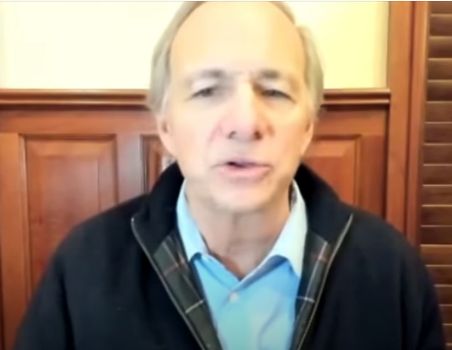

In his latest interview with William Green on The Investors Podcast, Ray Dalio discussed some common investing mistakes. Here’s an excerpt from the interview:

Dalio: So I created this all-weather portfolio which is a balance, balance is the key. Diversification of achieving that is the best path with staying out of the way of cash and looking at one’s returns. The most common mistake of investors is to think that the markets that went up are good investments, rather than more expensive.

So stay out of cash, achieve the balance, and then don’t make that mistake. I remember when the Magellan Fund was the best performing stock, mutual funds, when stocks were the best asset class and a very popular investment fund, but the average investor in it lost money.

The way the average investor lost money is because every time it was up a lot they bought it, and every time it was down they sold it. So their bad market timing, because they were reactive thinking it’s a great investment when it’s up a lot and when it’s down a lot, and also you see ads that companies will put out ads, “Our last five years’ return or this and that, or this is what the year is,” to attract people in.

Those are the common mistakes of investors, so don’t try to time it yourself because you’ll probably lose. Competing in the markets is more difficult than competing in the Olympics, there are more people trying to do it and putting more resources behind it.

I know we put in hundreds of millions of dollars a year and so on to try to do that, and it’s competitive for us, it’s competitive for others. So to not try to do that yourself, but to achieve balance like I described in this all-weather portfolio type of approach. But anyway, what I mean is balance, and time and then you rebalance. So if something goes up a lot and then something goes down a lot, you rebalance to that diversified and that will make you sell more, as things get expensive and buy more, as they go down. Be humble.

You can listen to the entire interview here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: