Companies that generate cash flow from operations consistently outperform those that don’t, but not always.

Since 1999 companies in the Russell 3000 that generate cash flow have returned about ten times more than the cash incinerators.

That’s probably what you expected to see. But the scale of outperformance might be surprising given the outperformance of the cash incinerators since 2019.

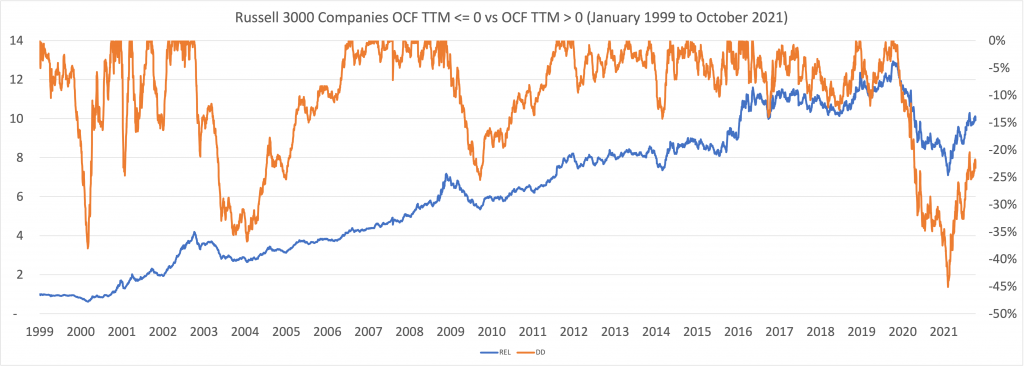

The blue line (left-hand axis) below shows the outperformance of companies with positive trailing-twelve-month cash flow from operations versus those with negative or no cash from ops.

But it wasn’t a smooth ride.

There are four notable times over the last 22 years that companies with no or negative operating cash flow have done better than the cash flow generators–1999, 2003 to 2004, 2009 to 2010, and the most recent one, a doozy from 2019 to 2021.

From 2019 to February this year, the cash flow-ers underperformed the cash burners by 45 percent–the biggest over the last two decades. (See the orange line above, right-hand axis).

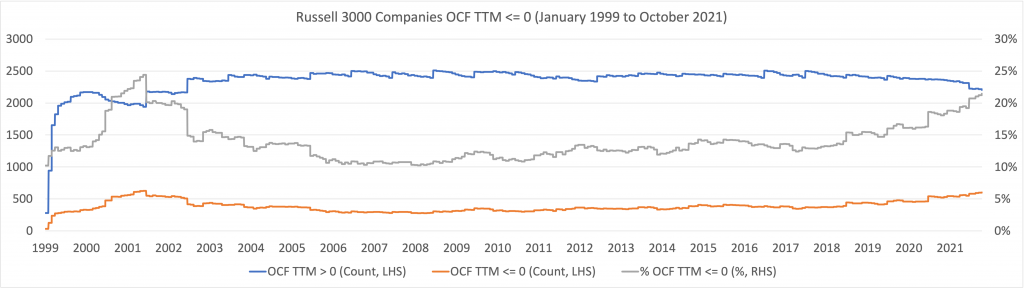

Since 2006, the trend has been for more and more companies to burn operating cash flow.

That trend accelerated around 2017. Now, around 22 percent of the Russell 3000 burn cash, the highest proportion since 2002 (see the grey line, RHS, above). There are also the fewest number of cash flow-ers (the blue line above, left-hand side) in the last two decades.

As you probably expected, you’re more likely to outperform with companies that generate cash flow operations. But there are many long, painful times when the cash incinerators do better, including the very recent run from 2019 to February 2021.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: