Here’s a list of this week’s best investing news:

Factor Investing in Commodities (Verdad)

Raccoonery in Action (Epsilon Theory)

Master Series: David Rolfe (Investment Masters Class)

What a Drag (Humble Dollar)

GMO Resource Equities (GMO)

Speculators Bet The Farm On Stocks (Felder)

Your father’s stock market is never coming back (Fortune)

Few Opportunities Amid Low Distress, Laments Marks (Validea)

Larry Cunningham on Margin of Trust: The Berkshire Business Model (MOI)

The Pied Piper Of SPACS (New Yorker)

Peter Lynch on Common Investor Mistakes (Novel Investor)

Carl Icahn Embraces Cryptos (WTI)

How Crypto Gets Hacked – The Death of The Dao (Furball)

Charlie Munger’s Book Recommendation List (CMQ)

Is the stock market out of step with the economy? (Morningstar)

Are Penny Stocks Compatible with Value Investing? (VVI)

MeWork (Scott Galloway)

How Ronald Read managed to accumulate a dividend portfolio worth $8 million (DGI)

Three Things I Think I Think – The More Things Change the More They Stay the Same (PragCap)

Fiat Meets Crypto; Bigger, Bolder Acquisitions; David Swensen’s Legacy (Andreessen Horowitz)

Lots of Liquidity (Dr Ed)

How to Write Creative Fiction: Umberto Eco’s Four Rules (Farnam Street)

136: Nvidia Q1 Highlights, 33 Bits, Druck & Soros’ Adventures, Thoughts on Amazon Unbound (Liberty)

What are the 10 Biggest Mistakes Made by Fund Investors? (Behavioural Investment)

The Difference Between Amateurs and Professionals (Howard Lindzon)

The Good, the Bad and the false. Addressing 9 arguments against ESG (Real Returns)

The True Addressable Market for Digital Advertising (Tanay)

Doing More with Less, a Lot More (Brinker)

How to stop noise undermining your decision making (EB Investor)

This week’s S&P vs CAPE:

36.77.

This week’s best value Investing news:

Is value investing about to stage a major comeback? (SMH)

A Longtime Value Manager Is Betting on Gold Stocks. Here’s Why. (Barron’s)

A Value Manager’s Take On Disruption: Competitive Strength As An Alpha Factor (Causeway)

Capitalism Won’t Thrive on Value Investing Alone (HBR)

Value And Growth: The Indivisible Dichotomy (Seeking Alpha)

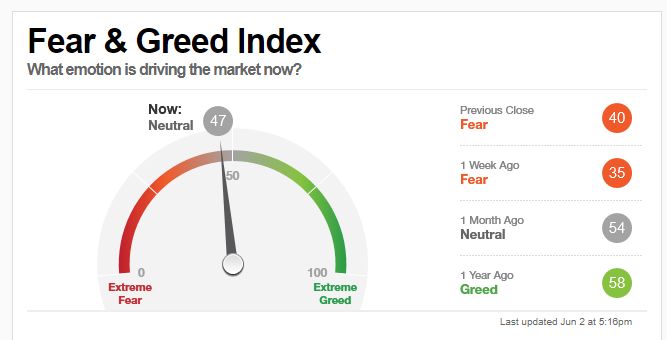

This week’s Fear & Greed Index:

This week’s best investing research:

DIY Asset Allocation Weights: June 2021 (Alpha Architect)

Market Rise Amid Low Participation (All Star Charts)

Permanent Capital: The Holy Grail of Private Markets (CFA)

Inflation dispersion increases market opportunities and trading (DSGMV)

Will the 2020 SPAC IPOs Boom Continue? (All About Alpha)

Massive Supply Chain Issues (UPFINA)

Adaptive Trend-Following Performance Update (PAL)

SPX Option Whale (MacroTourist)

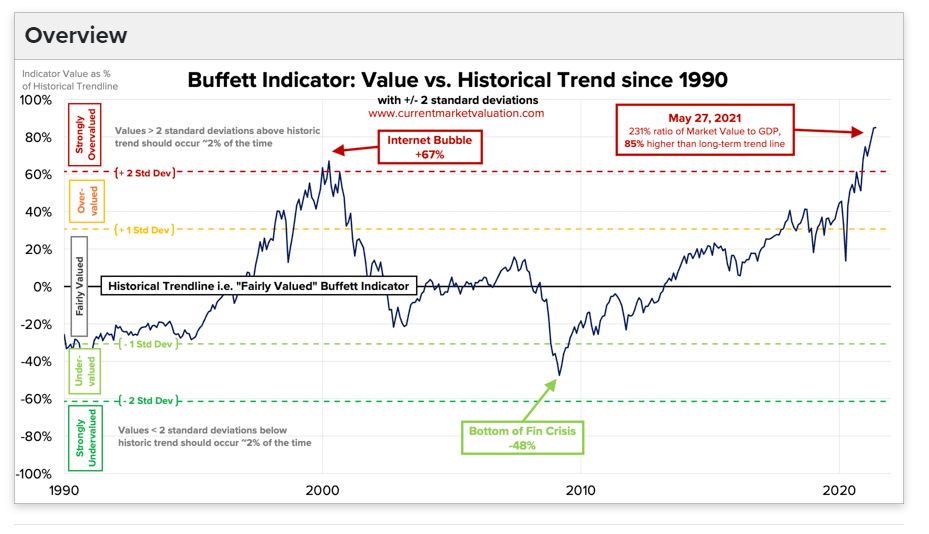

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing tweet:

This week’s best investing podcasts:

Charley Ellis – The Magic of David Swensen (Capital Allocators)

Could ARK Pose a Systemic Risk to the Market? A Look at How ETFs Work Can Help Us Find Out (Excess Returns)

#112 Adam Grant: Rethinking Your Position (Knowledge Project)

Guillermo Roditi Dominguez – Path or Destination, Not Both (S4E5) (Flirting with Models)

Dennis Lynch – Delivering Alpha in Adapting Markets (Invest Like The Best)

EP 314. How Much Is Too Much To Pay for a Great Business (Focused Compounding)

Break It Apart and Rebuild (Barron’s)

Arnold Van Den Berg – A Must Listen Life, and Investing, Discussion (Business Brew)

The Big Ideas of Investing | The Sale of Nuance: A Case Study in Incentives (Intelligent Investing)

The Investors Roundtable #37: What Does Investing in a Post-Pandemic World Look Like? (Planet MicroCap)

Special Presentation: Apple, Tesla, Amazon – Undervalued or Not? (Morningstar)

TIP351: The Psychology of Money w/ Morgan Housel (TIP)

Financial Nihilism, Narrative Investing, & the Hyperreality of Markets (Hidden Forces)

Second Coming of the Meme Stocks? (Real Vision)

From Hubris to Humility (Safal Niveshak)

MiB: Carson Block of Muddy Waters (Barry Ritholz)

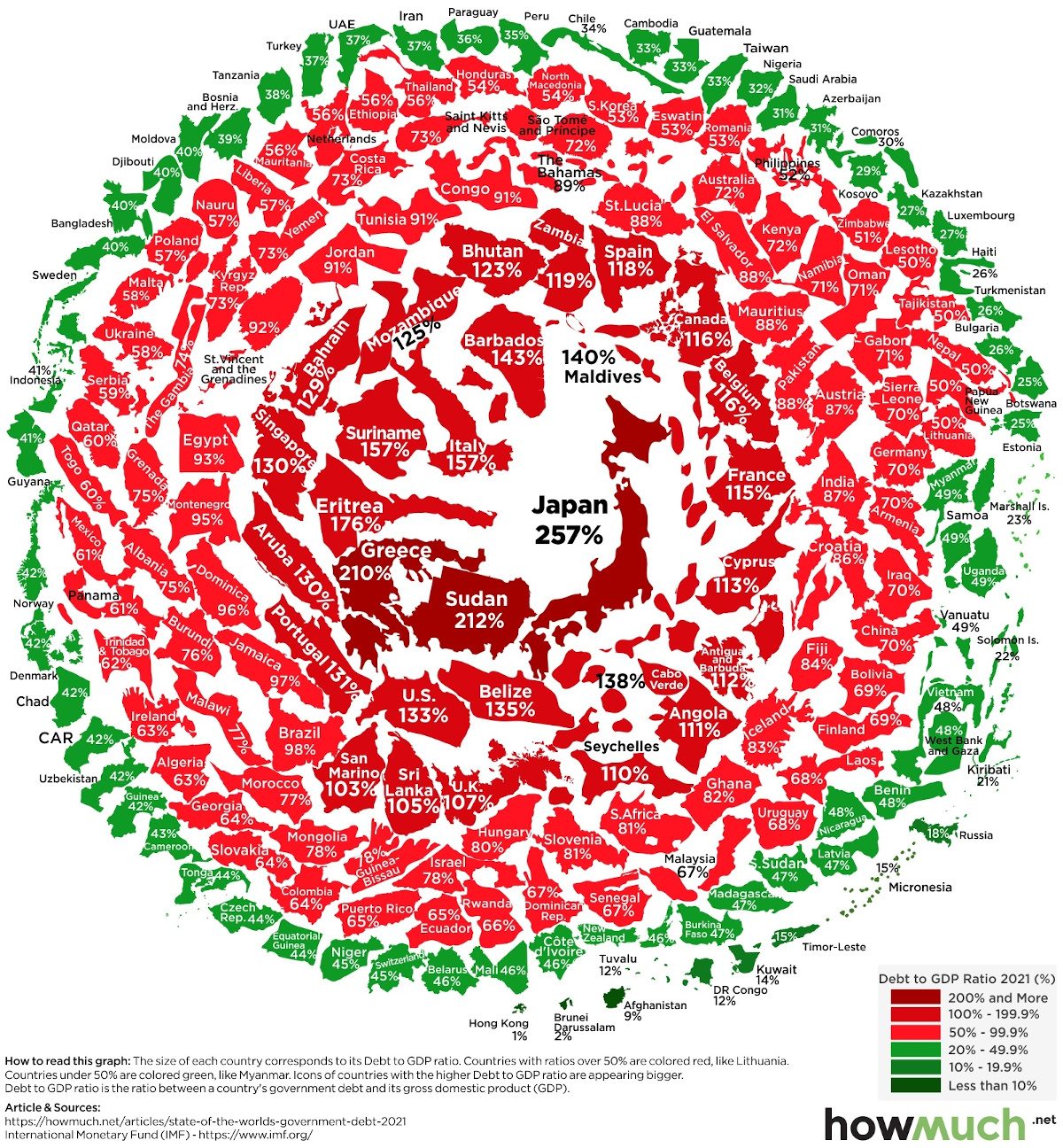

This week’s best investing graphic:

Visualizing the Snowball of Government Debt (Visual Capitalist)

(Source:howmuch.net)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: