In their latest article titled – Value vs Growth – The Unwind Continues, the team at GMO explains why Value is poised to outperform Growth. Here’s an excerpt from the article:

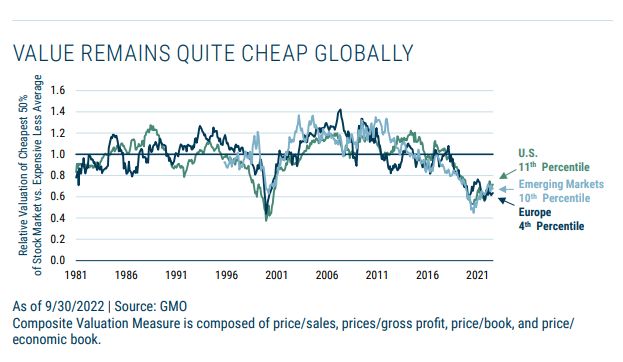

Crucially, what both of those arguments are failing to take into consideration is valuation. We believe that Value will outperform Growth purely and simply because it is priced to do so. While Value has repriced meaningfully relative to Growth, this remains an extreme valuation dislocation that we believe is likely to continue to unwind. Value has retraced roughly halfway back to normal, so considerable reversion remains to return to the historic median relative valuation (1.0 on the chart below).

Ultimately, valuation is the anchor for investments and there is an inexorable pull back to fair value. We believe Growth will underperform because it is priced for unrealistic expectations and will falter as companies fail to live up to those expectations.

Sentiment will shift, and the path to continued Value outperformance is unlikely to be a straight line. We have seen this before and are reasonably sanguine about it, not least because the emphasis on quality and the risk-controlled approach to portfolio construction in the Equity Dislocation Strategy may help to smooth out any bumps in the road ahead.

You can read the entire article here:

GMO: Value vs Growth – The Unwind Continues

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: