This is still the best talk ever given on The Art of Stock Picking by Charles Munger. It’s a masterpiece in the world of value investing. The lessons that Munger provides are timeless and it’s an absolute must read for all investors. Here is an excerpt from the article, The Art … Read More

The 12 Commandments of Warren Buffett’s Hero, Philip Carret

Late last year The Telegraph did a great piece on value investing legend Philip Carret, who Warren Buffett described as one of his hero’s. After founding his Pioneer Fund in 1928, one year before the great depression, Carret successfully steered his fund consistently upwards through the Great Depression and the … Read More

Howard Marks And Joel Greenblatt: “I Think You And I Would Agree That People Are Nuts.” Time Favors The Rational.

Earlier this year, Howard Marks and Joel Greenblatt came face to face at the inaugural Forbes and Shook Research Top Financial Advisor Summit in Las Vegas where it became apparent that their worldview is nearly identical. When speaking about the current market conditions the pair said, “Most people, including most people … Read More

New Evidence Shows Graham and Dodd Were Right About Most Quant Investing Strategies

A recent publication in the Financial Analysts Journal called Facts about Formulaic Value Investing, by U-Wen Kok, Jason Ribando and Richard Sloan demonstrates that most quantitative investing strategies used today are unlikely to generate superior investment performance even with the advent of computers and financial databases. The research states, “We found little compelling evidence … Read More

Jason Zweig: You Should Approach All Claims Of Market-Beating Patterns With Extreme Skepticism

One of our favorite finance writers at The Acquirer’s Multiple is Jason Zweig. Zweig is a personal finance columnist for The Wall Street Journal. He’s also the editor of the revised edition of Benjamin Graham’s The Intelligent Investor (HarperCollins, 2003), the classic text that Warren Buffett has described as “by far the … Read More

Aswath Damodaran: The Story Is What Gives ‘Soul’ To Your Business Valuation

One of the finance professors we follow closely at The Acquirer’s Multiple is Aswath Damodaran. Damodaran holds the Kerschner Family Chair in Finance Education and is Professor of Finance at New York University Stern School of Business. Recently, Damodaran did an awesome presentation for the folks at Google on business valuation saying, “Business valuation … Read More

Bruce Greenwald: You Will Do Much Better Investing In Ugly Diseased Stocks Than Glamorous Stocks

One of our favorite finance professors here at The Acquirer’s Multiple is Bruce Greenwald. Greenwald holds the Robert Heilbrunn Professorship of Finance and Asset Management at Columbia Business School and is the academic Director of the Heilbrunn Center for Graham & Dodd Investing. Described by the New York Times as … Read More

Value Investing Nuggets – Value Investor Insight Newsletter – March 2017

One of the best resources for value investors are the Value Investor Insight Newsletters. The VII newsletter is a value investment publication full of value investing nuggets and interviews with some of the best value investing firms. The newsletter was created by money manager Whitney Tilson and media executive John Heins.

There Are Now More Indexes Than Stocks – Here’s Why

According to a recent Bloomberg article, the number of market indexes now exceeds the number of U.S. stocks. Here’s an excerpt from that article:

John Huber – Short-Termism Provides Value Investors With A Significant Sustainable Advantage

One of the value investors we like to follow closely at The Acquirer’s Multiple is John Huber at Saber Capital Management LLC. Huber writes some of the best shareholder letters for his clients. In his latest 2016 investor letter he wrote a great piece that provides some awesome value investing … Read More

George Athanassakos: The Shift Towards Passive Investing Is Creating An Opportunity For Active Investors

One of the academics we like to follow closely at The Acquirer’s Multiple is George Athanassakos. Athanassakos is the Director of the Ben Graham Centre for Value Investing Ivey Business School. He recently wrote a great article that makes the case for why the market needs stockpickers now more than ever. The … Read More

Pzena Investment Management: Investing In The Cheapest Stocks Provides Superior Investment Performance Over The Long Term

One of the investors we follow closely at The Acquirer’s Multiple is Rich Pzena at Pzena Investment Management (Pzena). Pzena recently released its Q1 2017 commentary in which they demonstrate how investing in the cheapest stocks provides superior investment performance over the long term. Here’s an excerpt from the Q1 … Read More

Value Investing Nuggets – Graham & Doddsville Newsletter – Spring 2017

One of the best resources for value investors are the Graham & Doddsville Newsletters. The G&D newsletter is an investment publication from Columbia Business School (CBS) full of value investing nuggets and is co-sponsored by the Heilbrunn Center for Graham & Dodd Investing and the Columbia Student Investment Management Association … Read More

David Wallack (T. Rowe Price) – How Be A Successful Contrarian Investor

David Wallack is the portfolio manager of the T. Rowe Price Mid-Cap Value Fund and was recently named by Morningstar as the 2016 U.S. Domestic-Stock Fund Manager of the Year. Wallack is known as a contrarian value investor. He recently did a great interview with WealthTrack in which he discusses his contrarian … Read More

Meb Faber – Here’s Why Investors Are Missing Out By Ignoring Total Shareholder Yield

One of the blogs that we follow closely here at The Acquirer’s Multiple is mebfaber.com. Meb provides a lot of great investing insights in his articles. Earlier this year he wrote a great piece on the importance of looking at total shareholder yield instead of simply looking at dividend yield when … Read More

Jeremy Grantham: The Rules Have Changed for Value Investors

GMO Co-founder Jeremy Grantham recently did an interview with Wealthmanagement.com in which he discusses how the world has changed for value investors. He says, “Since 2000, it’s become much more complicated. The rules have shifted. We used to say that this time is never different. I think what has happened … Read More

TAM Deep Value Stock Portfolio Up 12.25%, Outpacing Russell 3000 Index by 1.55%

The TAM Deep Value Stock Portfolio is up 12.25% today outpacing the Russell 3000 Index by 1.55%, since inception. The portfolio has been boosted by the recent Q1 2017 earnings results of Bridgepoint Education Inc (NYSE:BPI), which had a 200% turnaround in Q1 earnings compared to the previous corresponding period, … Read More

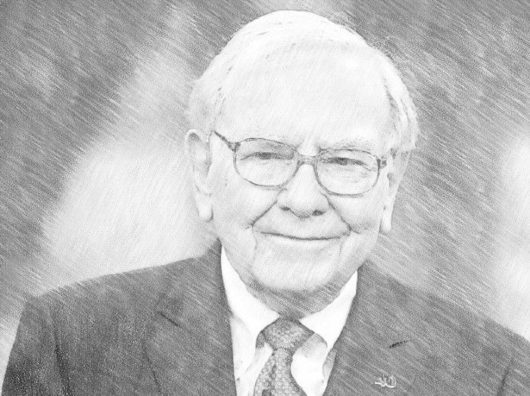

Warren Buffett: It’s A Huge Bargain To Buy Stocks Now If Interest Rates Stay Where They Are, Here’s Why

In a recent CNBC interview Warren Buffett said, “The most important item, over time, in valuation is interest rates”. He added, “It’s a huge bargain to buy stocks now if you knew interest rates would stay at this level”. In terms of investing in bonds Buffett said, “Anybody that prefers … Read More

Michael Mauboussin: The Incredible Shrinking Universe of Stocks – The Causes and Consequences of Fewer U.S. Equities

Michael Mauboussin and the team at Credit Suisse Global Financial Strategies recently published a report on The Incredible Shrinking Universe of Stocks – The Causes and Consequences of Fewer U.S. Equities. It’s a fascinating read. The report states: There has been a sharp fall in the number of listed stocks in … Read More

Charles Munger: The Investing World Is Just A Morass Of Wrong Incentives, Crazy Reporting, And A Fair Amount Of Delusion

During Saturday’s annual Berkshire Hathaway pilgrimage, Warren Buffett and Charlie Munger once again challenged the value of hedge funds and their managers. During the meeting Buffett said, “The huge money [in hedge funds] is in selling people the idea that you can do something magical for them”. Munger added, “The investing … Read More