In this interview with Excess Returns, Guy Spier explains that in a randomly selected portfolio held over a long period, most returns come from a few big winners, while many stocks do little or lose value. He emphasizes the challenge of intervening in a portfolio, as transaction costs and the … Read More

Howard Marks: After Significant Gains Take A Little Off The Table

In this interview with Global Money Talk, Howard Marks discusses the importance of flexibility over rigid rules in investing. He uses the example of a stop-loss order, which limits potential losses but may cause investors to miss out on future gains. There are no perfect rules that guarantee both safety … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

What Warren Buffett’s Market Cap-to-GDP Indicator Tells Us About U.S Stocks

During their recent episode, Taylor, Carlisle, and Brendan Hughes discussed What Warren Buffett’s Market Cap-to-GDP Indicator Tells Us About U.S Stocks. Here’s an excerpt from the episode: Tobias: Yeah, thinking of you guys. Are there any lessons from all of these crises? What’s the takeaway in your mind? What should … Read More

Terry Smith: Don’t Sell Good Companies

In his book – Investing for Growth, Terry Smith reflects on the lesson that selling stakes in good companies is almost always a mistake. He uses Sigma-Aldrich, a chemical company, as an example. Despite its strong financial and operational characteristics, Smith’s firm sold its stake when the company attempted to … Read More

Howard Marks: Why We Never Wait For The Bottom To Buy

In his book – Mastering The Market Cycle, Howard Marks discusses the difficulty of timing market bottoms and the risk of waiting too long to invest. He discusses the concept of “falling knives,” where investors fear buying before a market decline stops, leading them to wait for certainty. However, by … Read More

Seth Klarman – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E36): Author Brendan Hughes on Markets in Chaos: A History of Market Crises

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Brendan Hughes discuss: What Warren Buffett’s Market Cap-to-GDP Indicator Tells Us About U.S Stocks The Impact of Passive Investing: Are We Losing Price Discovery in Markets? How Labor Unions Are Reshaping Inflation Dynamics: A 1970s … Read More

Exxon Mobil Corp (XOM) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Exxon Mobil Corp (XOM). Profile ExxonMobil is an integrated … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (10/04/2024)

This week’s best investing news: Terry Smith – Risk VS Reward (TFPL) Practical Lessons from Chris Davis (Excess Returns) Rate Cuts: Bonds Back in Play? (Verdad) Whitney Tilson on lessons learned from knowing Warren Buffett, Charlie Munger & Bill Ackman (WealthTrack) Aswath Damodaran – Mag 7 companies have shown weak … Read More

TotalEnergies SE (TTE): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: TotalEnergies SE (TTE) TotalEnergies is an integrated oil and gas company … Read More

How Forced Divestitures and FTC Actions Spark Investment Ideas

During their recent episode, Taylor, Carlisle, and Doug Ott discussed How Forced Divestitures and FTC Actions Spark Investment Ideas. Here’s an excerpt from the episode: Tobias: What’s your idea generation process? Doug: Yeah. So, it’s the typical thing, is you look at the 13F, see what other great investors are … Read More

Howard Marks: The Contrarian’s Edge In A Hot Market

In his book – The Most Important Thing, Howard Marks reflects on the 2004–2007 period, where investors mistakenly believed that cutting risk into small pieces and distributing it could eliminate risk. This false sense of security contributed to the financial crisis of 2008. Popular strategies like absolute return funds, low-cost … Read More

Warren Buffett: How We Make Money Without Lifting a Finger

In his 2023 Berkshire Hathaway Annual Letter, Warren Buffett discusses Berkshire Hathaway’s long-term investments in Coca-Cola and American Express, which have been held for over two decades. While these positions are smaller compared to Apple, they remain significant assets. Both companies, founded in the 19th century, overcame past mismanagement and … Read More

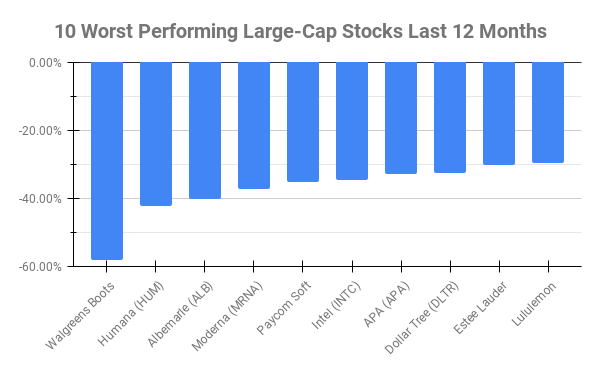

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -58.22% Humana (HUM) -42.30% Albemarle (ALB) -40.20% Moderna (MRNA) -37.28% Paycom Soft (PAYC) -35.17% Intel … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Case Against Investing in Metal-Based Industries

During their recent episode, Taylor, Carlisle, and Doug Ott discussed The Case Against Investing in Metal-Based Industries. Here’s an excerpt from the episode: Jake: Toby, do you remember who was– I forget who it was, but they wouldn’t invest in any company that produced anything out of metal, because that … Read More

Bill Ackman: How Ignoring My Own Rules Nearly Destroyed My Firm

During this interview with Lex Friedman, Bill Ackman recounts borrowing $300 million from JP Morgan during a financial crisis in his firm to buy stock in his public company, preventing an activist takeover. This decision, coupled with resolving his divorce and settling litigation, marked a turning point for his firm. … Read More

Mohnish Pabrai: How to Profit from Dhandho Arbitrage Spreads

In his book – The Dhandho Investor, Mohnish Pabrai explains that Dhandho arbitrage spreads, though temporary, offer valuable investment opportunities. The key question is how long these spreads will last and how wide their moat is. Quoting Warren Buffett, Pabrai emphasizes the importance of determining a company’s competitive advantage and … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More