In his 1960 Partnership Letter, Warren Buffett outlines his goal of achieving long-term performance superior to the Industrial Average, emphasizing that this superior performance will not be consistently evident compared to the Average. He explains that outperformance is likely in stable or declining markets, while performance may be average or … Read More

Howard Marks: The Best Investment Opportunities In 2024

During his recent interview with Bloomberg, Howard Marks explains that leveraged companies will face difficulties renewing their debt and will incur higher costs, creating better investment opportunities. Six years ago, banks offered generous loans at low interest rates, but now the terms are much stricter. This shift particularly impacts private … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Howard Marks: Accepting & Adapting In The Current Market Environment

Howard Marks emphasizes the importance of understanding and accepting the current investment environment, recognizing that it may not always present clear opportunities. Investors should assess market conditions accurately and act accordingly, avoiding actions based on ignorance or attempts to change the market. Marks’ investment philosophy is influenced by Japanese concepts, … Read More

Warren Buffett: WPC: From $10.6 Million to $221 Million

In his 1985 Berkshire Hathaway Annual Letter, Warren Buffett explained how in mid-1973, he purchased Washington Post Company (WPC) shares at a quarter of their business value, capitalizing on a significant market undervaluation. Most investors, influenced by academic theories on market efficiency, ignored intrinsic business value. By year-end 1974, despite … Read More

Bill Ackman – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Coca-Cola Co (KO) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Coca-Cola Co (KO). Profile Founded in 1886, Atlanta-headquartered Coca-Cola … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (07/05/2024)

This week’s best investing news: Warren Buffett has finally revealed what will happen to his money after he dies (CNN) Hedge Fund Baupost Cuts Almost a Fifth of Investing Staff (Bloomberg) Mohnish Pabrai: Who Made Billions By Following Warren Buffett’s Strategy (MSN) Show Us Your Portfolio: Eric Crittenden (Validea) Ray … Read More

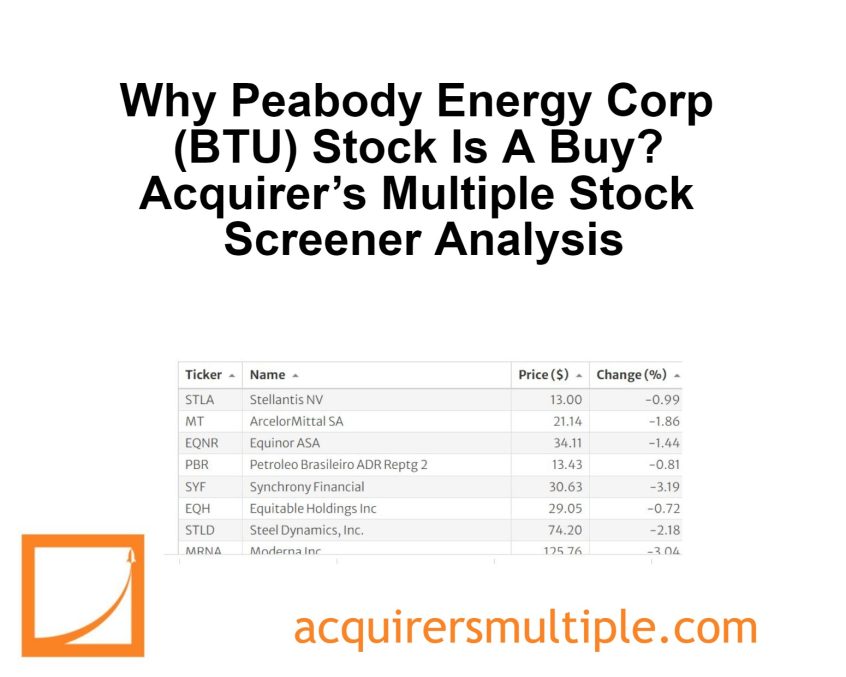

Why Peabody Energy Corp (BTU) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Peabody Energy Corp (BTU) Peabody Energy Corp is a producer of … Read More

Warren Buffett: How To Identify Outstanding Managers

In his 1986 Annual Letter, Warren Buffett acknowledges his underperformance in deploying capital compared to the excellent management by his company’s managers. Buffett and Vice Chairman Charlie Munger focus on retaining talented managers, who typically come with acquired companies and perform exceptionally due to their passion and owner-like mentality. Their … Read More

Prem Watsa: Caveat Emptor: The Risks of Long-Term Investment Optimism

In his 2015 Annual Letter, Prem Watsa criticizes the belief that common shares are always great long-term investments, noting historical downturns like the 1929 Dow Jones crash and the Nikkei’s stagnation since 1989. He highlights the potential for significant market risks and emphasizes cautious investment strategies. Watsa cites Ben Graham’s … Read More

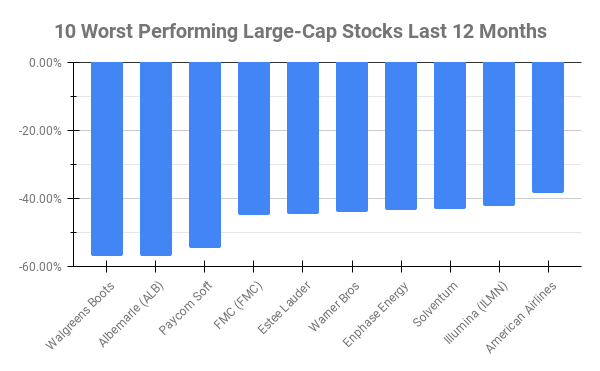

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -57.17% Albemarle (ALB) -56.96% Paycom Soft (PAYC) -54.81% FMC (FMC) -44.86% Estee Lauder Companies (EL) … Read More

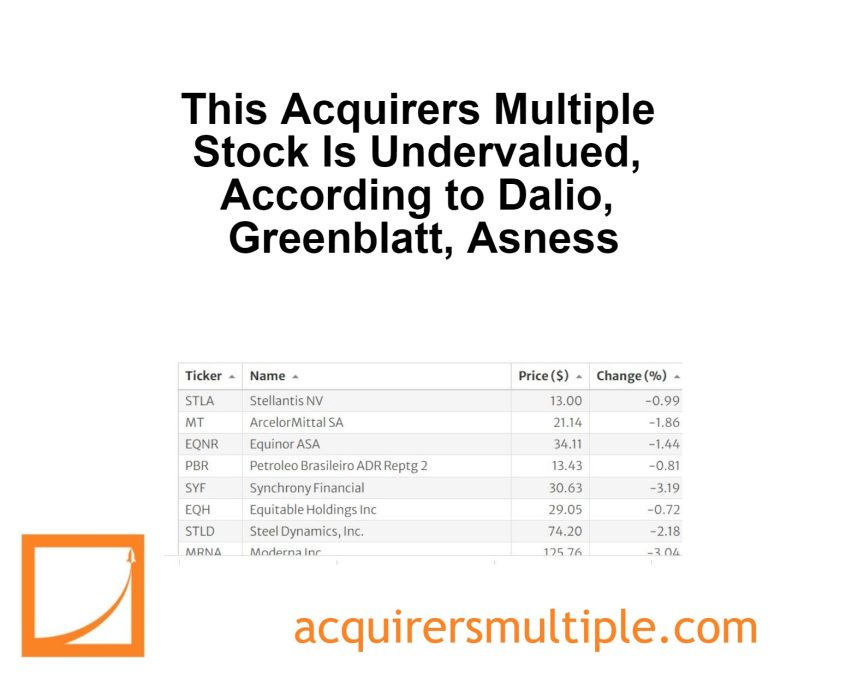

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Greenblatt, Asness

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Terry Smith: The Biggest Obstacle For Most Investors To Overcome

In his 2017 Annual Letter, Terry Smith criticizes the overuse of quoting Warren Buffett by those who barely understand his strategies. Instead, he quotes Buffett’s partner, Charlie Munger, who asserts that long-term stock returns align with the business’s returns on capital. Munger emphasizes that high returns on capital significantly impact … Read More

David Einhorn: How To Survive Irrational Markets

In his book – Fooling Some of the People All of the Time, David Einhorn describes the technology stock bubble, where investors poured capital into tech stocks, abandoning traditional investments and value investing. Julian Robertson’s Tiger Fund, which held old-economy stocks, suffered, leading to its liquidation. Einhorn’s fund experienced significant … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Warren Buffett: The Importance of Diversification in Investing

During the 2021 Berkshire Hathaway Annual Meeting, Warren Buffett cautions new stock market entrants against excessive trading, urging them to consider the unpredictability of long-term success for major companies. He highlights a list of the 20 largest companies by market value as of March 31st, led by Apple. Buffett then … Read More

Mohnish Pabrai: The Benefits Of Being A Focused, Solo Investor

In his book – The Dhandho Investor, Mohnish Pabrai explains why a critical law of investing, as demonstrated by Warren Buffett, is the importance of a small team size, ideally just one person. This approach allows for decisive and bold investments, exemplified by Buffett’s decision to invest 40 percent of … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Warren Buffett: Spotting A Business with A Long-Lasting Competitive Edge

During the 2017 Berkshire Hathaway Annual Meeting, Warren Buffett explains how Berkshire Hathaway identifies businesses to acquire, emphasizing long-term competitive advantage, trusted management, and cultural fit. He recalls purchasing See’s Candy in 1972, highlighting their confidence in its lasting appeal despite higher prices. This confidence has led to significant profits … Read More