During their recent episode, Taylor, Carlisle, and Doug Ott discussed The Three-Body Problem: Chaos Theory in Investing and the Economy. Here’s an excerpt from the episode: Jake: Okay. Cool. Well, we’re not going to talk about that at all. [Tobias laughs] We’re talking about the real-world mind-bending physics problem that’s … Read More

Joel Greenblatt: How Warren Buffett Taught Me To Pay Up For Good Businesses

In this interview with The Investor’s Podcast, Joel Greenblatt reflects on his investment approach, explaining how he initially sought both cheap and good businesses, but struggled to understand the value of paying more for quality. He discusses his decision to downsize his business and return outside capital when he couldn’t … Read More

Jim Chanos: Why Good Short Sellers Are Born, Not Made

In his interview in the book – Efficiently Inefficient, Jim Chanos reflects on the challenges of short selling, emphasizing that it’s not simply the inverse of going long. He highlights the behavioral difficulty of staying short in a market that overwhelmingly promotes positive news about stocks, making it emotionally taxing … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Putting 100% Of Your Net Worth Into One Position

During their recent episode, Taylor, Carlisle, and Doug Ott discussed Putting 100% Of Your Net Worth Into One Position. Here’s an excerpt from the episode: Tobias: What sort of concentration? How many names? Doug: So, I think we’re about 18, 19 now, which is a little higher than average. But … Read More

Warren Buffett: The Dangers of “I’m Rich, Therefore I’m Right!”

During the 2003 Berkshire Hathaway Annual Meeting, Warren Buffett reflects on the responsibility of public figures, particularly wealthy individuals, when sharing opinions on public policy. He acknowledges his own involvement in issues like campaign finance reform and taxes but tries to limit his public commentary to avoid the perception of … Read More

Terry Smith: These Are The Best Types Of Companies To Own

During his recent interview with The Financial Planner Life Podcast, Terry Smith discusses his investment strategy, which focuses on three key areas: consumer products, medical devices, and technology. He highlights the importance of everyday consumer goods, medical devices, and broad technology sectors, companies like Apple, Visa, and Microsoft. Smith explains … Read More

David Abrams – Top 10 Holdings – Latest 13F

Oe of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E35): Doug Ott on Arthur J Gallagher (AJG) Mettler-Toledo (MTD) Pool Corp (Pool)

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Doug Ott discuss: Putting 100% Of Your Net Worth Into One Position The Three-Body Problem: Chaos Theory in Investing and the Economy The Case Against Investing in Metal-Based Industries How Forced Divestitures and FTC Actions Spark Investment … Read More

Eli Lilly and Co (LLY) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Eli Lilly and Co (LLY). Profile Eli Lilly is … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (09/27/2024)

This week’s best investing news: Top Takeaways from Oaktree’s Quarterly Letters – September 2024 Edition (OakTree) AQR’s Cliff Asness on Stocks Value Gap, Nvidia, ‘Inefficient’ Markets (Bloomberg) Guy Spier – Outperforming The S&P500, Building Wealth & Managing Risk (Guy Spier) The Great Rotation (Part 2) (Verdad) Calgary Herald interview with … Read More

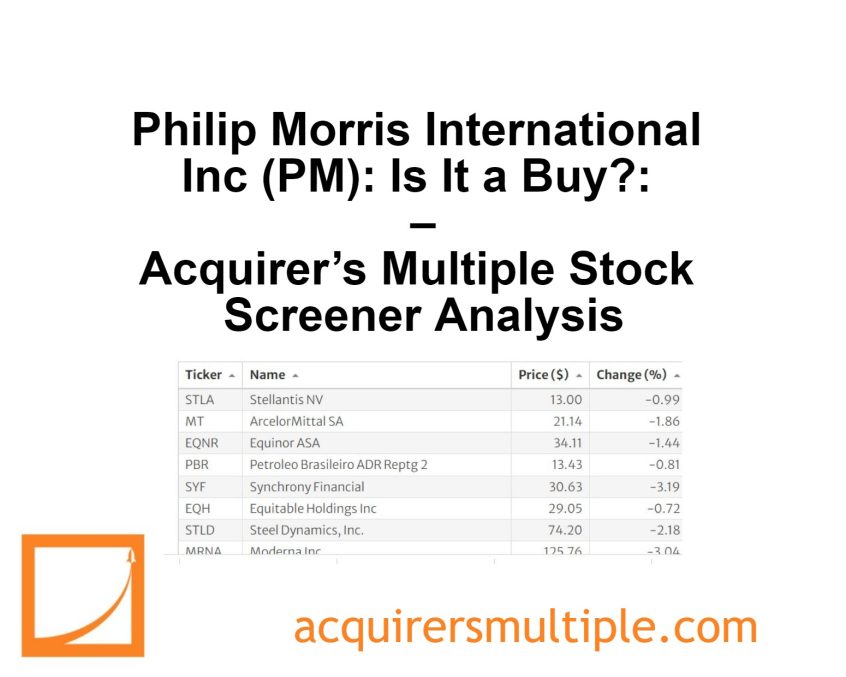

Philip Morris International Inc (PM): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Philip Morris International Inc (PM) Created from the international operations of … Read More

The Hidden Danger of Weekly Data in Long-Term Investing Strategies

During their recent episode, Taylor, Carlisle, and Alex Morris discussed The Hidden Danger of Weekly Data in Long-Term Investing Strategies. Here’s an excerpt from the episode: Alex: One thing that came to mind for me, as you’re saying this is and I’m thinking about the hibernation comment, and also, this … Read More

Lee Ainslie: The 3 Key Factors For Picking Long-Term Winners

In his interview in the book – Efficiently Inefficient, Lee Ainslie describes his investment process as forward-looking, focusing on identifying future winners and losers in each industry. The firm’s deep due diligence is enabled by a low ratio of positions to professionals, allowing constant updates on industries and spotting new opportunities. … Read More

Aswath Damodaran: What’s Your Moat Against the Bots in Investing?

During his recent interview with Excess Returns, Aswath Damodaran explores the impact of AI and automation, particularly in the context of mechanical, rule-driven tasks like factor investing. He emphasizes the need for individuals to differentiate themselves from machines by focusing on tasks that AI cannot easily replicate. Damodaran suggests that … Read More

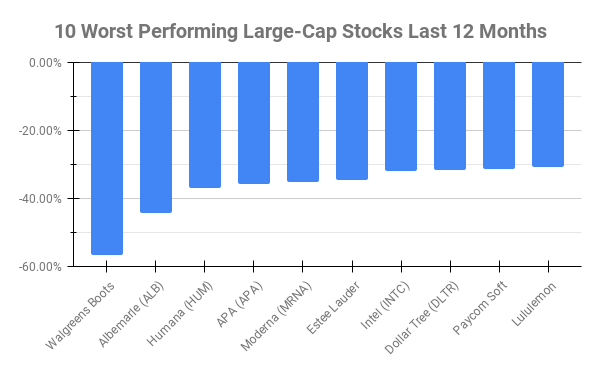

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -56.78% Albemarle (ALB) -44.22% Humana (HUM) -37.04% APA (APA) -35.70% Moderna (MRNA) -35.13% Estee Lauder … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

What Bears Can Teach Investors About Surviving Market Crashes

During their recent episode, Taylor, Carlisle, and Alex Morris discussed What Bears Can Teach Investors About Surviving Market Crashes. Here’s an excerpt from the episode: Jake: Should we just do veggies? Yeah. Tobias: Yeah. Jake: Let’s do it. Tobias: Let’s do veggies. Jake: Let’s do it. All right. So, given … Read More

Cliff Asness: Markets: The Crazy Periods Are Getting Crazier And Lasting Longer

In this interview with Bloomberg, Cliff Asness argues that market inefficiencies, such as wide spreads between cheap and expensive stocks, are becoming more pronounced and persistent. He explores three key reasons for this: the rise of passive investing, extended periods of ultra-low interest rates, and the influence of technology and … Read More

John Rogers: Why Value Investing Isn’t Dead Despite Growth Stock Dominance

In his recent interview with Odd Lots, John Rogers argues that value investing is not dead, despite the prolonged outperformance of growth stocks. He references Warren Buffett’s philosophy of being “greedy when others are fearful” and highlights the cyclical nature of markets. Rogers sees opportunities in overlooked, undervalued “orphan” stocks, … Read More