This week’s best investing news:

How Does Quality Work? (Verdad)

Betting the House (Humble Dollar)

Nature Shows How This All Works (Collaborative Fund)

What is Your Investment Edge? (Validea)

Big Change in the Narrative Weather (Epsilon Theory)

The Indian Smartphone Revolution: Paytm’s Coming of Age IPO! (Aswath Damodaran)

Returns, Values, and Outcomes: A Counterfactual History (S&P Global)

Multibagger stocks aren’t rare, but that doesn’t mean it is easy to find them (Klement)

Book Talk with Michael Mauboussin – “Expectations Investing” (Columbia)

Facebook Political Problems (Stratechery)

More Than Surviving Uncertainty (Part II of II) (Frank Martin)

187: Interrogative-led Questions, Facebook’s Ashes, Google Making CPUs, Sarah Tavel, Tobias Carlisle (Liberty)

JP Morgan Q4 2021 Guide to the Markets (JPM)

Market Timing vs. Buy And Hold (DGS)

Three Things I Think I Think – Myths that Never Die (PragCap)

Capital Allocation Insights from Constellation Software (MOSI)

The Greatest Industry in the History of Mankind? (Woodlock House)

Gene Fama on an unsung benefit of indexing (EB Investor)

A 5-step approach to investing in dividend stocks (UK Value)

No Time to Die: China Banks Edition (Net Interest)

Positioning Your Portfolio For A Debt Ceiling Debacle (Boyar)

Transcript: Jack Schwager Interview (MIB)

Apple Doesn’t Make Videogames. But It’s the Hottest Player in Gaming (WSJ)

Stocks Stumble Through September (Brinker)

This week’s Superinvestor news:

David Einhorn’s market nihilism (FT)

Ray Dalio on Changing World Order (SALTNY)

Akre How We Think About Cash (Akre)

Legendary Value Investor Bill Miller Still Buying Bitcoin, Plus Vroom, GM And Tupperware (Forbes)

Citadel CEO Ken Griffin Sounds Off on Everything from Cryptocurrencies to President Trump (Bloomberg)

Royce: 3Q21 Small-Cap Recap (Royce)

How to generate ideas? A talk with outperforming Value Investor Cliff Sosin (Good Investing)

Mario Gabelli – 2021 Capital Link’s 20th Annual CEF & Global ETFs Forum – A Roundtable Discussion among CEOs (Capital Link)

Value stocks could return 5% or more over the market: Rob Arnott Research Affiliates founder (Yahoo)

Li Lu – When Should You Sell A Stock? (VIA)

NN Taleb: Detecting Quackery in a Psychology Paper (NNTaleb)

This week’s best value Investing news:

First Eagle: Small Cap Value Investing (CityWire)

Why Value Investing Should Be Part of Your Portfolio (US News Money)

Identifying ValueTraps with Deep Learning (Euclidean)

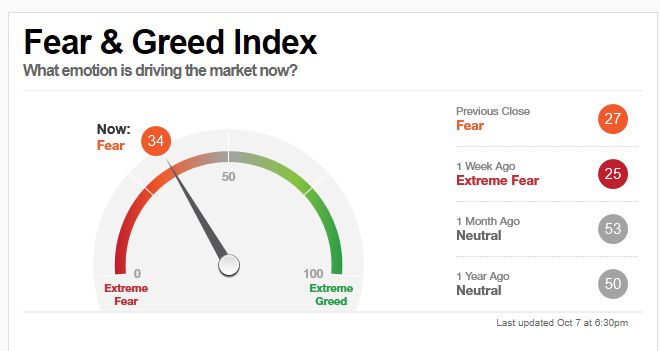

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Is The Stock Market Starting To Discount An Earnings Recession? (Felder)

Chris Davis – A Multifaceted Perspective on Financial Services (VIL)

TIP384: Evergrande, Alibaba, and the Collapse w/ David Stein (TIP)

#121 Walter Isaacson: Curiosity Fuels Creativity (Knowledge Project)

Jenny Lefcourt – The Go-to-Market Motion (Invest Like The Best)

Episode #357: Marko Papic, Clocktower Group, “If You Don’t Make Calls, Why Are You In This Industry?” (Meb Faber)

S2E4 Special: How the World‘s Greatest Investors Win, with William Green (MOI)

Tadas Viskanta: Luck Plays a Big Role in Investing (Long View)

China’s Evergrande’s Fall & What it Means Now (WealthTrack)

How to hunt software multibaggers, Zoom’s busted deal & Z1P + MSFT = ? (Rask)

Meb Faber – Quant Savant (Business Brew)

How to Maximize Your Firm’s Long-Term Value (Barron’s)

The Long Term Bull Case for Oil (Contrarian)

Good Reasons to Ignore Valuation by Brian Feroldi (MicroCapClub)

Tesla 2021 Shareholder Meeting Preview (Ep. 424) (Dave Lee)

Direct Indexing versus ETFs – Which One Will Dominate? (Gaining Perspective)

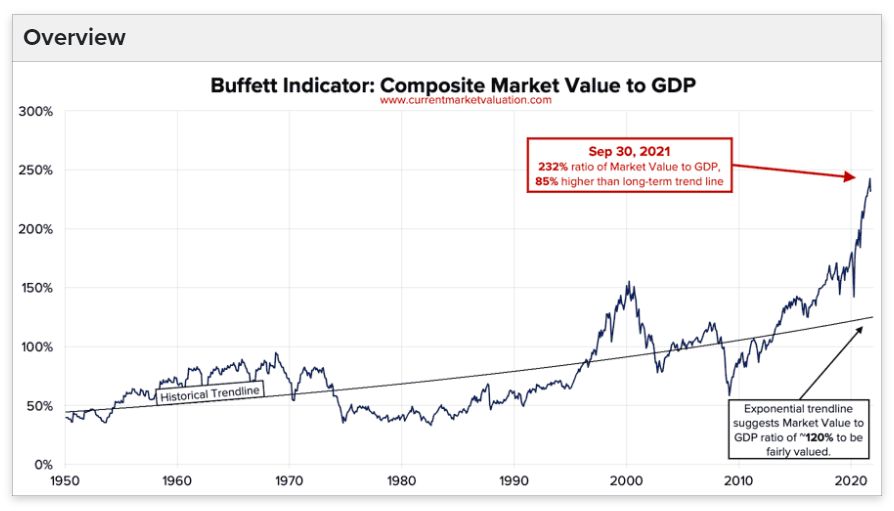

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

ETF Liquidity Risks? A Discussion (Alpha Architect)

Are CAPEs back in fashion? (Slack)

10 Years of Behavioral Finance: Thaler, Kahneman, Statman, and Beyond (CFA)

Inflation dispersion and skew creates inflation uncertainty that cannot be controlled by Fed (DSGMV)

Where’s the Alpha At? (All Star Charts)

Longest Equity Market Consolidation (PAL)

What Happens If You Add Crypto to a 60/40 Portfolio? (All About Alpha)

This week’s best investing tweet:

This week’s best investing graphic:

The World’s 100 Most Valuable Brands in 2021 (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: