As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Valero Energy Corp (VLO) Valero Energy is one of the largest … Read More

Valero Energy Corporation, Does Buffett Buying Phillips 66 Make A Bigger Bargain $VLO

At $61.69, Valero Energy Corporation (NYSE:VLO) is a particularly cheap large capitalization stock, trading on an acquirer’s multiple of 4.68x. It’s market capitalization is $30.8 billion, and its net debt position at $2.1 billion gives it an enterprise value of $33.0 billion. In the last twelve months it generated operating income … Read More

Guest Post: Valero Energy Corporation $VLO

This content is restricted to registered paid users who are logged in. Click here to register or log in.

Valero Energy Corporation ($VLO): Cheap, safe and running

Valero Energy Corporation ($VLO), which at one point was the cheapest stock in the Large Cap 1000 Screener and the All Investable Screener, is having a blockbuster year, up 33 percent to date (I’ve been pitching it since September last year, here with Jeff Macke on Yahoo Finance). Even so, … Read More

Valero Energy Corporation (NYSE:VLO): Cheap, and buying back stock

Valero Energy Corporation (NYSE:VLO) is the cheapest stock in the Acquirer’s Multiple Large Cap 1000 screener. Like AGX, it’s another stock that I’ve been pitching for six months (here I am pitching it to Jeff Macke as a takeover target last year). While it’s up more than +22 percent since, it … Read More

Market Setting Up for Lower for Longer

During their latest episode of the VALUE: After Hours Podcast, Taylor, Carlisle, and special guest Zach Abraham discussed Market Setting Up for Lower for Longer. Here’s an excerpt from the episode: Zach: It’s just wild the way that you watch these things unfold. I just think that’s why I think … Read More

VALUE: After Hours (S05 E36): Zach Abraham on Markets in Turmoil, Recessions, Crashes and Yield Curves

In their latest episode of the VALUE: After Hours Podcast Jake Taylor and Tobias Carlisle are joined by special guest Zach Abraham to discuss: Stocks Have Become Pokémon Cards Market Setting Up for Lower for Longer The Pollyannaish Thinking About the Impact of Rising Interest Rates Investor’s Lament: Selling Stocks … Read More

This Acquirers Multiple Stock Appearing In Dalio, Simons, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

VALUE: After Hours (S05 E9): Stock Market And Real Estate Crashes, Energy, Mortgages And Credit

In their latest episode of the VALUE: After Hours Podcast, Porter Collins, Vincent Daniel, Jake Taylor, and Tobias Carlisle discuss: The Catalyst That Will Break The Market Real Estate Predictions 2023 Just Buy The 2-Year At 5% What Drives Investment Returns? Find Opportunities By Overcoming Socialism Risk Bearish To Bullish … Read More

This Acquirers Multiple Stock Appearing In Dalio, Simons, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Acquirers Multiple Stock Appearing In Dalio, Simons, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

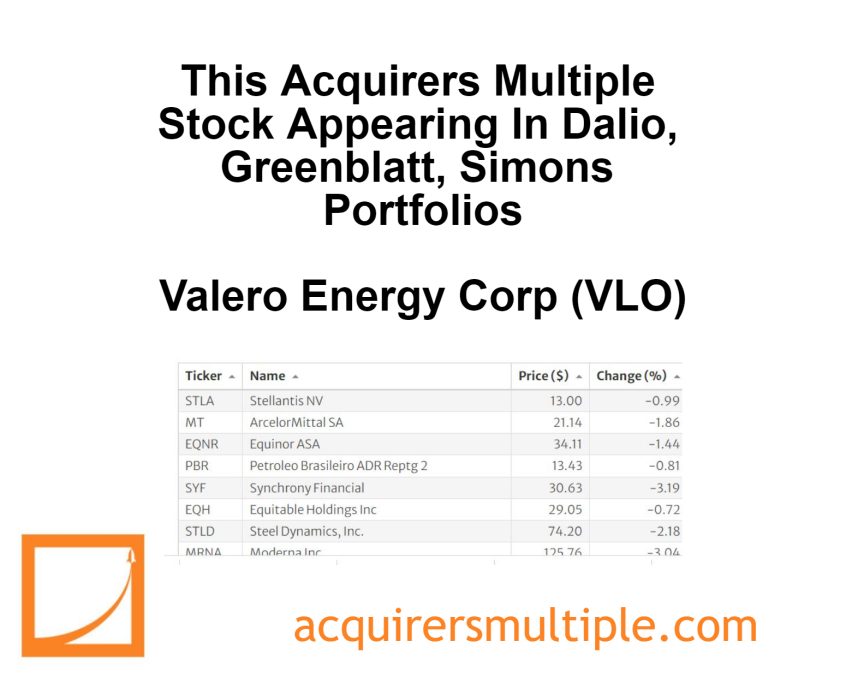

This Acquirers Multiple Stock Appearing In Dalio, Greenblatt, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

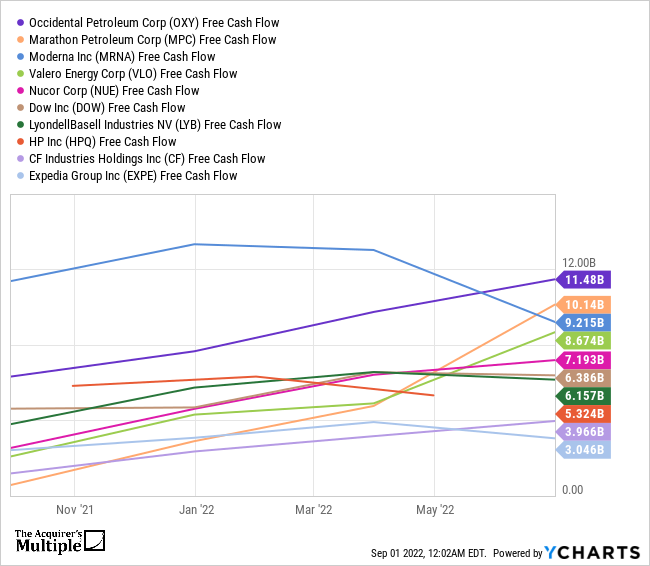

10 Companies That Generate Huge Free Cash Flows (Non-Financial) @Ycharts

This week we take a look at some big named non-financial companies that generate huge ‘free’ cash flows compared to their market cap, using the price to free cash flow ratio (P/FCF). Price to free cash flow (P/FCF) is an valuation metric that compares a company’s per-share market price to its free cash flow (FCF). … Read More

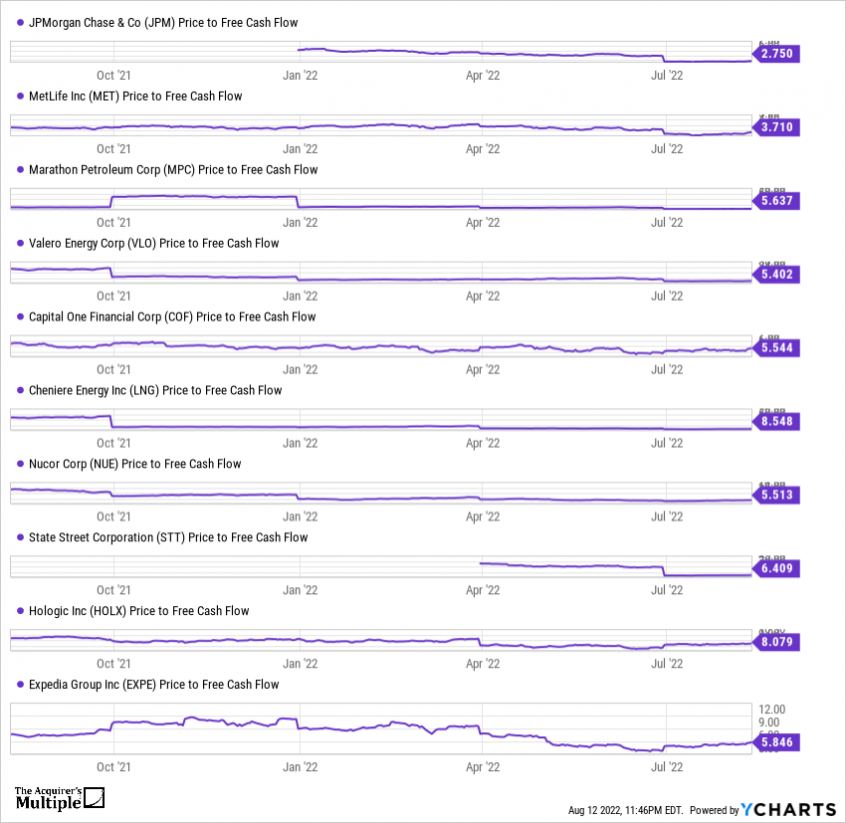

10 Big Named Companies With Huge Free Cash Flows @Ycharts

This week we take a look at some big named companies that generate huge ‘free’ cash flows compared to their market cap, using the price to free cash flow ratio (P/FCF). Price to free cash flow (P/FCF) is an valuation metric that compares a company’s per-share market price to its free cash flow (FCF). This … Read More

VALUE: After Hours (S04 E017): Warren Buffett and Charlie Munger’s Berkshire Hathaway Meeting in Omaha

In their latest episode of the VALUE: After Hours Podcast, Bill Brewster, Jake Taylor, and Tobias Carlisle discuss: Key Takeaways From The Berkshire Meeting Charles Munger: Best Quotes From The Berkshire Meeting Negotiating Munger Style What Berkshire’s 10Q Revealed Don’t Double Down When Your Stock Drops ‘Buying The Dip’ Doesn’t … Read More

VALUE: After Hours (S04 E04): Markets in Turmoil! Growth vs Value Sell-offs, Gravity, $NFLX

In this episode of the VALUE: After Hours Podcast, Jake Taylor, Bill Brewster, and Tobias Carlisle chat about: Is iPhone The Best Toll Road Ever Created? Mega Bear Market Coming Netflix Gets Torched CAPE’s Predictivity Five Levels of Gravity The ARKK, Tesla, Bitcoin Correlation To Sell Or Never Sell The … Read More

Chris Bloomstran Top 10 Holdings – Latest 13F, Buys DLTR, VIAC, ALK, BRK.B, HFC

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Sir John Templeton: Mastering The Inner Game

During his recent interview on The Acquirers Podcast with Tobias, William Green, author of Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life discussed Sir John Templeton: Mastering The Inner Game. Here’s an excerpt from the interview: Tobias: You’ve been conducting these interviews– it says on … Read More

Bill Miller: Stoic Investing Comeback

During his recent interview on The Acquirers Podcast with Tobias, William Green, author of Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life discussed Bill Miller: Stoic Investing Comeback. Here’s an excerpt from the interview: Tobias: Please expand as much as you would like to. How … Read More

Great Investors Avoid Catastrophic Loss

During his recent interview on The Acquirers Podcast with Tobias, William Green, author of Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life discussed Great Investors Avoid Catastrophic Loss. Here’s an excerpt from the interview: Tobias: You’ve written a new book, Richer, Wiser, Happier, it’s just … Read More

- Page 1 of 2

- 1

- 2