This week’s best investing news:

Howard Marks: Conversation at Panmure House (OakTree)

High Yield, High Volatility (Verdad)

Why famed hedge-fund manager David Einhorn recently issued a bullish call on gold (G&M)

Six Things That Might Go Right (Validea)

Mega Questions | Ray Dalio (Charlie Rose)

Weimar, War, and the Narrative of Central Bank Omnipotence (Epsilon Theory)

Keep It Going (Collaborative Fund)

Sell in May? (Humble Dollar)

I really started thinking about the integrity of the data (Rudy Havenstein)

Ray Dalio: Reducing Inflation Will Come at a Great Cost: Stagflation (Linkedin)

Trustless (Scott Galloway)

Warren Buffett Stocks: The Coca-Cola Company (Sure Dividend)

Someone paid $19 million for a steak lunch with Warren Buffett (CNN)

The Shiller CAPE 10: how to use it, not abuse it (EB Investor)

ExxonMobil At The Crossroads (CNBC)

Make Haste Slowly (Woodlock House)

Activist shareholder Nelson Peltz in tussle with insurgent investors (FT)

Do Bear Markets Lead to Recessions? (Morningstar)

Berkshire Hathaway: Hit To Book Value Could Be Drastic But A Buying Opportunity Comes With It (SA)

296: Constellation Software, SONY, the AWS of Advanced Manufacturing (Liberty)

How to Stand Up to a Bear Market (WSJ)

JPMorgan Packed Its Wealthy Clients Into Tiger Global Fund for Private Bets (Bloomberg)

Aswath Damodaran: Valuations In Challenging Markets (Lunches with Legends)

Ken Fisher on ‘ghostbusters’ bear market: ‘People don’t like to be kneecapped’ (Fox News)

The Fire Burning Beneath Crypto’s Meltdown (WSJ)

Cliff Asness Says Value Investing Can Keep Winning (Bloomberg)

Stocks Historically Don’t Bottom Out Until the Fed Eases (WSJ)

Wonking Out: Wasn’t Bitcoin Supposed to Be a Hedge Against Inflation? (NYT)

The Perfect Storm In Oil Caught Markets Off Guard (OilPrice)

The World’s Bubbliest Housing Markets Are Flashing Warning Signs (Bloomberg)

Don’t get caught up in day-to-day swings when investing: Matrix’s David Katz (CNBC)

Don’t just look at moats, keep an eye on crumbling castles too (Morningstar)

Sequoia Is Down Bad (Newcomer)

Prem Watsa: We can’t think of a better country to invest in than India (Bloomberg)

“Paint or Get Off the Ladder” – Jeffrey Gundlach (CNBC)

Nick Train and Michael Lindsell commit to seven more years managing money (Interactive Investor)

Richard Thaler on the current market (Morningstar)

Which Small-Caps Look Set to Benefit from Inflation? (Royce)

Maintaining an Even Keel Through Volatile Conditions (First Eagle)

Investor Sentiment, Style Investing, and Momentum (papers.ssrn)

Why Broader Portfolio Diversification Has Finally Started Paying Off (Morningstar)

Your Balanced Index Still Isn’t Balanced (PragCap)

This week’s best value Investing news:

Value Investing Outlook 2022 (Morgan Stanley)

The Golden Era of Value Investing is Back (Yahoo)

Will value stocks continue to outperform expensive sector peers? (BNP Paribas)

Don’t Gamble – Invest In Contrarian Value (Seeking Alpha)

Ep 362. Value Stock vs. Value Trap: The Importance of Business Momentum (Focused Compounding)

Ep. 230 – Deep Value MicroCap Investing with Michael Melby, Founder and Portfolio Manager at Gate City Capital Management (Planet MicroCap)

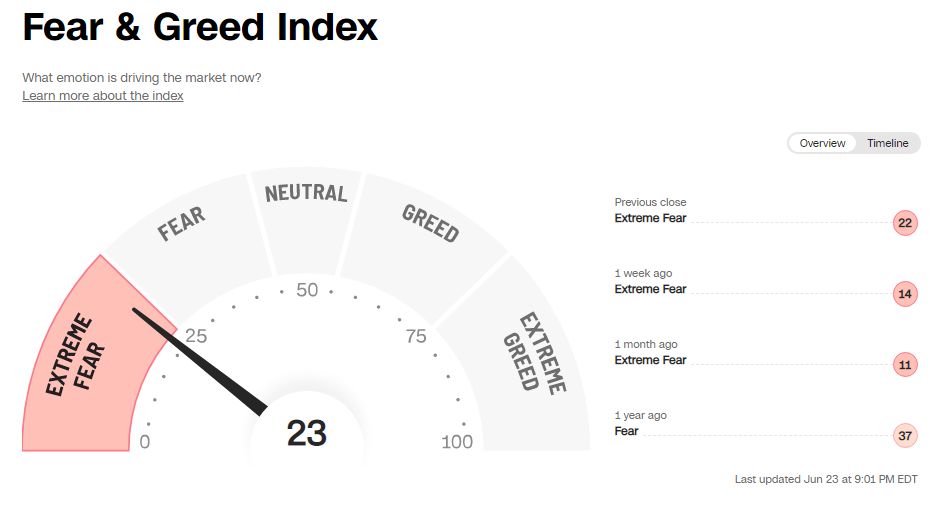

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

TIP459: The Equation for a Meaningful Life w/ Vitaliy Katsenelson (TIP)

Episode #425: Dan Ariely, Irrational Capital – Investing in Human Capital (Meb Faber)

#140 TKP Insights: Sex and Relationships (Knowledge Project)

Zero to 100 (billion) in six years (Equity Mates)

Six Experts Help Us Understand Momentum Investing (Excess Returns)

How to Trade Market Sentiment & Why Inflation Is Coming Down | Jared Dillian (Hidden Forces)

Lydia Jett – Investing in E-commerce (Invest Like The Best)

Scared to Invest in a Bear Market? (Morningstar)

Jordan Noone – Rockets and Venture Capital! (Business Brew)

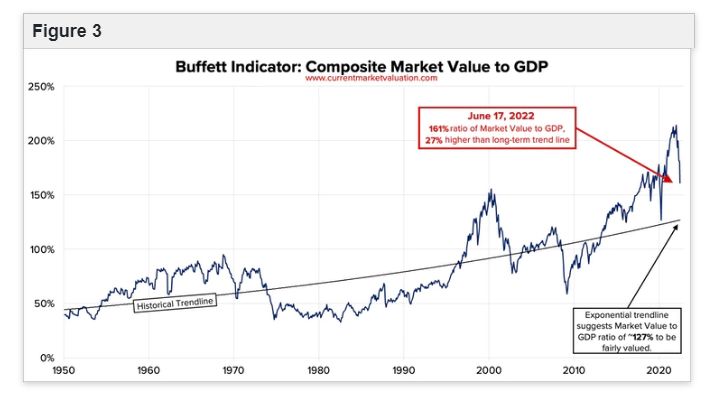

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Does Emerging Markets Investing Make Sense? (AlphaArchitect)

Long-Duration Assets Still Moving Together (AllStarCharts)

Cochrane and Coleman: The Fiscal Theory of the Price Level and Inflation Episodes (CFA)

The two cousins – asset and price inflation” (DSGMV)

Is the Energy Rally Over? (PAL)

This week’s best investing tweet:

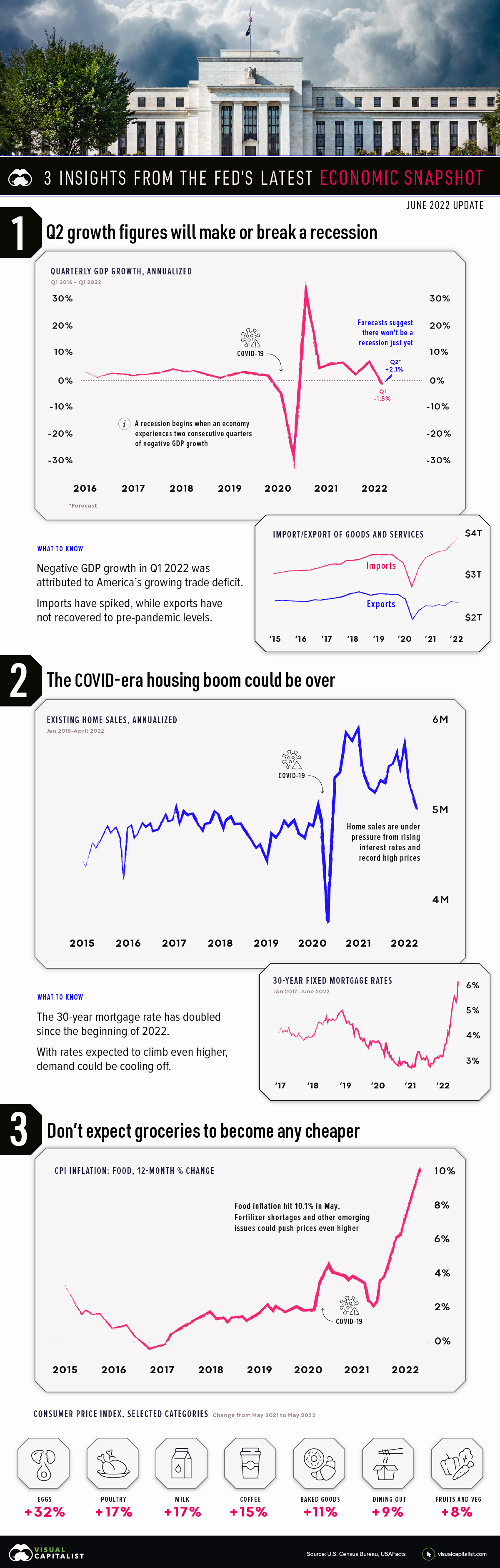

This week’s best investing graphic:

3 Insights From the FED’s Latest Economic Snapshot (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: