Here’s a list of this week’s best investing news:

Emerging Markets: Slow Growth, High Volatility (Verdad)

Financial Innovation & Historical Recap (Investor Amnesia)

Howard Marks & Joel Greenblatt: Is It Different This Time? (Real Vision)

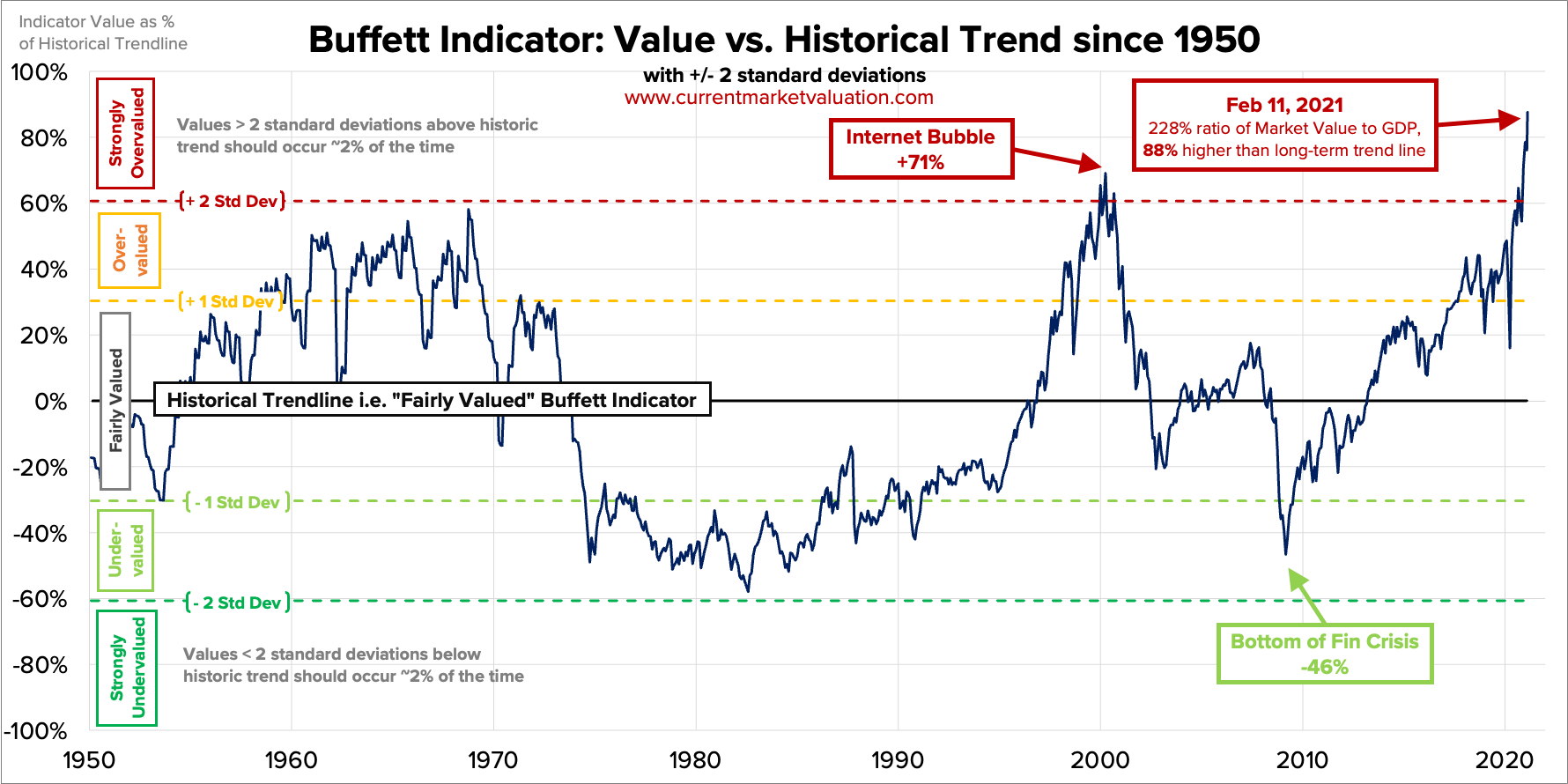

The Buffett Indicator at All-Time Highs: Is This Cause for Concern? (Visual Capitalist)

A Few Good Books (Collaborative Fund)

Anthony Deden, Edelweiss Holdings – Preview (Grant Williams)

What I Worked On (Paul Graham)

Redemptions of $5 Billion Since Dec 1 for Renaissance Technologies (Validea)

The Algebra of Wealth (Scott Galloway)

One For The Ages, Part Tres (Felder)

Solve Problems Before They Happen by Developing an “Inner Sense of Captaincy” (Farnam Street)

Berkshire a Net Seller of Equities in Q4 (Morningstar)

Beware Economists Warning Against “Too Much Stimulus” (Again) (Barry Ritholz)

Charlie Munger Warns of Lost Decade for Investing (2021-2031) (Internet Tycoon)

Graham & Doddsville Newsletter Winter 2021 (G&D)

Why ‘Buy Low, Sell High’ Doesn’t Actually Work for Most People (Whitney Tilson)

Pershing Square Holdings Annual Investor Presentation (Pershing Square)

Warren Buffett’s Latest Three New Investments (DGI)

Three Things I Think I Think – YOLO Gambling is Reckless (Prag Cap)

Michael Mauboussin – Measuring the Moat (Credit Suisse)

Leon Cooperman Calls for Reinstating the Uptick Rule (Bloomberg)

The Renaissance of Pipelines and Our Sell Discipline (Vitaliy Katsenelson)

Data Update 4 for 2021: The Hurdle Rate (Aswath Damodaran)

Robinhood, Citadel, Reddit Executives Testify at GameStop Hearing (Bloomberg)

Bruce Berkowitz: From Morningstar Manager of the Decade to 15 Years of Underperformance (Canuck)

Capital Account: A Money Manager’s Reports on a Turbulent Decade 1993-2002 by Marathon (Novel)

Learning from Disney’s Bob Iger (Investment Masters Class)

The Equity Market Implications of the Retail Investment Boom (ssrn)

The Case for Default Insurance (Andreessen Horowitz)

Here Are the 100 Most Sustainable Companies Right Now (Barron’s)

How This Boom/Bubble Ends (Howard Lindzon)

Cutting Dividends to Create Value (Woodlock)

2021:4 Druckenmiller buckle up, German companies can split-up, Estée Lauder, luxury marketing rules and short-selling (Observing the Market)

Economic Metrics (SaaS Engineering)

The MoneyByRamey Top 5 Dividend Stocks for 2021 (Sure Dividend)

Lindsell Train UK Equity Fund January 2021 (Lindsell Train)

Fourth Quarter 2020 Letter (Greenwood)

Constellation Software Shareholder Letter (Constellation)

Hayden Capital Q4 2020 (Hayden)

This week’s best value investing news:

It’s Nice To Finally See Value Stocks lead The Market (BNN Bloomberg)

Investors, Don’t Succumb To The Fear Of Missing Out (Forbes)

A Value Manager on How Most Value Managers Are Getting It All Wrong (Bloomberg)

The Man Who Abandoned Value (Institutional Investor)

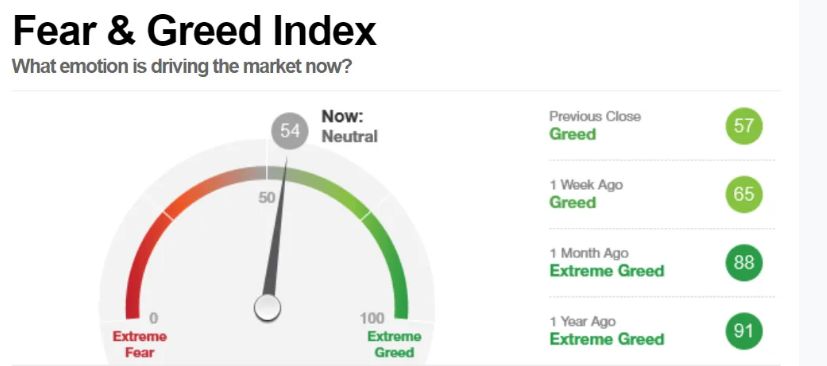

This week’s Fear & Greed Index:

This week’s best investing research:

Data Update 4 for 2021: The Hurdle Rate Question! (Aswath Damodaran)

ESG Factors and Traditional Factors (Alpha Architect)

Impact-Weighted Accounting: The Missing Ingredient? (CFA Institute)

The Worst Year for Bonds in History? (Compound Advisors)

Do TIPS Limit The 10 Year Yield? (UPFINA)

S&P 500 and Month of February (PAL)

This week’s best investing tweet:

This week’s best investing podcasts:

Tom Gardner: How to Beat the Market In the Next 10 Years (Ep. 252) (Dave Lee)

#104 Nir Eyal: Mastering Indistraction (Knowledge Project)

Invest in the Mind (Barron’s)

The Elusive Definition of Risk – And Some Practical Ways to Measure It (Excess Returns)

Staying Sane in an Insane Environment, SPACs, Geoff’s Favorite Businesses, Valuation, Management, and Other Questions From Twitter (Focused Compounding)

Scott Belsky – Focus on the First Mile – EP. 213] (Invest Like The Best)

304- Li Lu’s Speech and Investable Assets (InvestED)

Ben Inker on Value and Asset Allocation (MIB)

Myopic Loss Aversion, Lumpiness of Returns | Human Misjudgment 3.0 (Intelligent Investing)

Zombie Companies, The Amazon Effect, and ETFs (Stansberry)

Derek Walin – Entrepreneur and Music Maven (Business Brew)

Girls’ Gambit – Ep 112 (Intelligent Investor)

Disney Q1 FY21 – A Better Mouse Trap (Science of Hitting)

TIP336: Mental Models Used by Billionaires w/ Sahil Bloom (TIP)

This week’s best investing graphic:

The Buffett Indicator at All-Time Highs: Is This Cause for Concern? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: