Here’s a list of this week’s best investing news:

Charlie Munger Speaks At The DJCO Annual Meeting (Yahoo Finance)

Technology & The Financial Printing Press (Jamie Catherwood)

Emerging Market Crises (Verdad)

The Feynman Learning Technique (Farnam)

A Conversation with Bill Ackman (Harvard Law)

Paul Singer Warns of Trouble, and Is Eager to Say ‘Told You So’ (Bloomberg)

Ray Dalio: Are We In A Stock Market Bubble (Ray Dalio)

When Everyone’s a Genius (A Few Thoughts on Speculation) (Collaborative)

Howard Marks: ET Now (2021) (ET Now)

Ken Fisher Debunks Common Myths About Valuations in Technology Stocks (Fisher Investments)

The Era Of Gut Feelings (Jason Zweig)

Yale, Harvard and Others Buying Bitcoin (Validea)

Wise Words on Surviving Bull Markets (Novel)

Cy Cordner (Scott Galloway)

Go Ahead, Covet Your Neighbor’s Wife (Vitaliy Katsenelson)

“I know what I’ve been put on earth to do.” (Barry Ritholz)

3 and a Half Insights from Charlie Munger at the 2021 Daily Journal Annual Meeting (Behavioral Value)

David Rosenberg – We’re Getting Closer To A Breaking Point (themarket.ch)

Solving Puzzles During A Golden Age of Learning (Oakmark)

Any Interest? (Humble Dollar)

Google’s Next Possible Trillion-Dollar Opportunity (Whitney Tilson)

King of Capital (Brian Langis)

A Memo To Investors (Albert Bridge)

Three reasons for active managers to feel positive (EB Investor)

When It Comes To US Debt, What Matters Most? The Amount? The Cost? Both? (Brinker)

Lessons Learned from the Gamestop Fiasco (Canadian Value)

We’re All Nigeria Now (Epsilon Theory)

While investors party like its 1999, Insiders are selling stock like there’s no tomorrow. Is a crash imminent? (WhaleWisdom)

This Rally Is Justified In Both Markets & Housing? (UPFINA)

Rising Dividends = Rising Returns (DGS)

S&P 500 Earnings: V-Shaped Recovery (Dr Ed)

Payments Opportunity In Software (JP Morgan)

Historic Gains in Small Stocks Highlight Investor Exuberance (WSJ)

Broyhill Letter Q4 2020 (Broyhill)

The Digital Transformation of Cars is Just Beginning (Mule)

Narratives, reflexivity, and markets (Tanay)

Do bonds still serve a purpose? (Gist)

Investing in Optimism (Andreessen Horowitz)

This week’s best value investing news:

What Are Value Stocks (Forbes)

Is Value Investing Dead? (Business Times)

Value Investing’s Old Rules ‘Have Outlived Their Usefulness,’ Academics Argue (Institutional Investor)

‘Excessive stimulus’ puts value stocks on track to outperform growth over next 4 years (MarketWatch)

Dow Turns Positive as Value Stocks Lead Comeback; Tech Stumbles (Investing.com)

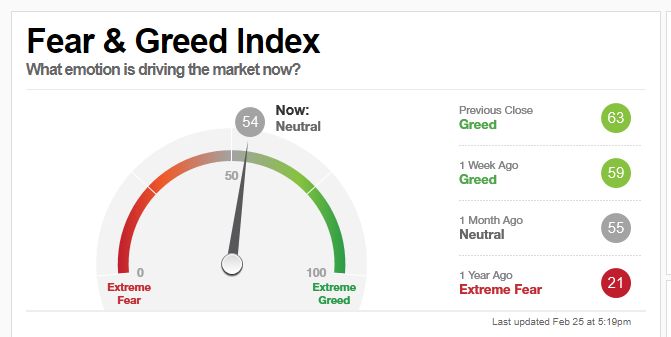

This week’s Fear & Greed Index:

This week’s best investing research:

The Forecasting Power of Value, Profitability, and Investment Spreads (Alpha Architect)

Is The Commodity Supercycle Extravaganza Here? (All Star Charts)

The Feynman Learning Technique (GMM)

Have Bonds Actually Underperformed Stocks? (PAL)

Beyond Intention: Diversity, Equity, and Inclusion Require Action (CFA Institute)

Commodity shock sensitivity – Look at stocks to usage ratio (DSGMV)

This week’s best investing tweet:

This week’s best investing podcasts:

James Davolos On Protecting Yourself Against A Paradigm Shift In Inflation (Felder)

#105 Seth Godin: Failing On Our Way To Mastery (Knowledge Project)

Episode 031: Jamie Catherwood, host Rick Ferri (Bogleheads)

David Baran and Kazuhiko Shibata – Friendly Activism in Japan at Symphony (Capital Allocators)

TIP337: How to Identify Value in Commercial Real Estate w/ Ian Formigle (TIP)

GameStop: What Happened, How it Happened, and Lessons We Can Learn From It (Excess Returns)

Jeremy Grantham – A Historic Market Bubble (Invest Like the Best)

305- The Role of Shorting in the Market (InvestED)

Doug Braunstein on Investment Banking (MIB)

Ep. 161 – The Science of Hitting (and not selling yourself short) with Alex @TSOH_Investing (Planet MicroCap)

Oren Falkowitz – No Phishing Way (Business Brew)

The Renaissance of Pipelines and Our Sell Discipline – Ep 113 (Intellectual Investor)

The Transcript Podcast Ep. 7 (The Transcript)

David Barr on Private vs. Public and How the Concept of Value Is Evolving (Intelligent Investing)

This week’s best investing graphic:

How Much Solar Energy is Consumed Per Capita? (1965-2019) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: