In his 2020 Annual Letter, Terry Smith makes a great observation regarding todays ‘technology’ companies saying, “I would suggest that the secular drivers of these businesses have some distinct differences and that their prospects are not governed by a single factor — technology. This one size fits all label does not help much in evaluating them.” Here’s an excerpt from the letter:

Some commentators have attributed our recent outperformance to the performance of technology stocks accompanied by warnings that a ‘bubble’ is building in technology stocks rather like the Dotcom Bubble and that it may burst with similar ill effects. The technology heavy NASDAQ Index has provided a total return of +40.9% in 2020 and the MSCI World Information Technology Index delivered +40.2% so maybe they have a point.

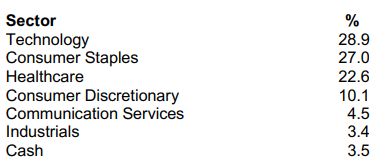

I suspect that some of these commentators are the same ones who told you some years ago that our investment strategy was too heavily dependent on consumer staples stocks which they also viewed as over-rated. However, it’s always good to start with the facts. Our Fund’s sectoral exposure was as follows at the year-end:

Technology is certainly the largest sectoral exposure but it is closely followed by Consumer Staples and in fact if you take all our consumer stocks — discretionary and staples — together, they far outweigh our technology exposure.

Moreover, I am not sure that these sector labels are all that helpful in determining what we are really exposed to. For example, our Communication Services holding is in fact Facebook. Isn’t that a technology company?

What do the following companies have in common? Amadeus, Automatic Data Processing, Facebook, Intuit, Microsoft, PayPal, Sage and Visa? They are all owned by our Fund and they are all labelled as technology companies.

Yet they span airline reservation systems; payroll processing; social media, digital advertising and communications; accounting and tax software; operating systems, distributed computing (the ‘cloud’), software development tools, business applications and video gaming; and payment processing.

I would suggest that the secular drivers of these businesses have some distinct differences and that their prospects are not governed by a single factor — technology. This one size fits all label does not help much in evaluating them.

You can read the entire letter here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: