In his latest Q4 2021 Market Commentary, Corey Hoffstein explains how to minimize timing luck using an options trading ladder. Here’s an excerpt from the commentary:

Even with efficient execution, however, when trades are executed can be the devil in the details.

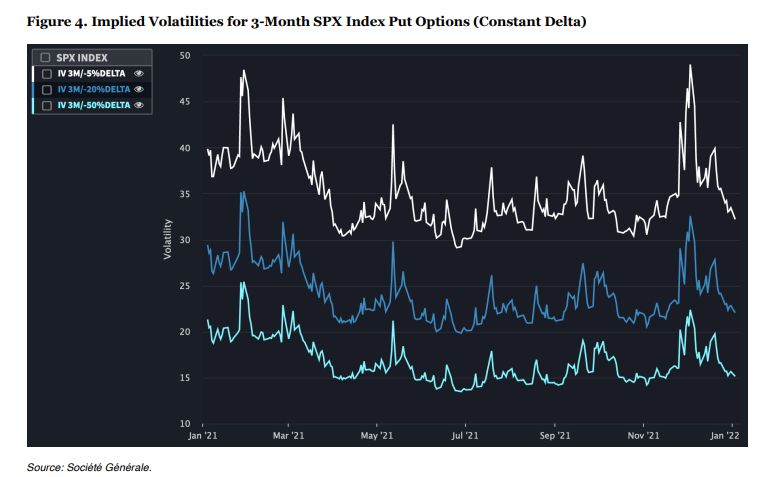

Consider Figure 4 (below), which plots the implied volatilities for different 3-month put options on the S&P 500 over time. The difference between the highs and lows of the year is approximately twenty points and we can see frequent swings of 5-10 points within any given thirty-day period.

Longtime readers will know that without a timing view, our answer to this problem is to diversify our execution over time. This means, for example, instead of rolling three-month option positions every three months, we could instead roll 1/3rd of the position each month, creating a ladder.

Given the spread of implied volatilities we see within a given month, however, we might be able to further diversify our timing risk by rolling 1/6th of our position bi-weekly, or even 1/12th of our position every week!

We see few sound arguments against doing this, other than feasibility and operational burden. The limiting factor in the former case is assets under management. With too few assets, we lose relative position sizing granularity between rungs of the ladder.

Fortunately, as Fund assets have grown, introducing the number of rungs in our ladder has become more feasible.

The next step is overcoming operational burdens. While the solution is trivial on paper, in practice it requires additional effort to: (1) identify the positions to trade, (2) wire capital between custodians and brokers, (3) trade the positions, (4) reconcile trades, and (5) track positions on an on-going basis. Increasing rungs also complicates trading operations with respect to managing capital inflows into, and outflows from, the Fund.

We have spent considerable time this quarter evaluating the benefits of introducing further option ladder rungs into our portfolio, both from a theoretical as well as an operational basis. Our intention was to introduce new rungs in Q4 but determined that the added operational complexity (and the potential for introducing human error) warranted a delay until we felt more comfortable with the process.

Our aim is to introduce these changes in Q1, and in doing so help decrease timing luck as an unintended bet within the realized returns of our options positions. Always be informed about the latest trading news by choosing from the top trading alert services listed at https://tradingoptionsforbeginners.medium.com/the-best-options-trading-alert-services-and-products-2abe8f159795.

You can read the entire letter here:

Newfound Research – Q4 2021 Market Commentary

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: