Here’s a list of this week’s best investing reads:

Gold, Bitcoin & Markets (Jamie Catherwood)

Apple, Epic, and the App Store (Stratechery)

50 Of The Best Investing Podcasts On The Planet (2020) (Acquirer’s Multiple)

Why Warren Buffett Is Buying Precious Metals (Again) (Felder Report)

Post-Reorg Equities (Verdad)

Modeling a Wealth Tax (Paul Graham)

Rational Exuberance (Daily Reckoning)

What Happens When Stocks Make New Highs? (The Irrelevant Investor)

Bubble-hunting has become more art than science (Economist)

The Most Annoying Job In The Investment Biz (The Reformed Broker)

Apple becomes first U.S. company to reach a $2 trillion market cap (CNBC)

The Hardest Investing Questions to Answer (A Wealth of Common Sense)

The Cautionary Tale (Monevator)

‘The Longest Unprofitable Short I’ve Ever Seen.’ (Institutional Investor)

A Viral Market Update XIII: The Strong (FANGAM) get stronger! (Aswath Damodaran)

Rob Arnott Weighs In On the Impact Of Fiscal And Monetary Policy On The Economy (TD Ameritrade)

Big Tech’s Domination of Business Reaches New Heights (NY Times)

Markets are more efficient than you think (EBI)

More Thoughts on Concentrated Index Risk (Barry Ritholz)

What’s driving the new gold rush? (Fortune)

When The Magic Happens (Collaborative Fund)

Is Buffett Really Bearish?! (Brooklyn Investor)

The ‘Everything Bubble’ Isn’t Everything, and Maybe Not Even a Bubble (WSJ)

A Follower is Not a Follower (Of Dollars & Data)

Microsoft + TikTok = nfw (Scott Galloway)

Facebook Delenda Est (Epsilon Theory)

Tesla: The Most Dangerous Stock for Fiduciaries (New Constructs)

Paper Shuffling to Fool Investors (Novel Investor)

Weekly Quotes From Earnings Calls 08.17.20 (The Transcript)

The Observer Effect: Seeing Is Changing (Farnam Street)

A Golden Rule from a Golden Fool (Jason Zweig)

The Sketchbook of Wisdom: A Hand-Written Manual on the Pursuit of Wealth and Good Life (Safal Niveshak)

The Pandemic’s Big-Box Retail Renaissance (Whitney Tilson)

Investors: Think like a Physiotherapist (Real Returns)

Why did stocks not outperform bonds for 50 years? (Klement)

Lifetime Value & Customer Acquisition Cost: A Framework For Investing (Macro Ops)

Why Investors Blow Up (and How To Avoid That) (Musing Zebra)

The S&P Back At All Time Highs – Definitely A Better Moment To Panic (Howard Lindzon)

The Different Factors and Elements To Consider When Trying To Evaluate A Business (Fat Pitch)

Now Is The Time To Buy Cheap, Not To Buy Everything (Advisor Perspectives)

Who Picks Up the Tab for the Free Lunch? (Frank Martin)

So I Tried TikTok (Brian Langis)

Carl Icahn Issues Statement Regarding Herbalife (Carl Icahn)

Why You Should Be a Goals-Based Investor (CFA Institute)

GreenWood Investor Letter Q2 2020 (GreenWood)

Another Roaring Twenties May Be Ahead (Dr Ed)

Long Term Investors Needed (DGI)

Risk Managers Throw Caution To The Wind (Dana Lyons)

Why Planes, Trains, And Automobiles Are Worth Watching – The Index, Not The Movie (Brinker)

NYC Is Dead, Long Live NYC (AVC)

Tale of Two Markets (Boyar)

When Entry Multiples Don’t Matter (Andreessen Horowitz)

A Warning To The Compounder Bros… (Adventures In Capitalism)

This week’s best value investing reads:

Value Investing: An Examination of the 1,000 Largest Firms (Alpha Architect)

Why You Should Give Value a Chance (Validea)

Value Betting vs Value Investing (ValueWalk)

The champ’s big comeback: Why beaten-down value stocks are poised to thrive (Fortune)

This week’s best investing tweet:

“Beware the investment activity that produces applause; the great moves are usually greeted by yawns.”

-Buffett— soonervaluecap (@soonervaluecap) August 20, 2020

This week’s best investing research reads:

Rebalance Timing Luck: The (Dumb) Luck of Smart Beta (Flirting with Models)

Yield Curve Control Disappointment (Macro Tourist)

Strong Earnings Revisions But There’s A Problem (UPFINA)

A victory for shareholders trying to learn about dark companies! (Oddball Stocks)

Bond Real Yields: What’s Happening Beneath the Surface (Schwab)

The most important index in the world set a new high…along with only 1 sector (SentimenTrader)

Leverage Aversion (Breaking The Market)

Bank Risk Premia Indices: Unbankable? (Factor Research)

Holding risky assets going forward – Will luck change? (DSGMV)

[Chart Of The Week] Breadth Expansion Continues (All Star Charts)

Is the US Stock Market Overvalued? A Back-of-the-Envelope Calculation (All About Alpha)

This week’s best investing podcasts:

TIP310: Mastermind Discussion 3Q 2020 (TIP)

Compounding Knowledge, Investments and Passion w/ Gautam Baid (Episode 35) (Value Hive)

The Four Most Dangerous Words (Animal Spirits)

Tim Koller – Valuation (5GQ)

Lessons From Analyzing Past 100-Bagger Stocks (Focused Compounding)

The S&P 500 Hits New Highs, Robinhood Investing Strategies, and More! (Moneyline)

A Conversation about Buffett, Berkshire & High-Quality Shareholders w/ Professor Lawrence Cunningham (Excess Returns)

Tyrone Ross: Giving Back, Empowerment, and Gratitude (EP.17) (Infinite Loops)

The Narrative Game Ep. 3 – The Grift That Keeps On Giving (Grant Williams)

Katrina Lake – The Next Wave of E-Commerce (Invest Like the Best)

The Real Reason for All Time Highs: What Are Your Thoughts (The Compound)

#90 Apolo Ohno: Process Versus Prize (Knowledge Project)

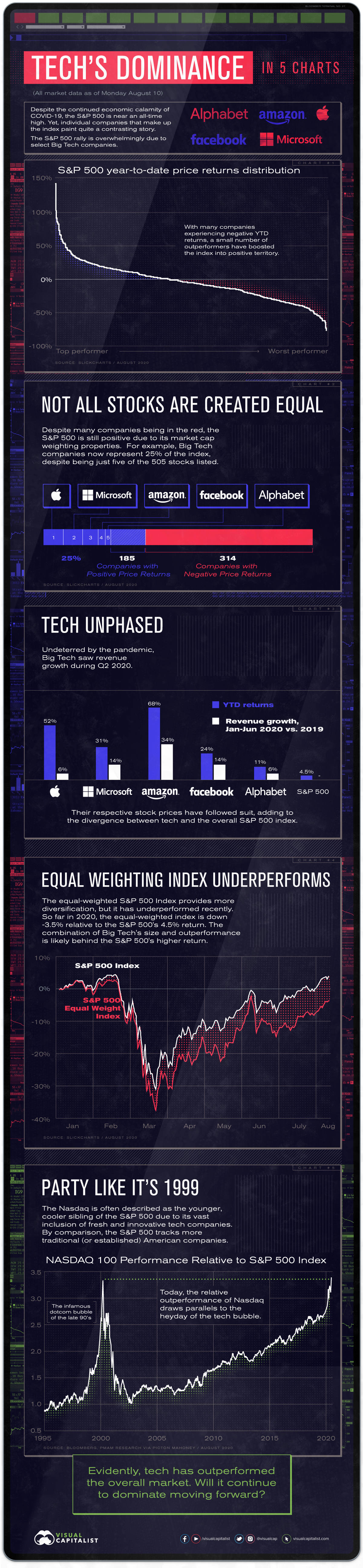

This week’s best investing graphic:

The Stocks to Rule Them All: Big Tech’s Might in Five Charts (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: