This week’s best investing news:

Howard Marks Memo: What Really Matters? (OakTree)

How Intangible Assets Shape Markets (Jamie Catherwood)

Buffett’s Berkshire boosts stakes in Japan’s five biggest trading houses (Reuters)

Bridgewater’s Ray Dalio Sees Rough Road Ahead For Global Economy As Debt Bubble Deflates (Forbes)

Why the Investing Pros Were Such Suckers for FTX (WSJ)

Mario Gabelli – Don’t ignore Paramount because ‘short-termism’ is having a challenge (CNBC)

Bill Nygren – Volatility Creating Value Opportunity in US Equities (Natixis)

Billionaire Investor Carl Icahn Is Betting Against GameStop Shares (Bloomberg)

More Bearish Market Action Before The Bull Can Run (ZeroHedge)

Achieving long-term financial security is about investing adventurously now (FT)

Trend-Following: Why Now? A Macro Perspective (AQR)

Transcript: Marcus Shaw (Barry Ritholz)

Crypto Is Collapsing but Activist Investor Bill Ackman Sees Promise (Barron’s)

Some Thoughts on Investing, an Ongoing List. (Borrowed and not) (Collab Fund)

John Hussman – Weighing Machine, Voting Machine (Advisor Perspectives)

The Hustler: Lessons from a Young Warren Buffett (Neckar)

Chase Coleman’s Tiger Global Is Slashing the Value of Its Venture Holdings by 24% (Yahoo)

The MacGuffin, Part 2: The Story Arc of SBF and FTX (Ep Theory)

Jim Bianco – The Fed Has Ways to Go With Hiking Rates (The Market)

Making Lemonade (Humble Dollar)

When Narratives Collapse (Barry Ritholz)

Rising Uncertainty = Greater Value Potential (Miller Value)

Matrix Asset Advisors Q2 2022 Commentary (Matrix)

This week’s best value Investing news:

SA Interview: Value Investing With Courage & Conviction Investing (SA)

AQR’s Cliff Asness Is Finally Winning, But He’s as Grouchy as Ever (Bloomberg)

Can value investing get you the returns you want? Think bank, power, and FMCG stocks (Economic Times)

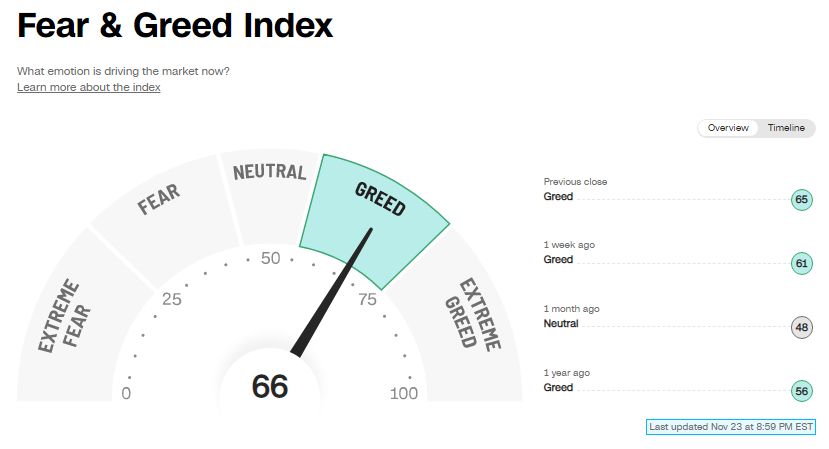

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP496: Mastermind Q4 2022 w/ Tobias Carlisle and Hari Ramachandra (TIP)

Robeco – The Cross-Section of Stock Returns before 1926 (and beyond) (Meb Faber)

How Long Can This Rally Last? (Real Vision)

What Really Matters? (Howard Marks)

Kessler: More Market Warnings (WealthTrack)

Ep 375. Q&A: Buffett’s Best Investment (Focused Compounding)

Expert: John Caulfield – Investing in carbon credits | VanEck (Equity Mates)

Shane Battier – The No-Stats All-Star (Invest Like The Best)

A Common Sense Approach to Markets with Ben Carlson (Excess Returns)

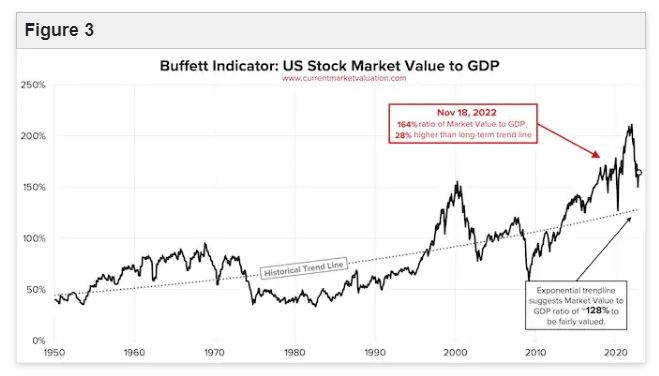

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Optimal Trend Following Rules in Two-State Regime-Switching Models (AlphaArchitect)

Bonds Pump the Brakes (AllStarCharts)

Exploit style momentum – Track the style leaders (DSGMV)

Can Hedge Funds Behave If Fixed Income Doesn’t? A Manager-Selection View (AllAboutAlpha)

This week’s best investing tweet:

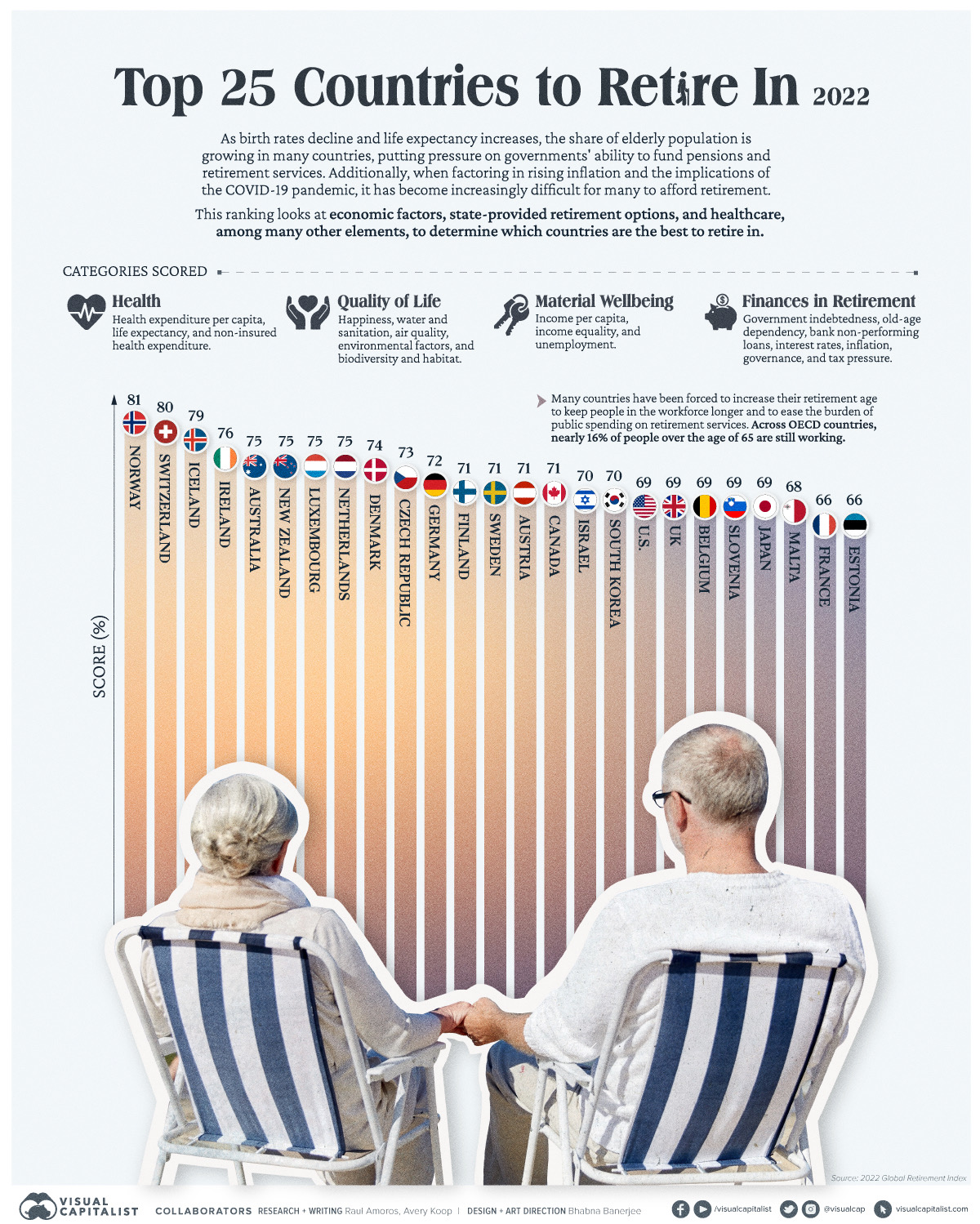

This week’s best investing graphic:

Ranked: The Best Countries to Retire In (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: