During his recent interview with Jamie Heller at the WSJ D.Live Conference, Bill Ackman discussed a number of topics including why companies get the shareholders they deserve. Here’s an excerpt from the interview: Ackman: You get the shareholders you deserve. If you have earnings guidance you’re going to have analysts … Read More

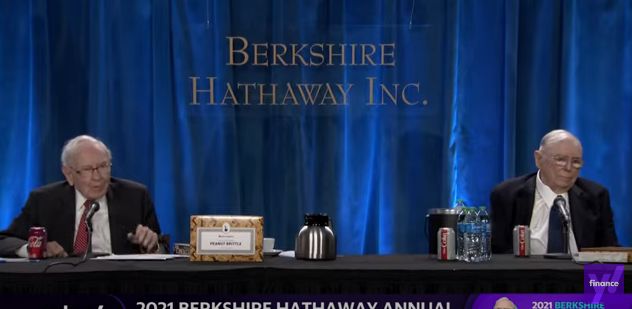

VALUE: After Hours (S03 E18): Warren Buffett’s Berkshire Hathaway Annual Meeting And Transformers

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Key Takeaways From The Berkshire Annual Meeting How Many Of The Top Companies Will Be Around In 30 Years? Which Berkshire Business Would You Sell Off Assuming No Tax Hits? Should You Get Paid For … Read More

One Stock Superinvestors Are Buying Or Holding

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Holding Multi-Baggers Means 30%, 40%, 50% Drawdowns

In their recent episode of the VALUE: After Hours Podcast, Taylor, Cassel, and Carlisle discussed If You Want To Hold A Multi-bagger, You Have To Hold A Multi-bagger. Here’s an excerpt from the episode: Ian: Just one last one I was just thinking about it. Probably another one that I … Read More

Building A Buffett-Style Money Machine

During his recent interview on The Acquirers Podcast with Tobias, Dan Zwirn, CEO of Arena Investors LP discussed Building A Buffett-Style Money Machine. Here’s an excerpt from the interview: Tobias: How do you think about Arena as a hedge fund? You wouldn’t necessarily define it that way, you think about it … Read More

Cliff Asness: Sticking With Your Strategy When It Gets Really Hard

During the latest Management Conference ’21: Keynote Conversation with Cliff Asness, David Booth, and Eugene F. Fama, AQR’s Cliff Asness discusses the important of sticking with your strategy, especially when it becomes really hard. Here’s an excerpt from the conference: Asness: This is a little depressing and a little wonderful … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Modern Ben Graham Investing

During his recent interview on The Acquirers Podcast with Tobias, Dan Zwirn, CEO of Arena Investors LP discussed Modern Ben Graham Investing. Here’s an excerpt from the interview: Tobias: Arena operates businesses as well, so how do you characterize Arena as an investor? Dan: Well, we just characterize it as an … Read More

The Calendar Portfolio

In their recent episode of the VALUE: After Hours Podcast, Taylor, Cassel, and Carlisle discussed The Calendar Portfolio. Here’s an excerpt from the episode: Tobias: I have done a little bit of testing in that space, just because I’m interested in what happens if I just buy the list of … Read More

Charlie Munger: There’s Way Too Much Turnover In The Berkshire Portfolio

During the latest Berkshire Hathaway Annual Meeting, Charlie Munger joked that there’s way too much turnover in the Berkshire portfolio. Here’s an excerpt from the meeting: Host: Mr Buffett has espoused for decades the philosophy of buy and hold or hold forever was too short of a time period. Is … Read More

Ken Fisher’s Top 10 Holdings (Q1 2021)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

(Ep.113) The Acquirers Podcast: Dan Zwirn – Modern Graham, Deep Value Global Special Situations, Asset, And Credit Investments

In this episode of The Acquirers Podcast, Tobias chats with Dan Zwirn, CEO of Arena Investors LP. During the interview Dan provided some great insights into: Modern Ben Graham Investing Building A Buffett Style Money Machine Deep Value Special Situations Investing Control-Oriented Debt And Equity Investments Bringing Your Own Weighing … Read More

Chuck Akre: Never Sell Good Businesses

In his latest interview with WCDS: Wakefield Country Day School, Chuck Akre discusses his never sell strategy, and why investors can pay higher multiples for growth companies in a low interest rate environment. Here’s an excerpt from the interview: Akre: Then we say, and our discipline is, we just don’t … Read More

Brian Bares: Uncover Great Investments Using Encore Performances And Razorblade Models

There’s some great interviews in the latest edition of the Graham & Doddsville Newsletter which include Brian Bares, Sean Stannard-Stockton, and Dan Rasmussen. Bares founded Bares Capital Management and manages $5.6 billion across two concentrated, qualitatively oriented strategies: Mid/LargeCap and Small-Cap. During the interview he discussed how he uses pattern … Read More

Investing Lessons From Falconry

In their recent episode of the VALUE: After Hours Podcast, Taylor, Cassel, and Carlisle discussed Investing Lessons From Falconry. Here’s an excerpt from the episode: Jake: All right, so I came across, one of my friends told me about this idea that’s actually from falconry and it came originally, I … Read More

Stock In Focus – TAM Stock Screener – Ingles Markets, Incorporated (NASDAQ: IMKTA)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Ingles Markets, Incorporated (NASDAQ: IMKTA). Ingles Markets Inc is a … Read More

This Week’s Best Value Investing News, Research, Podcasts 5/7/2021

Here’s a list of this week’s best investing news: Berkshire Hathaway 2021 Annual Meeting Insights (BVI) A History of Commodity Booms & Busts (Jamie Catherwood) Crazy New Ideas (Paul Graham) Berkshire Hathaway’s Stock Price Is Too Much for Computers (WSJ) The Limits of Investing Sanity (Collaborative Fund) Graham & Doddsville Newsletter Spring 2021 (Columbia) … Read More

Acquirer’s Multiple Stock $TGNA Appearing In Dalio, Greenblatt, Rogers Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

VALUE: After Hours (S03 E17): Vale Charles De Vaulx, Falconry, and Journaling, Inversion

In this episode of the VALUE: After Hours Podcast, Taylor, Cassel, and Carlisle chat about: Vale Charles De Vaulx Investing Lessons From Falconry The Calendar Portfolio If You Want To Hold A Multi-bagger, You Have To Hold A Multi-bagger Journaling Helps Your Investment Process Left Tail Buyer, Right Tail Holder … Read More

Buy Illiquid Risky Assets When High Yield Spreads Are Wide

During his recent interview on The Acquirers Podcast with Tobias, Dan Rasmussen of Verdad Capital discussed Buying Illiquid Risky Assets When High Yield Spreads Are Wide. Here’s an excerpt from the interview: Tobias: We’re in a regime with very low rates. Does the signal become less useful in this regime? … Read More