This week’s best investing news:

Mohnish Pabrai’s Talk with CFA Society of Mexico (MP)

Ray Dalio: It Starts With Inflation (LinkIn)

The MBA Indicator (Verdad)

Burry Re-Ups on Gloomy Prediction: ‘We Have Not Hit Bottom Yet’ (Bloomberg)

How the Worst Market Timer in History Built a Fortune (CA)

Terry Smith’s listed emerging equities fund to close (Reuters)

How To Read The Labels Wall Street Uses To Rate Stocks (Validea)

Tweedy, Browne: “Price Matters Again” (AP)

Palantir CEO Alex Karp and Stanley Druckenmiller (Palantir)

Billionaire investor Mario Gabelli explains why he’s looking to buy agriculture stocks (CNBC)

Tian Yang On The Virtues Of Variant Perception Versus Unconscious Conformity (Felder)

The Fed should not vary interest rates from normal levels, says Nassim Taleb (CNBC)

We expect equities to continue being the asset of choice, says Oakmark’s Bill Nygren (CNBC)

Ark Invest’s Cathie Wood predicts inflation will see ‘major downside surprises’ in coming months (Fox)

Apple: Don’t Panic, Hold On Like Warren Buffett (SA)

Municipal Bonds Suddenly Look Cheap. Some Are Tax Traps (WSJ)

Bear Market Bounce or Stock Market Bottom? (GS)

Wall St tumbles to biggest loss in two years following CPI data (Reuters)

Are Individual Investors Rational? Evidence from NBA Top Shot Challenges (ssrn)

David Katz: 2022 Market Outlook Post-Labor Day (Bloomberg)

The energy historian who says rapid decarbonization is a fantasy (LA Times)

Future market surprises will be on the upside, says Wharton’s Jeremy Siegel (CNBC)

It’s Supposed To Be Hard (Morgan Housel)

Equity Markets Aren’t Pricing in the Next Stage of the Tightening Cycle (Bridgewater)

What’s Alpha? (Morningstar)

The First Totally Honest Stock Market Story (Barry Ritholz)

An economist studied popular finance tips. Some might be leading you astray (NPR)

September Views from First Eagle Global Value Team (FE)

This week’s best value Investing news:

Testing the patience of value investors (Larry Swedroe)

Value in Disguise (Causeway)

Value Investing In Japan Has Merits (Bloomberg)

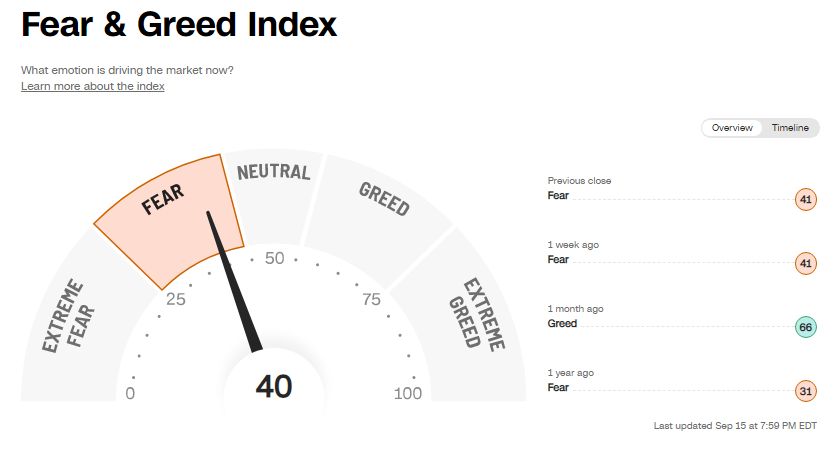

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP475: Mastermind Q3 2022 w/ Tobias Carlisle (TIP)

Behind The Memo: The Illusion of Knowledge (Howard Marks)

Episode #443: Kyle Bass on The Market, Energy Crisis & His New Big Bet For The Next Decade (Meb Faber)

Gabriel Leydon – How Web3 Onboards a Billion Users (Invest Like The Best)

New iPhone Can’t Make Apple’s Stock Shine (Morningstar)

Dotcom 2.0 bubble has burst. What is next? – Ep 163 (Intellectual Investor)

What To Do at the Acceptance Stage of the Tightening Cycle (Real Vision)

The Cyclicality of Malthusianism (This Week In Intelligent Investing)

Making Big Gains In Bear Markets (w./ Christian Putz) (Capital Employed)

Talking Like Volcker, Channeling Burns (guests: Rob Arnott, Brent Kochuba) (Market Huddle)

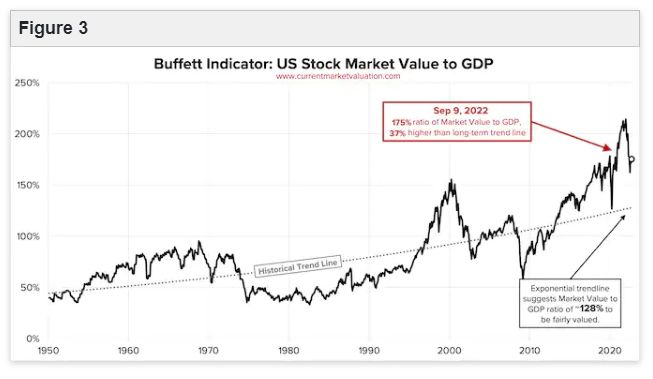

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Brand Values and Long-Term Stock Returns (AlphaArchitect)

The Fed’s “Time of Testing”: Is This Where the Trouble Will Stop? (CFA)

Yields Pack a Punch (AllStarCharts)

This week’s best investing tweet:

This week’s best investing graphic:

Animation: The Most Popular Websites by Web Traffic (1993-2022) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: