Here’s a list of this week’s best investing news:

Gilded Age or Roaring Twenties? (Jamie Catherwood)

Warren Buffett’s $10 Billion Mistake (Reuters)

Inflation, Overvaluation, and the Future of Diversification (Verdad)

Cliff Asness – The Replication Crisis That Wasn’t (AQR)

Hot and Cold (Epsilon Theory)

Five Investing Powers (Collaborative Fund)

The Agony & The Ecstasy (JP Morgan)

Gold Goes Out Of Style (Felder)

Quality at a Discount Investing: Six Elements of Quality (Weitz)

Howard Marks on Dealing with Market crashes (RIC)

Tech Bubble or Rotation? (Barry Ritholz)

The End of Tesla’s Dominance May Be Closer Than It Appears (Bloomberg)

John Stuart Mill’s Philosophy of Equality (Farnam Street)

Dalio sees ‘good probability’ bitcoin gets outlawed (Yahoo)

How big is the Greensill problem at Credit Suisse? (Bronte)

Overhauling Twitter; Were the Airline Bailouts Really Needed?; (Whitney Tilson)

Bernstein: Free trading is like giving chainsaws to toddlers (EB Investor)

This chart shows why investors should never try to time the stock market (CNBC)

Rising Risk (Humble Dollar)

Will the Inflation Dog Bark? (Real Returns)

Capitalism Is Dead, Long Live Debtism (CFA Institute)

Peter Bernstein: The Importance of Staying Power (Novel)

How to Spot a Bubble (Hussman)

Forget The Fox…What Do The Dots Say? (Brinker)

First Eagle – Finding Balance in International Equity Markets (FEIM)

Interest Rates, Inflation & Economic Confidence (Brian Langis)

Peter Lynch: How to Invest At All Time High Stock prices (RIC)

Beyond Investing (Investment Masters Class)

What Hedge Funds Teach About Investment Management (Morningstar)

Stocks Don’t “Only Go Up” (Prag Cap)

Buy And Hold Is Not Buy And Forget (DGS)

A fallen star of the investment world (FT)

20 Things To Avoid (According To Charlie Munger) (CMQ)

Narratives and hype in verticals (Tanay)

Time To Play Defence (Macro Tourist)

Does Sustainable Investing Change What Shareholders Want? (Behavioural Investment)

This week’s best value investing news:

How Value Stocks Could Outpace Growth for Years (Barron’s)

GMO – The Duration of Value And Growth (GMO)

The Great Value Rotation and the Strategy’s Evolution (Validea)

Is Value Investing Back for Good? (Morningstar)

Why Value Investing Can Come Back Strongly in 2021 (Yahoo)

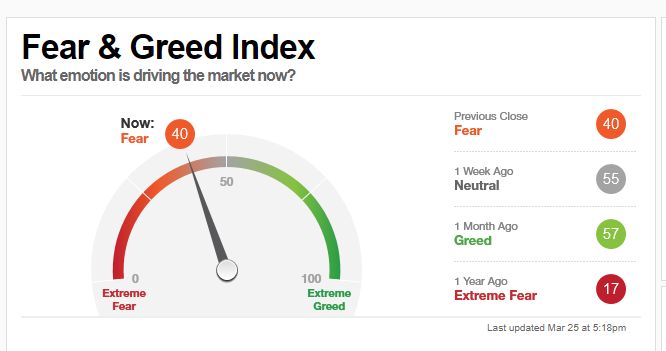

This week’s Fear & Greed Index:

This week’s best investing research:

Gold’s Worst Enemy (Compound Advisors)

Currency trading and business cycle dispersion (DSGMV)

Alternative Data: The Gateway to Global Markets (All About Alpha)

An Economic Framework for ESG Investing (Alpha Architect)

Dual-Axis Charts Are Not Forecasts (PAL)

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

TIP341: Investing Mastermind Q1 2021 w/ Toby Carlisle, Wes Gray, and Jake Taylor (TIP)

Ray Dalio: Influencers with Andy Serwer (Yahoo)

The Practice of Modern Value Investing (w/Dan Rasmussen & James Grant) (Real Vision)

Daniel Kahneman Doesn’t Trust Your Intuition (Taken for Granted)

Ep. 166 – Investing in Thrift Conversions 101 and Lessons Learned as a Jeopardy Contestant with Jim Royal, Ph.D., Author of “The Zen of Thrift Conversions” (Planet MicroCap)

Nasdaq Woes In A Re-Opening “Explosion” (Real Vision)

Markets to Peak in 2nd Quarter Before Bust: David Hunter (Contrarian Investor)

Telsa – ICE Cold Killer? Interview with Michael Covel – Ep 117 (Intellectual Investor)

Special: From Poker Player to Portfolio Manager, with Evan Tindell and Elliot Turner (Intelligent Investing)

#107 Matt Ridley: Infinite Innovation (Knowledge Project)

Being like Bezos (Barron’s)

Ted with Jenny Heller – Compounding Knowledge and Relationships (Capital Allocators,)

Rafael Resendes On Intrinsic Value, Economic Margin and How Some Value Models Have Lost Their Way (Excess Returns)

Jesse Walden – A Primer on NFTs (Invest Like the Best)

EP 298. Highlights and Thoughts on Charlie Munger’s 2021 Daily Journal Meeting (Focused Copounding)

The Lonely Century: Coming Together in a World That’s Pulling Apart | Noreena Hertz (Hidden Forces)

Alex Danco – Makes A Scene (EP.39) (Infinite Loops)

This week’s best investing graphic:

Who Americans Spend Their Time With, by Age (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: