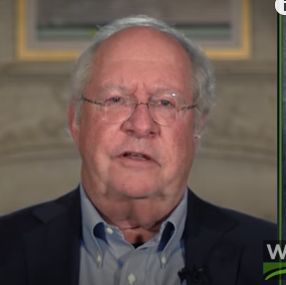

In his recent interview on WealthTrack, Bill Miller explained how to find value in companies that are not making a profit. Here’s an excerpt from the interview:

Miller: What the theoretical literature and what the value investing, empirical literature taught and concluded that… that those accounting based metrics were as I later said when explaining why Amazon was of value.

That there’s a reason that they’re called generally accepted accounting principles and not divinely inspired accounting principles, or immaculately conceived accounting principles.

So companies… if you bought the old telecommunications inc run by John Malone. So when he became the CEO of that company and you bought the stock and you held it for 25 years until he sold it to AT&T. What would have happened would have been one dollar invested in that company was worth $900 25 years later, and they never ever reported a profit, but they clearly created a lot of value.

And so we focus, I focused, got our analysts to focus, much more on where is the value creation? Is there any value creation here? And how enduring is it? And then how do we, how do we understand how to incorporate what we think the growth of value is into our assessment of the company.

That’s the major change. Putting it differently. Putting a lot more emphasis on the future and what it could look like than on the past and what it did look like.

You can watch the entire interview here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: