During the 2011 Berkshire Hathaway Annual Meeting, Warren Buffett explained why the best asset to hold in an inflationary environment is a high return on tangible capital business that requires very little capital to grow, such as See’s or Coke. He calls these businesses “wonderful assets” because they can continue … Read More

Ray Dalio: How To Create a Hedge Fund Empire by Focusing on Return Streams

In this interview with Value Investing with Legends, Ray Dalio explains how his approach to investing is to focus on return streams rather than asset classes. He defines a return stream as “a decision rule that would produce return streams.” He then goes on to explain that he can construct … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Ben Graham Doesn’t Get Enough Credit For His Work On Quantitative Value Investing

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and Brewster discussed Ben Graham Doesn’t Get Enough Credit For His Work On Quantitative Value Investing. Here’s an excerpt from the episode: Jake: Yeah. So, Kevin, just to give some context for everyone else, Kevin’s a professor of … Read More

Warren Buffett: If At First You ‘Do’ Succeed, Quit Trying

In his 1991 Berkshire Hathaway Annual Letter, Warren Buffett uses the quote, “If at first you do succeed, quit trying.” It’s a tongue-in-cheek way of saying that once you find a great investment, you should hold on to it. This is because great businesses are rare and difficult to find. … Read More

Bill Ackman: Investors Should Focus On A Small Number Of High-Conviction Investments

In this interview at Delivering Alpha, Bill Ackman explains why he typically owns a small number of stocks but holds large positions in each one. This allows his fund to focus on its best ideas and have a significant impact on the companies it invests in. Here’s an excerpt from … Read More

David Abrams – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E37): Value Spread Wide but Closing, and What’s Driving the Value Spread

In their latest episode of the VALUE: After Hours Podcast Jake Taylor, Tobias Carlisle, and Bill Brewster discuss: Ben Graham Doesn’t Get Enough Credit For His Work On Quantitative Value Investing Logical Conclusion of Fundamental Analysis is a Hold Forever Period Contrarian Optimism: The Secret to Outperforming the Market Operation … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (10/13/2023)

This week’s best investing news: Howard Marks Memo: Further Thoughts on Sea Change (OakTree) GMO’s Jeremy Grantham on Merryn Talks Money (MTM) PIPE-Works and PIPE-Dreams (Part II) (Verdad) Oaktree’s Howard Mark on Bloomberg Wealth with David Rubenstein (Bloomberg) Burry Predicts Market Crashes—With Mixed Results (Validea) Interview with Berkshire’s Todd Combs: … Read More

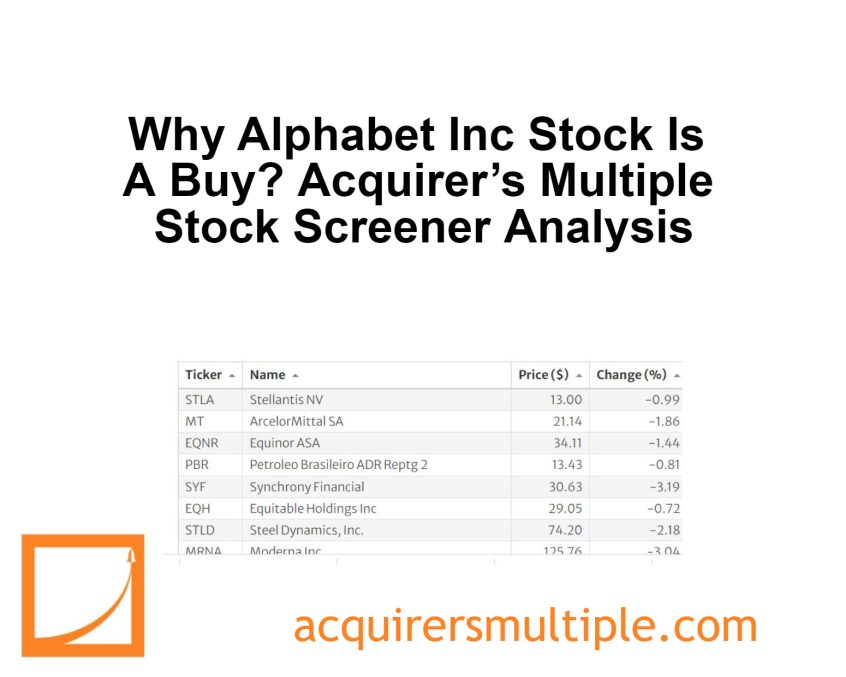

Why Alphabet Inc Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Alphabet Inc (GOOGL) Alphabet is a holding company. Internet media giant … Read More

The Importance of Dry Powder for Investors

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and special guest Zach Abraham discussed The Importance of Dry Powder for Investors. Here’s an excerpt from the episode: Jake: Yeah. I’ve heard you guys have a lot of conversations about this one, especially when it went down. … Read More

Cliff Asness: Definition Of A Bubble: ‘No Reasonable Future Outcome Can Justify These Current Prices’

In this interview with Carson Group, Cliff Asness Cliff Asness explains why he’s annoyed by the overuse of the word “bubble” in finance. He defines a bubble as a situation where no reasonable future outcome can justify current prices. Here’s an excerpt from the interview: Asness: I wrote a whole … Read More

Howard Marks: A Lessening Of Optimism Will Throw Some Sand Into The Financial Gears

In his latest memo titled Further Thoughts on Sea Change, Howard Marks believes that investors are still optimistic about the future of the stock market, despite the recent challenges caused by inflation and interest rate hikes. However, he also believes that this optimism may be misplaced, and a lessening of … Read More

This Acquirers Multiple Stock Is Undervalued, According To Dalio, Greenblatt, And Singer

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Pollyannaish Thinking About the Impact Of Interest Rates

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and special guest Zach Abraham discussed Pollyannaish Thinking About the Impact Of Interest Rates. Here’s an excerpt from the episode: Zach: Yeah. Maybe that’s the way this goes, right? Maybe it’s a wave hits this and a wave … Read More

Warren Buffett: Make No Attempt To Pick The Few Winners That Will Emerge From An Ocean Of Unproven Enterprises

In his 2000 Berkshire Hathaway Annual Letter, Warren Buffett explained why he makes no attempt to pick winners that will emerge from an ocean of unproven enterprises. Here’s an excerpt from the letter: At Berkshire, we make no attempt to pick the few winners that will emerge from an ocean of unproven … Read More

Bill Nygren: Why Low P/E Stocks Provide The Best Hunting Ground in 2023

In his latest Q3 2023 Market Commentary, Bill Nygren explains why low P/E stocks provide the best hunting ground in 2023 because there is no observable decline in business quality in the 50 lowest-ranked companies by P/E ratio on the S&P 500 today compared to the ones that made that … Read More

Paul Tudor Jones: Why It’s A Very Difficult Time To Be Investing In U.S Stocks

During his latest interview with CNBC, Paul Tudor Jones says that it is a very difficult time to be an equity investor in US stocks right now. There is a lot of uncertainty, both geopolitical and fiscal. Geopolitical uncertainty can lead to unexpected and non-linear outcomes, which can make it … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Market Setting Up for Lower for Longer

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and special guest Zach Abraham discussed Market Setting Up for Lower for Longer. Here’s an excerpt from the episode: Zach: It’s just wild the way that you watch these things unfold. I just think that’s why I think … Read More