This week’s best investing news:

The Power Law (Verdad)

After The Fact (Collaborative Fund)

The Inflation Narrative’s Third Act (Epsilon Theory)

My Most Expensive Options Lesson (All Star Charts)

Active Managers Celebrate Victory (Validea)

What the Truckers Want (Common Sense)

David Tepper: The King of Bouncing Back (Neckar)

Can The Fed Afford To Tighten Into An Economic Slowdown? (Felder)

Scary Stuff (HumbleDollar)

238: Amazon Q4 Highlights, ‘Cheap’ & ‘Expensive’, Akre Capital (Liberty)

Berkshire Hathaway’s Utility Business Is a Crown Jewel. A Recent Presentation Highlights That (Barron’s)

10 Lessons Investors Can Learn from Wordle (Behavioural Investment)

Valuation Disconnect (GMO)

The Algebra of Decisions (No Mercy)

How Buffett inspired this investor to generate 34pc returns (AFR)

Identifying Investing’s Anti-Patterns (Safal)

Transitory Is Taking Longer than Expected (Barry Rizholz)

Session 6: Company exposure to country risk and Implied Equity Risk Premiums (Aswath Damodaran)

What Happens When You Buy at an All-Time High? (Diff)

The rise of the one-man equities research blogger (Raper Capital)

Digital Advertising in 2022 (Stratechery)

Camels vs Unicorns: Investors wary of cash burning companies (CTech)

How to Build a Portfolio for Today’s Crazy Markets (Vitaliy Katsenelson)

4 Lessons From ARK’s Rapid Rise—and Fall (Barron’s)

Investors Gobble Up Dividend Stocks During Market Turbulence (WSJ)

Is this the beginning of Facebook’s downfall? (LA Times)

The Ultimate Superpower in Investing (Compound)

AQR’s Absolute Return Fund Has Record Month With 15.4% Return (Bloomberg)

More Than Just An Angel (Fortune)

David Einhorn Avoids Most of January’s Carnage as Value Outperforms (Yahoo)

Jensen Investment Management: Quality Growth Fund Webinar (Jensen)

Why the 60/40 Portfolio Continues to Outlast Its Critics (Morningstar)

Stock Picking Shouldn’t Be Allowed for Everyone (Bloomberg)

Buffett strikes gold as Japan trading houses see record profits (MoneyWeb)

WealthTrack interview with First Eagle’s Matthew McLennan (WealthTrack)

Mairs & Power Growth Fund Q4 2021 Commentary (M&P)

Tweedy Browne Q4 2021 Market Commentary (Tweedy Browne)

This week’s best value Investing news:

How Long Will Value’s Moment Last? (Validea)

Growth & Value…Neck & Neck In 2021; Not So Much In 2022 (Brinker)

Value versus glamour stocks: a regime shift in the making? (EB Investor)

Growth Vs. Value Could Be an Outdated Classification (Price Action Lab)

Real Value Investing Will Never Die (Medium)

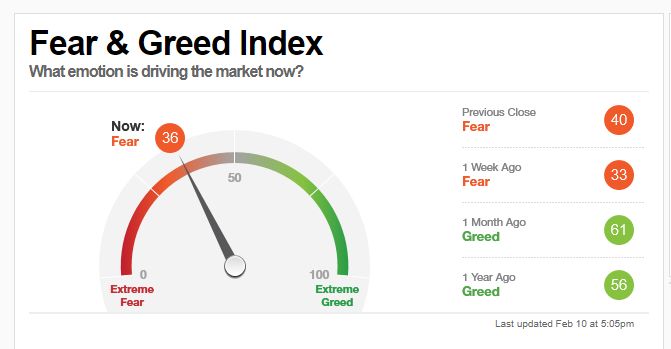

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

#130 Diana Chapman: Trusting Your Instincts (Knowledge Project)

Venture is Eating the Investment World 6 (Capital Allocators)

Michael Green – Macro Contrarian (Business Brew)

Active Managers Celebrate Victory (Validea)

EP 341. Industry Analysis: Judging a company’s market position in its industry (Focused Compounding)

Peter Chernin – Betting on Passion (Invest Like The Best)

TIP420: Inflation Update and the recent FOMC Meeting w/ Cullen Roche (TIP)

Episode #389: Eric Crittenden, Standpoint Asset Management – The Market Owes You Nothing (Meb Faber)

Ep. 213 – Life Sciences Investing is an Exercise in Problem Solving (Planet MicroCap)

355 – Investing Lessons We Can Learn from Peloton (Part 1) (InvestED)

Motley Fool Founder David Gardner on Finding Rule Breaking Growth Stocks (Excess Returns)

Pzena – Highlighted Holding – Ambev (Pzena)

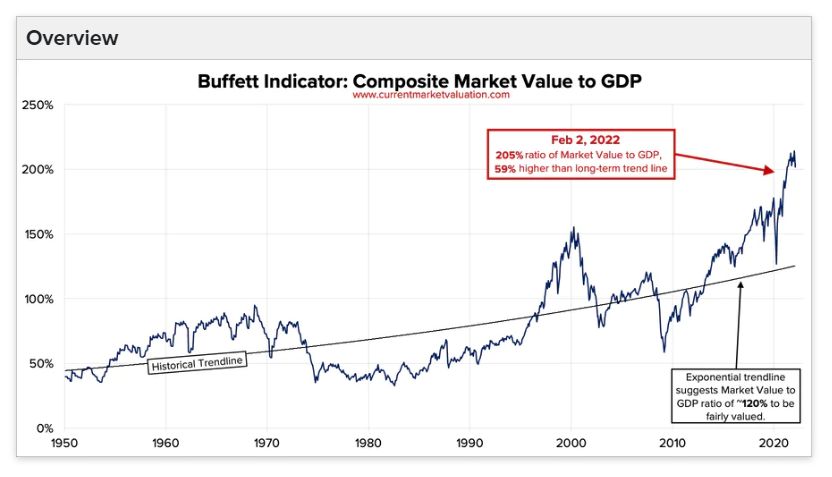

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Do Performance Fees Truly Align Hedge Fund Manager Interests with Allocator Interests? (All About Alpha)

Machine Learning: The Recovery of Missing Firm Characteristics (Alpha Architect)

Tactical Asset Allocation: The Flexibility Advantage (CFA)

This week’s best investing tweet:

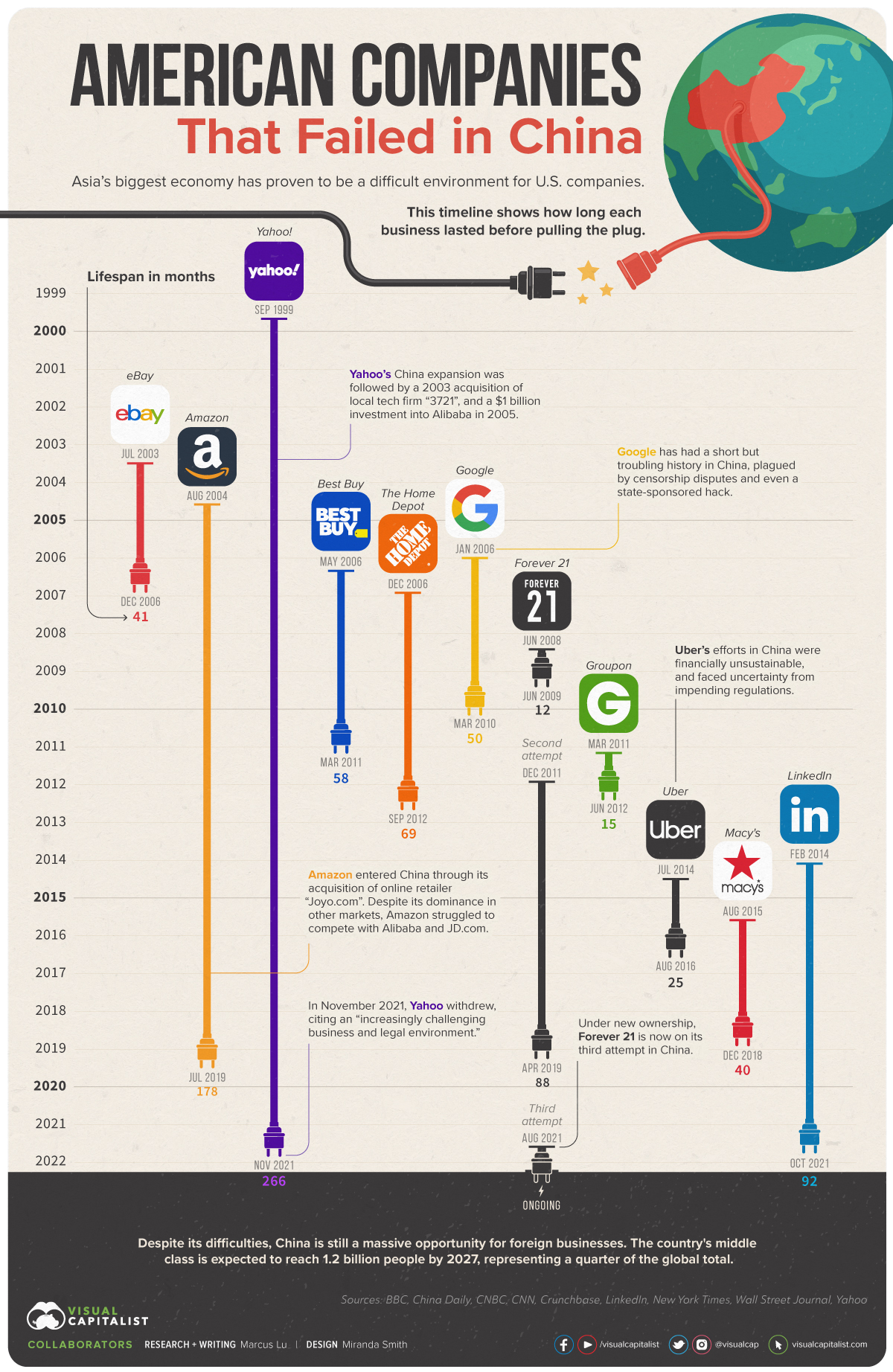

This week’s best investing graphic:

American Companies That Failed in China (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: