This week’s best investing news:

How Bill Ackman Finds His Targets (Validea)

Panic Series (Pt. III) – 1825 (Jamie Catherwood)

A Macro View of Factors (Verdad)

Mistakes were made (I did a dumb thing) (Neckar)

How Warren Buffett Rewards Berkshire’s Managers For Using Less Capital (#21) (Watchlist)

Let’s Keep Humans At The Heart Of Hiring Practices (Vitaliy Katsenelson)

Zeroism and the Allocator Status Quo (Epsilon)

Great Expectations (Humble Dollar)

Jumping the SPAC (Scott Galloway)

Climate Change, Cow Burps, and ZELP (Collaborative)

That’s the point of being active (Klement)

181: Mark Leonard, Software Base Rates (Liberty)

Changing your mind (DGI)

“Culture As An Asset” (GMM)

It’s Time to Break the Debt Ceiling (PragCap)

Why active managers face a tough end to the year (EB Investor)

What’s Next For Apple and Tim Cook (Brian Langis)

How the “Buy the Dip” Generation Came to Be (Compound Advisors)

Dividend Stock Bubble: Is It Even Possible? (DGS)

Is That A Light At The End Of The Inflation Tunnel? (Brinker)

NFTs as financial assets, status, identity, community and fun (Tanay)

Is China Investable (MS)

Does Guru Investing Work? (CFA)

This week’s Superinvestor News

Part 2: What to Do in the Case of Sustained Inflation (GMO)

Cathie Wood Pumps And Dumps Tesla (WTI)

AQR hedge fund suffers $10bn in outflows (FT)

Jim Chanos on Chinese economic model (CNBC)

First Eagle: Views from Global Value Team (FEIM)

Jeffrey Gundlach on Govt, Spending, Inflation & the Dollar (DDMB)

Ray Dalio on Evergrande, China, Bitcoin and the Fed (Bloomberg)

How Billionaire Steve Cohen Learned to Love Cryptocurrencies (Bloomberg)

Ken Fisher Discusses Why Most Investors Misunderstand Quantitative Easing (Fisher)

There are many ‘orphan discount stocks’: Ariel’s co-CEO Rogers (CNBC)

This week’s best value Investing news:

Cathie Wood, Rob Arnott and Why Value vs. Growth Is the Wrong Topic to Debate (Barron’s)

Value Investing: An Examination of the 1,000 Largest Firms (Alpha Architect)

Value Trap or Opportunity? PART 1 (ValueWalk)

Growth? Value? Some investors opt for a bit of both (Reuters)

Wall Street tech stocks running out of steam; value stocks could take centre stage now (Fin Express)

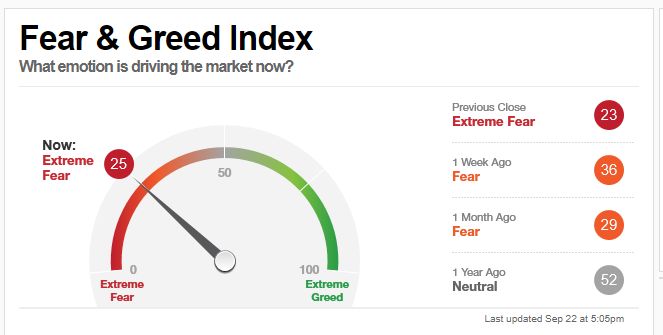

This week’s Fear & Greed Index:

Extreme Fear.

This week’s best investing podcasts:

Tobias Carlisle — Philosophy of the Markets (EP.66) (Infinite Loops)

David Fialkow – Paint Outside the Lines (Invest Like The Best)

#120 Chris Bosh: Hunger and Greatness (Knowledge Project)

What to Expect from Vanguard and the Stock Market (Morningstar)

Rui Ma – Talking China (Business Brew)

Episode #352: James Rasteh, Coast Capital, “The World Is Running Out Of Gold” (Meb Faber)

S2E2: Labor Shortages | Don’t Miss the Big Ideas in Investing (MOI)

Ep. 193 – A Deeper Look at Financials with Derek Pilecki (Planet MicroCap)

A Replication Crisis and a Housing Crisis (EP.168) (Rational Reminder)

Shreekkanth Viswanathan: Finding Great Businesses Outside The US (Value Hive)

TIP380: A Holistic Approach w/ David Schawel (TIP)

The Markets Today: Substantial New Risks [2021] (WealthTrack)

Bitcoin in Macro Land (What Goes Up)

S11 E8: Goldman Sachs’ David J. Kostin on Profit Margins, Duration and ESG (Sherman)

Campbell Harvey (MIB)

Chase Sheridan ’06 and Will Pan – The Art of Fund Management (VIL)

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Crowding and Factor Premiums (AlphaArchitect)

Short-Term Bears Are Expendable (PAL)

Bitcoin’s Bear Trap (AllStarCharts)

Are Stock Markets Becoming More Correlated? (AllAboutAlpha)

This week’s best investing tweet:

This week’s best investing graphic:

This Simple Chart Reveals the Distribution Of Global Wealth (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: