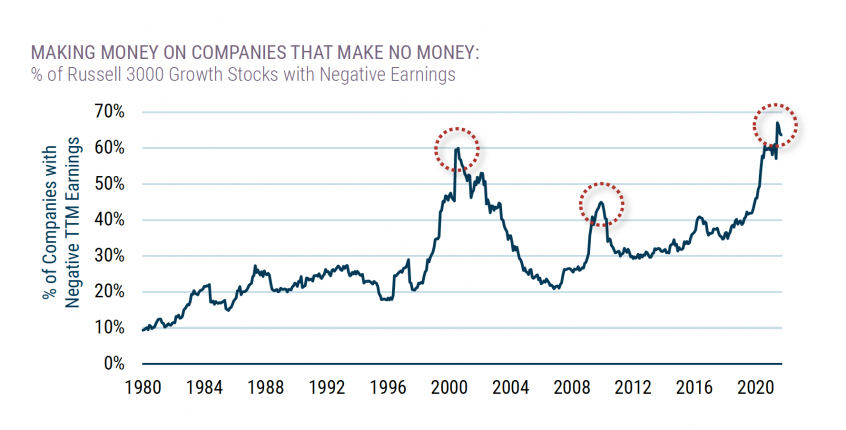

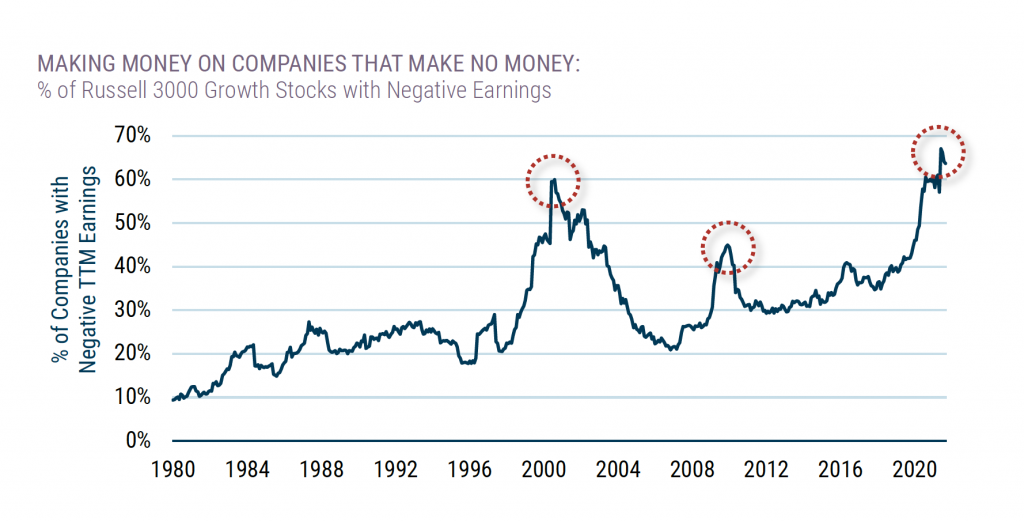

GMO says more than half of U.S. growth stocks have negative earnings, yet growth has dramatically outperformed in the past few years.

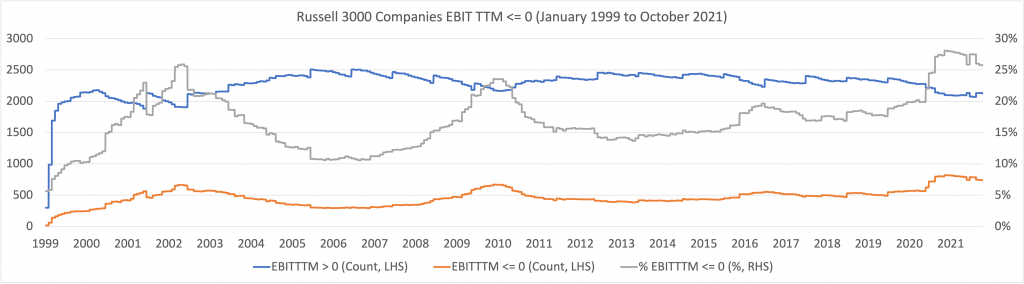

I ran the same test for all stocks in the U.S. in the Russell 3000 using trailing twelve month operating income (EBIT).

The blue line shows the number of stocks with positive (EBIT) operating income over the last twelve months (the money makers). The orange line shows the number of stocks with negative or no EBIT over the last twelve months (the money losers).

The grey line shows the proportion of negative operating income (the money losers) to positive operating income (the money makers).

There are three clear cyclical peaks for money losers–2002, 2009, and 2020–all the ends of infamous bears. It’s a good time to be a value investor.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: