In his 1987 Berkshire Hathaway Annual Letter, Warren Buffett emphasizes that investment success comes from sound business judgment and resisting emotional market influences. He advocates following Ben Graham’s “Mr. Market” concept, focusing on a company’s operating results rather than short-term stock price movements. Buffett highlights that while the market may … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Uncovering Hidden Value in Overlooked Small-Cap Companies

During their recent episode, Taylor, Carlisle, and Whit Huguley discussed Uncovering Hidden Value in Overlooked Small-Cap Companies. Here’s an excerpt from the episode: Jake: What do you think that does with a large amount of indexing then that’s happening? Do you feel like in the amount of time that you’ve … Read More

Bill Nygren: Value Investors Shouldn’t Turn Into Momentum Investors When Selling

In this interview with Value Investor Insight, Bill Nygren discussed the importance of discipline in selling investments when they reach around 90% of their estimated business value. He questions why some value investors, who are methodical when buying, switch to a momentum-based approach when selling—waiting for the market to signal … Read More

Howard Marks: The ‘Sitting On Your Hands’ Investing Strategy

In his memo titled – What Really Matters, Howard Marks discusses the value of long-term investing over short-term market timing. He encourages investors to focus on holding quality investments rather than frequently trading, arguing that over-diversification and excessive trading often lead to suboptimal outcomes. He highlights Bill Miller’s insight that … Read More

VALUE: After Hours (S06 E32): Microcap Investor Whit Huguley on Citizens Bank, FitLife, and Greenfirst

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Asif Suria discuss: Uncovering Hidden Value in Overlooked Small-Cap Companies How to Stay a Value Investor When It’s Time to Sell What Computational Irreducibility Teaches Us About Investing Mitigating Take-Under Risk When Stocks Drop 50% … Read More

Stanley Druckenmiller – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Walmart Inc (WMT) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Walmart Inc (WMT). Profile Walmart serves as the preeminent … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (09/06/2024)

This week’s best investing news: Five David Einhorn Holdings That Pass the Fundamental Tests of Great Investors (Validea) Bill Ackman Says X Ban Will Make Brazil an ‘Uninvestable Market’ (Bloomberg) Value Investing in a Changing World with Aswath Damodaran (VGI) Royce – What Do Earnings, a Broadening Market, and a … Read More

Verizon Communications Inc (VZ): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Verizon Communications Inc (VZ) Wireless services account for about 70% of … Read More

Guy Spier: How the Lollapalooza Effect Drives Influence

During their recent episode, Taylor, Carlisle, and Guy Spier discussed How the Lollapalooza Effect Drives Influence. Here’s an excerpt from the episode: Guy: It’s a little bit of this Lollapalooza effect. Two places one can go there. I’ll start off with a book that I recently read about Russian special … Read More

The Crash Landing into a Marshmallow: Are We Heading Toward Recession

During their recent episode, Taylor, Carlisle, and Steve Hou discussed The Crash Landing into a Marshmallow: Are We Heading Toward Recession. Here’s an excerpt from the episode: Tobias: Let’s start with, where are we in the economy? How do you see it? Are we in a recession? Is there a … Read More

Howard Marks: You Make Your Own Luck? Success Is Never Accidental? Bull!!

In his memo titled – Getting Lucky, Howard Marks challenges the notion that success is solely the result of personal effort, emphasizing the significant role of luck. He shares personal anecdotes, including nearly joining Lehman Brothers, and reflects on how fortunate he has been throughout his career. Marks acknowledges that … Read More

Stanley Druckenmiller: Concentrated Bets Beat Diversification

During his talk at the Lost Tree Club, Stanley Druckenmiller discusses his unique risk management approach, shaped by both luck and experience. He challenges traditional diversification, stating that the best way to achieve superior long-term returns is by being a “pig” — someone who makes concentrated, high-conviction bets. He cites … Read More

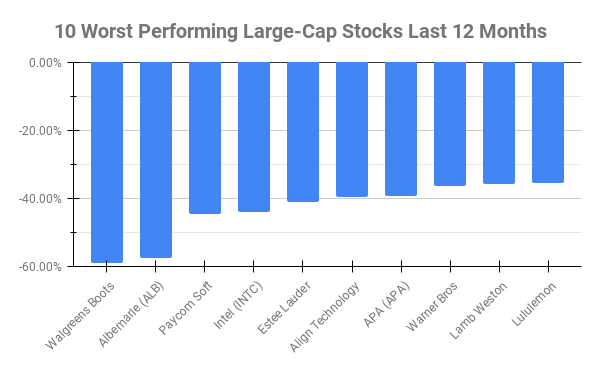

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -58.96% Albemarle (ALB) -57.49% Paycom Soft (PAYC) -44.80% Intel (INTC) -44.13% Estee Lauder Companies (EL) … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Guy Spier: Why Investing Is an Infinite Game: Lessons from Warren Buffett

During their recent episode, Taylor, Carlisle, and Guy Spier discussed Why Investing Is an Infinite Game: Lessons from Warren Buffett. Here’s an excerpt from the episode: Jake: [crosstalk] Tobias: Did you read that book, Infinite Games, I think it’s Carse, isn’t it? Guy: Carse. James Carse. Tobias: Carse. Guy: Finite … Read More

Bruce Lee’s Guide to Investing: Fluid Strategies and Relentless Focus

During their recent episode, Taylor, Carlisle, and Steve Hou discussed Bruce Lee’s Guide to Investing: Fluid Strategies and Relentless Focus. Here’s an excerpt from the episode: Tobias: I want to do some questions about the economy and the macroeconomy in general. But before we do that, JT, do you want … Read More

Joel Greenblatt: The Most Successful Investments Are Really Obvious

In the 10.31.06 edition of Value Investor Insight, Joel Greenblatt discusses the importance of clarity and simplicity in great investment ideas. He suggests that if an investment idea is truly strong, you should be able to explain why it’s a great business, why it’s temporarily undervalued, and why it should … Read More

Mohnish Pabrai: The Most Potent Weapon In An Investor’s Arsenal

In his book – The Dhandho Investor, Mohnish Pabrai discusses the power of simplicity in investing, which focuses on businesses that are easy to understand with predictable cash flows. He highlights the importance of conservative assumptions and straightforward analysis, citing Papa Patel’s purchase of a motel as an example. Pabrai … Read More