This week’s best investing news:

Panic Series (Pt. VII) – 1873 (Jamie Catherwood)

Bill Miller: An Investor’s Evolution (Part I) (Neckar)

The Great Equalizer Part II: Evidence from Europe (Verdad)

The Same Stories, Again and Again (Collaborative Fund)

Pin The Blame On The Scapegoat (Epsilon Theory)

These Economists Aren’t Worried About Inflation. Here’s Why. (Barron’s)

Joel Greenblatt Keynote Presentation: Ben Graham VIII Annual Conference (CFA)

Full List Of Investment Letters Q3 2021 (LV)

198: Bezos’ Inner Bill Gates, Unintended Consequences (Liberty)

Rich Pzena Q3 2021 Earnings Call Transcript (Seeking Alpha)

Deflating Your Inflation Fears (WSJ)

The current state of web3 (Tanay)

Research Affiliates Rob Arnott Explains Investing Fundamentals (UYW)

Expectations Investing (Brian Langis)

Investing Myths Debunked | Phil Town (Rule #1)

Inflation Update: Not Transitory Yet! (Vitaliy Katsenelson)

Brandes Letter: Value Is in the Eye of the Beholder (Brandes)

Regulatory Changes in China and Our Approach to Risk Management (Oakmark)

Jensen Quality Growth Fund Webinar (Jensen)

The Great Inflation, Factors, and Stock Returns (canvas.osam)

What Makes A Great Investor? (Woodlock)

Tweedy Browne Q3 2021 Letter (Tweedy Browne)

GMO Q3 2021 Letter (GMO)

Greenhaven Road Q3 2021 Letter (Greenhaven)

This week’s best value Investing news:

Inflation Equals Value Stocks’ Time To Shine (Validea)

Smart beta ‘value’ investing is ripe for a comeback (FT)

Inflation Could Mean Value Stocks’ Time to Shine (WSJ)

Value Investing Is Like a ‘Pop Quiz.’ This Fund Is Scoring High (Forbes)

Is Value Investing Making A Comeback, Or Has It Been Here All Along? (Finance Monthly)

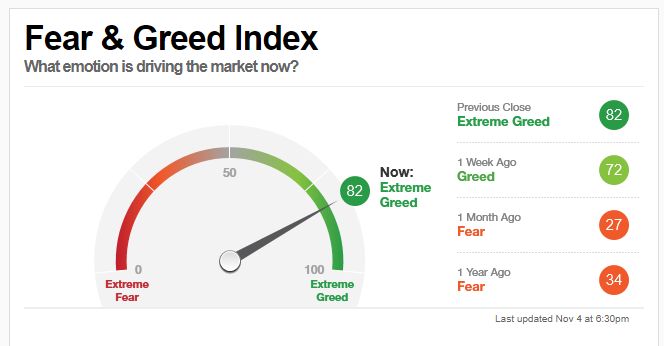

This week’s Fear & Greed Index:

Extreme Greed.

This week’s best investing podcasts:

#123 William Irvine: How To Live a Stoic Life (Knowledge Project)

Everything You Need to Know About Inflation with Cullen Roche (Excess Returns)

Sarah Friar – Building the Local Graph (Invest Like The Best)

Ep. 199 – Merger Arbitrage, Naked Wines and Value Traps with Luis Sanchez, Investor/Founder of LVS Advisory (Planet MicroCap)

Ep 149. Kate & Owen’s top personal finance apps in 2021 (Rask)

Kyler Hasson – Playing His Game (Business Brew)

Todd Harrison On The ‘Trade Of A Lifetime’ (Felder)

Talking $SPOT with @FrancoOlivera and @SleepwellCap (TSOH)

TIP392: Frameworks for Building Billion Dollar Brands w/ Kat Cole (TIP)

Emerging Markets Could Be Poised To Lead (WealthTrack)

The Case for Global Short Selling (Zer0es TV)

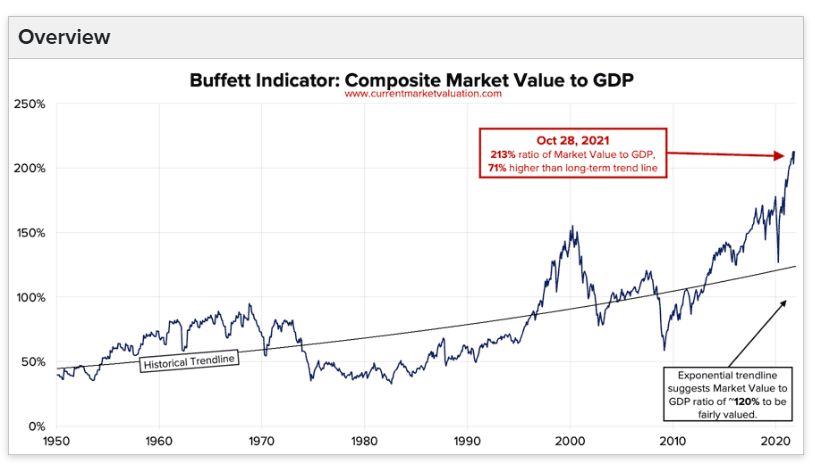

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Using Machine Learning to Predict Options Returns (AlphaArchitect)

Breakouts and Breadth Expansion (AllStarCharts)

What About Beta | I Once Had Strings, But Now I’m Free (AllAboutAlpha)

Chinese and World Stock Market Co-Movements: Two Findings (CFA)

An Irrelevant Forecast Made in 1999 About Dow Jones Reaching 36000 (PAL)

This week’s best investing tweet:

This week’s best investing graphic:

Visualizing Congestion at America’s Busiest Port (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: