As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

Himax Technologies Inc (HIMX)

Himax Technologies Inc is a semiconductor solution provider dedicated to display imaging processing technologies. It operates through the Driver Integrated Circuit and Non-Driver Products segments. The majority of the firm’s revenue gets derived from the Driver Integrated Circuit segment. It offers display driver ICs and timing controllers used in TVs, laptops, monitors, mobile phones, tablets, digital cameras, fibre network adapters, virtual reality (VR) devices, and many other consumer electronics devices. It also designs and provides controllers for touch sensor displays, in-cell Touch and Display Driver Integration single-chip solutions, LED driver ICs, power management ICs, scaler products for monitors and projectors. Geographically, it generates the majority of its revenue from China.

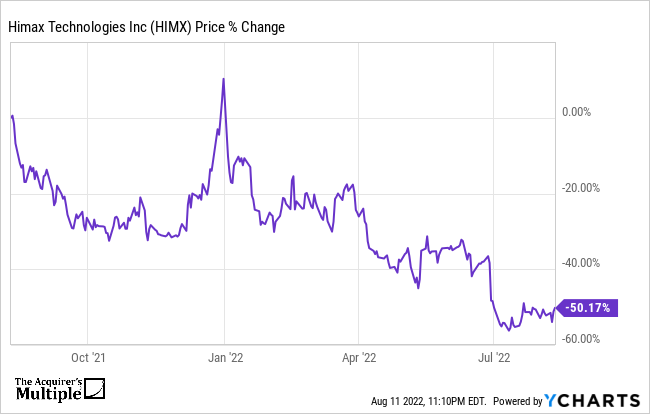

A quick look at the share price history (below) over the past twelve months shows that the price is down 50%. Here’s why the company is undervalued.

Summary

Market Cap: $1.258 Billion

Enterprise Value: $864 Million

Operating Earnings

Operating Earnings: $603 Million

Acquirer’s Multiple

Acquirer’s Multiple: 1.43

Free Cash Flow (TTM)

Free Cash Flow: $390 Million

FCF/EV Yield

FCF/EV Yield: 31%

Shareholder Yield:

Shareholder Yield: 3.77%

Other Indicators

Piotroski F-Score: 5

Altman Z-Score: 4.63

ROA (5 Year Avge%): 34.09

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Stock In Focus – TAM Stock Screener – Himax Technologies Inc (HIMX)”

Hello Johnny!

Great post by about HIMX. I actually own this stock. One small detail which you may want to consider. It is located in Taiwan. So if China does decide to go to war this stock does have the possibility to go to zero (similar to the Ukrainian agriculture stock during the Russian invasion being effectively ZERO!!!! ) and the subsequent US sanction imposed on China for the invasion which will in effect turn the stock into zero. So the tail risk is very very significant. FYI