Annual Ranking of the Highest-Earning Hedge Fund Managers (Institutional Investor)

Riding the Rails (Humble Dollar)

Bridgewater overhaul explains new hedge fund reality (AFR)

Verdad Research Update (Verdad)

So You Want To Be The Next Warren Buffett (russell-clark)

Soft Landing: Berkshire Hathaway Completes 80% Acquisition of Pilot (Kingswell)

Transcript: Maria Vassalou (Big Picture)

Why the Recession Is Always Six Months Away (WSJ)

EV Battery Company Our Next Energy Partners with Berkshire Hathaway in W.Va. (LocalToday)

Enough: The Forgotten Lesson of Ben Graham’s Life (Neckar)

Oil prices are in a good place right now, says Occidental Petroleum CEO (CNBC)

What I Learned Reading 1,000 Investor Reports (Collab Fund)

Tesla Stock Is More Popular Than Ever Among Individual Investors (WSJ)

Uncle Warren’s Inflation Warning (Felder)

Activist hedge fund manager Dan Loeb takes a passive stake in AMD (CNBC)

Silicon Valley Confronts the End of Growth. It’s a New Era for Tech Stocks (Barron’s)

This week’s best value Investing news:

Compression: Can the Value Spread Expand Forever? (AlphaArchitect)

The State of Value Investing (Brandes)

Value investing: is this the start of a new narrative? (M&G Investments)

Value versus growth investing – the great rotation and what’s next (Hargreaves Lansdown)

Growth stock vs. value stock? It’s all in the eye of the beholder (CNBC)

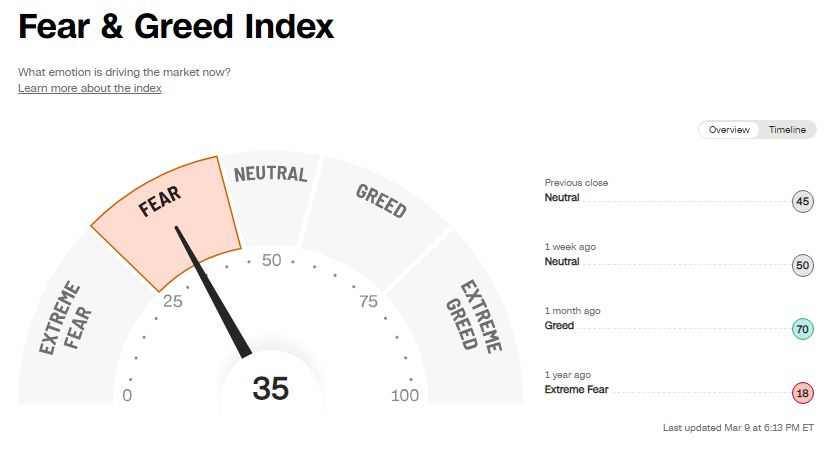

This week’s Fear & Greed Index:

This week’s best investing podcasts:

The Rewind: Calling The Market (Howard Marks)

TIP531: Mark Leonard: The Best Capital Allocator You’ve Never Heard of (TIP)

Episode #469: Jason Calacanis on Democratizing Venture Capital, How to Handle Large Winners (MF)

#161 Jim Dethmer: The Pillars of Integrity (KP)

Is There a Canary in the Coal Mine? (Real Vision)

Small-Cap Stocks with Short-Term Problems: The Secret to Beating the Market (WealthTrack)

Mike and Eli – Chasing Scratch and Podcasting (Business Brew)

Episode 055: Edward Chancellor on economic history and today’s markets (Bogleheads)

Trae Stephens – Find Good Quests (ILTB)

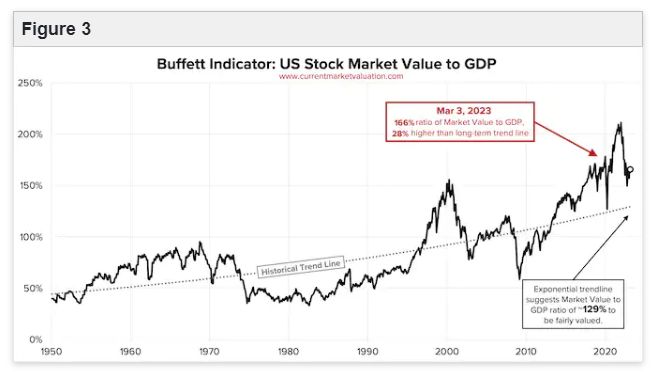

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

The Risk of Return (ASC)

Compression: Can the Value Spread Expand Forever? (AlphaArchitect)

Risk Vs. Uncertainty and the Illusion of Control (PAL)

The Queen of Wall Street – Hetty Green: America’s First Value Investor (AAA)

This week’s best investing tweet:

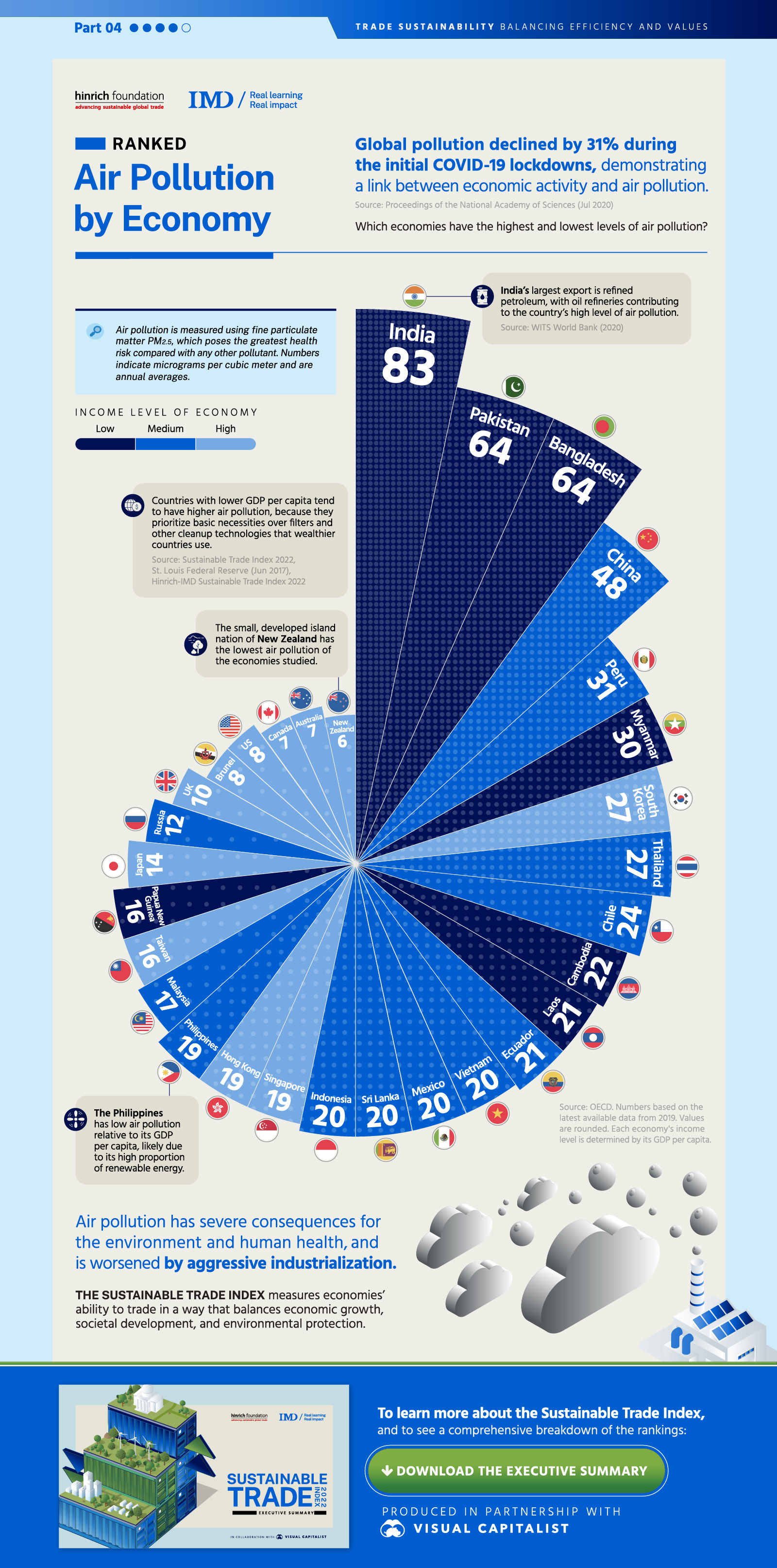

This week’s best investing graphic:

Ranked: Air Pollution by Economy (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: