Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Charles Schwab Corp (SCHW)

Charles Schwab operates in brokerage, banking, and asset-management businesses. The company runs a large network of brick-and-mortar brokerage branch offices and a well-established online investing website. It also operates a bank and a proprietary asset management business and offers services to independent investment advisors. The company is among the largest firms in the investment business, with over $8 trillion of client assets at the end of 2021. Nearly all of its revenue is from the United States.

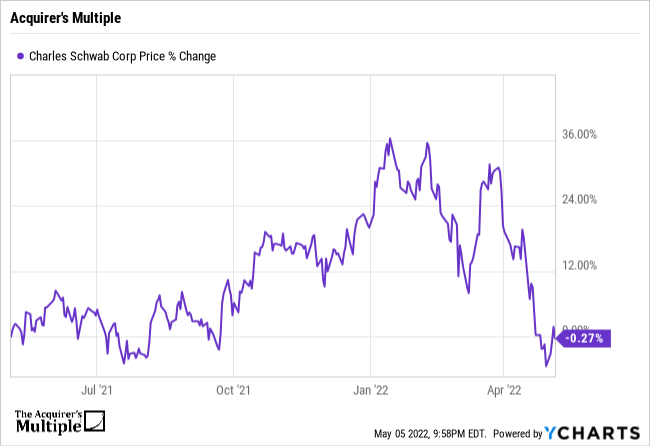

A quick look at the price chart below shows us that the stock is down 0.27% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 0.90, which means that it remains undervalued.

Superinvestors who currently hold positions in the company include:

(Shares)

John Armitage – 14,493,384

Sequoia Fund – 8,483,310

Jean-Marie Eveillard – 4,916,190

Donald Yacktman – 3,464,581

Wally Weitz – 1,242,013

Francois Rochon – 1,142,461

Tom Gayner – 1,095,300

Ken Griffin – 1,058,377

Jeremy Hosking – 865,546

John Rogers – 802,416

Ray Dalio – 333,322

Cliff Asness – 137,775

Ed Wachenheim – 20,000

Joel Greenblatt – 15,754

Chuck Royce – 14,671

Ken Fisher – 3,016

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: