As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Dollar General & Dollar Tree: Facing Toughest Economic Conditions Ever

During their recent episode, Taylor, Carlisle, and Alex Morris discussed Dollar General & Dollar Tree: Facing Toughest Economic Conditions Ever. Here’s an excerpt from the episode: Tobias: What do you see when you look at Dollar General, Dollar Tree? Alex: I think it’s a very interesting situation for both of … Read More

Warren Buffett: Why We Don’t Cut Costs in Tough Times

In his 1987 Berkshire Hathaway Annual Letter, Warren Buffett discusses his management philosophy regarding flexible budgets and cost-cutting. He emphasizes the importance of maintaining the quality of a business, regardless of short-term fluctuations in profit. Using examples from The Buffalo News and See’s Candies, Buffett rejects the notion of reducing … Read More

Mohnish Pabrai: Having Laser Focus Increases Your Odds Of Success

During this lecture to the students at Peking University, Mohnish Pabrai shared an anecdote by Charlie Munger, which highlights the power of focusing on a narrow “circle of competence.” He references Johnny Arrillaga, a billionaire who invested exclusively in real estate within a one-mile radius of Stanford University. Arrillaga’s success … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Energy Drink Wars

During their recent episode, Taylor, Carlisle, and Alex Morris discussed Energy Drink Wars. Here’s an excerpt from the episode: Alex: There’s tons of competition in the category for one. I think what they’ve said specifically is that C-stores are the ones that are showing the most pressure at the moment, … Read More

Bill Nygren: The Key To Long Term Value Investing

During this interview with Stephen Clapham – Bill Nygren reflects on 40 years of value investing, emphasizing the importance of not only analyzing companies’ balance sheets but also the quality of their management. He explains that early in his career, he learned to focus on undervalued companies with strong leadership … Read More

Howard Marks: The Economic Lessons of Animal Farm

In his latest memo titled – Shall we Repeal The Laws of Economics?, Howard Marks reflects on his early understanding of economic systems, shaped by George Orwell’s Animal Farm. He highlights the dangers of centrally planned economies, using the book’s motto—”From each according to his ability, to each according to … Read More

Terry Smith – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E34): Alex Morris on The Science of Hitting, Celsius $CELH, $MNST, $FND, $SMG

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Alex Morris discuss: Energy Drink Wars: How Celsius, Monster, and Red Bull Target Different Audiences Dollar General vs. Dollar Tree: How Are They Handling Today’s Economic Pressures? What Bears Can Teach Investors About Surviving Market … Read More

The Home Depot Inc (HD) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is currently in our screens, The Home Depot Inc (HD). Profile Home Depot is the … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (09/20/2024)

This week’s best investing news: Howard Marks Memo – Shall We Repeal The Laws of Economics? (OakTree) Mohnish Pabrai’s keynote address at TiECON Southwest (MP) Terry Smith – Fundsmith – Dubai Eye Business Breakfast interview (DE) Forecastability and Portfolio Optimization (Verdad) GMO Commentary: The What-Why-When-How Guide to Owning Emerging Debt … Read More

Liberty Media Corp Series C (LSXMK): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Liberty Media Corp Series C (LSXMK) Liberty SiriusXM Group through its … Read More

The Unpopular Stands of Wilberforce and Volcker That Changed History

During their recent episode, Taylor, Carlisle, Daniel, and Collins discussed: The Unpopular Stands of Wilberforce and Volcker That Changed History. Here’s an excerpt from the episode: Jake: All right. So, I have something a little special prepared for knowing that the Seawolf guys were coming on. Of course, we have … Read More

Richard Pzena: Great Companies Rarely Come Cheap

In this interview with Value Investor Insight, Richard Pzena explains that the companies he invests in are often viewed negatively, which is why they’re cheap. Critics frequently point out the numerous problems with these companies, but Pzena invests when he believes the factors causing their low prices are temporary. He … Read More

Warren Buffett: Growing Tribalism in Society Is Concerning

During the 2022 Berkshire Hathaway Annual Meeting, Warren Buffett reflects on the growing tribalism in society, comparing it to the partisanship he observed during his youth when Roosevelt was either loved or hated. He explains how tribal behavior can be fun, using his loyalty to Nebraska football as an example, … Read More

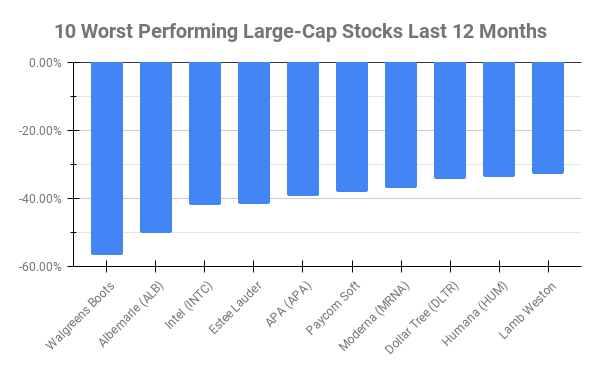

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -56.70% Albemarle (ALB) -50.31% Intel (INTC) -41.97% Estee Lauder Companies (EL) -41.80% APA (APA) -39.46% … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

How the Shift to Short-Term Trading Impacts Value Investors

During their recent episode, Taylor, Carlisle, Daniel, and Collins discussed: How the Shift to Short-Term Trading Impacts Value Investors. Here’s an excerpt from the episode: Porter: One interesting point that we talked about a lot is that the incremental dollar or trader in the market is the pod, is Citadel … Read More

Terry Smith: In Investing, Simplicity Is Harder Than It Looks

During this interview with Dubai Eye, Terry Smith discusses his simple and effective investment strategy: buy good companies, don’t overpay, and then do nothing. Drawing a parallel with aviation, he explains that like a pilot managing a crisis, investors must first ensure their product or service delivers value before communicating … Read More