In their recent Q4 2022 Letter, GMO highlighted that in 2022 within U.S. large caps, the value/growth spread was a stunning 24% in favor of value. Here’s an excerpt from the letter:

Even within at least one strategy that looks to have been perfectly JOMO – the value versus growth spread within U.S. large cap equities – slightly odd things happened under the surface.

Within U.S. large caps, the value/growth spread was a stunning 24% in favor of value. Only 2000, where that spread was an even more amazing 28%, was a better year for value versus growth.

Historically, good years for value are good years for value within value as well. In 2000, for example, the value half of the market beat the overall market by over 14%. And the cheapest 20% of the market (deep value) beat the next 30% of the market (shallow value) by 17%.

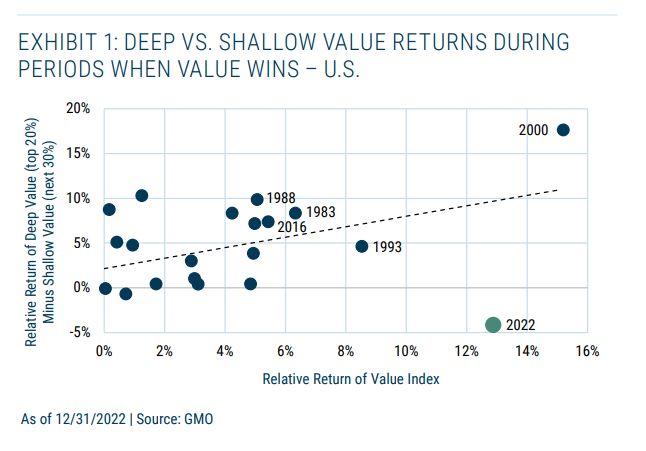

Value within value absolutely crushed the rest of value. That was an exceptional performance for “value within value,” but in a way 2022 was even more exceptional, just not in a good way for fans of deep value. Exhibit 1 shows the performance of deep versus shallow value across all years since 1980 in which value beat growth.

Relative to the general pattern, 2000 was an outlier to the upside – deep value beat shallow value by about 6% more than would have been expected. But in 2022, deep value lost to shallow value by almost 5%, against an expected win of 10%. It’s far and away the largest outlier on the chart, and we can’t find anything fundamental that would explain it.

Deep value stocks were not particularly junky or cyclical at the time relative to the market, their underlying earnings and other fundamentals were pretty good, and they came into the year trading at one of their biggest discounts to the market and to shallow value that we’d ever seen.

In keeping with the JOMO theme, I’d say that 2022 was not so much a year where it was a ton of fun as a value manager, rather a nightmare for high-priced growth. Unless you called the energy rally and bet heavily on that, value investing felt more like a matter of watching the stuff you’d never own fall sharply while still feeling a bit frustrated that the market still didn’t fully appreciate the charms of the stocks you held.

You can read the entire letter here:

GMO – 2022: THE JOY OF MISSING OUT – A Bad Year in Markets Brings Better Opportunities

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: