Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Understanding Reproducible Strategies in Investment

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Understanding Reproducible Strategies in Investment, here’s an excerpt from the episode: Jake: So, my segment this week, Toby, is asking Luca questions about the book. So, maybe I’ll keep going in this thread. How does this relate then to the … Read More

François Rochon: Market Opinions vs. Company Value: The Short-Term Stock Market

In his 2020 Giverny Capital Annual Letter, François Rochon explained how on April 20, 2020, a bizarre event occurred in the financial markets when the price of West Texas Intermediate crude oil futures for May delivery plummeted from $18 to -$37 per barrel. This unprecedented situation, where sellers paid buyers … Read More

Warren Buffett: Seizing Opportunities with Small Amounts of Capital

During the 2010 Berkshire Hathaway Annual Meeting, Warren Buffett discusses the perpetual presence of investment opportunities, particularly for those not managing large sums of money. He highlights the inherent conflict in the investment management industry, where asset gathering can overshadow asset management. Buffett illustrates this with an example from Charlie … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Value Investing and Ergodicity: A Framework for Long-Term Success

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Value Investing and Ergodicity: A Framework for Long-Term Success, here’s an excerpt from the episode: Tobias: I think one of the things that value guys do, and probably the reason that Jake and I are so attracted to the idea … Read More

Leon Cooperman: As AI Captures Attention, One Overlooked Sector Offers Hidden Value

In this interview with Jon Schultz, Leon Cooperman observes that technological advancements can render existing technologies obsolete. Highlighting past market trends, he recalls the overvaluation of Cisco during the internet boom, and the collapse of the “Nifty Fifty” stocks in the 1970s due to the oil crisis. Cooperman suggests the … Read More

Howard Marks: 3 Investment Essentials For All Investors

In this interview with 3 Takeaways, Howard Marks provides his three investment essentials for all investors. Marks explains that the market is unpredictable and constantly changing, so one should not be overconfident in their predictions. He states that higher returns generally require higher risks, and that offers promising high returns … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Ergodicity in Action: A Story of Ski Racing and Investment

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Ergodicity in Action: A Story of Ski Racing and Investment, here’s an excerpt from the episode: Luca: Yeah. So, the trick is to avoid defining it and make an example first. Because when people hear the story, they understand it … Read More

Nassim Nicholas Taleb: The Myth of Skill In Investment Management

In his book – Fooled by Randomness, Nassim Nicholas Taleb discusses how success can easily by attributed to luck, and introduces the Monte Carlo engine to simulate purely random situations, avoiding conventional methods of attribute analysis. By generating artificial scenarios with known attributes, the Monte Carlo engine can demonstrate outcomes … Read More

Warren Buffett: Investing Is All About Knowing What You Know

In his 1999 Berkshire Hathaway Annual Letter, Warren Buffett explains that he and Charlie Munger aren’t distressed by their lack of tech insights, as there are many areas where they lack expertise. They avoid making judgments in fields like patents and manufacturing, focusing instead on operating within their circle of … Read More

Rich Pzena – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E25): Luca Dellanna on his books Winning Long-Term Games and Ergodicity

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Luca Dellanna discuss: Ergodicity in Action: A Story of Ski Racing and Investment Value Investing and Ergodicity: A Framework for Long-Term Success Understanding Reproducible Strategies in Investment Why Society Needs More ‘Elon Musks’ with Better … Read More

Merck & Co Inc (MRK) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Merck & Co Inc (MRK). Profile Merck makes pharmaceutical … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (07/19/2024)

This week’s best investing news: Memo from Howard Marks: The Folly of Certainty (Oaktree) Todd Combs on Charlie Munger’s Legacy || Q&A Transcript (2024) (Kingswell) Neglecting Equilibrium (Verdad) Mohnish Pabrai’s Session with Rotary Bangalore DownTown (MP) The Magnificent 7: Which Stocks Are The Most Fundamentally Sound? (Validea) Cliff Asness – … Read More

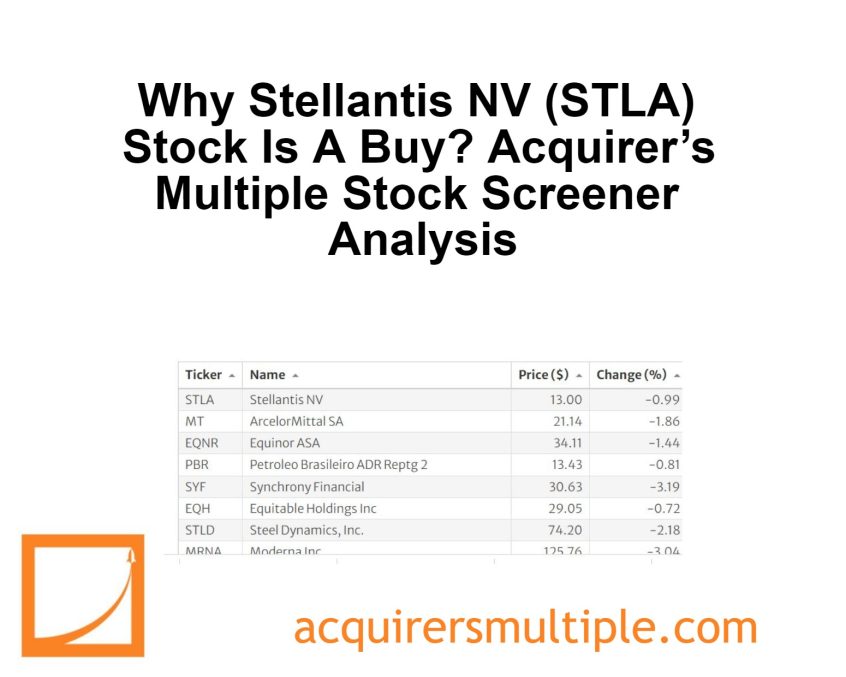

Why Stellantis NV (STLA) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Stellantis NV (STLA) Stellantis NV was formed on Jan. 16, 2021, … Read More

Seth Klarman: The Paradox of Responsible Living and Reckless Investing Explained

In his book – Margin of Safety, Seth Klarman highlights the irrational behavior of some investors who, despite being responsible and deliberate in most aspects of their lives, act recklessly when investing money. These individuals spend months or years saving diligently, only to invest hastily without proper research. Klarman contrasts … Read More

Howard Marks: Why Successful Investors Aren’t Always Intelligent

In his latest memo – The Folly of Certainty, Howard Marks critiques the diverse and often conflicting predictions about the upcoming presidential election, noting that intelligence and data analysis alone cannot ensure accurate forecasts. He references John Kenneth Galbraith’s insights on the fallibility of forecasters and the mistaken association of … Read More

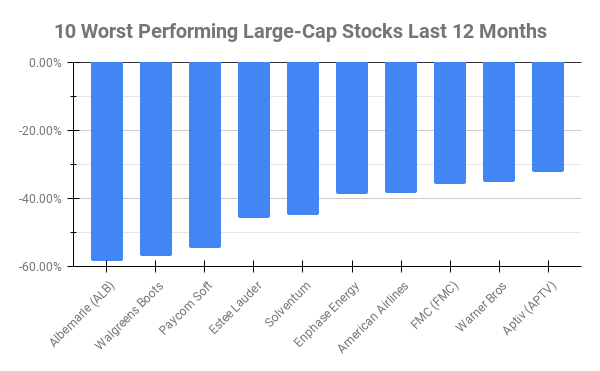

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Albemarle (ALB) -58.45% Walgreens Boots Alliance (WBA) -56.90% Paycom Soft (PAYC) -54.82% Estee Lauder Companies (EL) -45.87% Solventum (SOLV) … Read More