This week’s best investing news:

Regulatory Nightmares (Jamie Catherwood)

Are Financial Crises Predictable? (Verdad)

How a Narrative Goes Viral (Epsilon Theory)

Where There’s Fire There’s Smoke (Felder)

Are Equities an Inflation Hedge? (Validea)

Wall Street Will Keep Getting Good Talent: Leon Cooperman (Bloomberg)

Shut Up and Wait (Safal Niveshak)

Warren Buffett Calls It Right on EV Batteries (Bloomberg)

CMQ021: Why Chasing Past Performance Is Hazardous to Your Wealth (CMQ)

How F*cked Is Business Travel? (Barry Ritholz)

GMO: Valuation Metrics In Emerging Debt 2Q 2020 (GMO)

Berkshire Reports Strong Earnings, Boosted by Manufacturing and Buybacks (Barron’s)

Short-termism and momentum investing (Klement)

How Millennial Investors Lost Millions on Bill Ackman’s SPAC (Institutional Investor)

Ray Dalio remains a China bull (WTI)

Full interview with Ariel Investments’ Charlie Bobrinskoy (CNBC)

My Peloton (Howard Lindzon)

Dan Rasmussen – Inside The Coronavirus Haul Of A Wall Street Whiz Kid (Forbes)

Apple’s Mistake (Stratechery)

This Time is Different (Novel Investor)

The creator economy is in crisis. Now let’s fix it (Li)

New to the investment industry? Eight things you must follow (Real Returns)

Investing in Helium (Andreessen Horowitz)

Turning Japanese (HumbleDollar)

The Month Of May Gets A Bad Rap (Brinker)

Factor drift: what it is and how to tackle it (EB Investor)

Sinking Ark: What a star US investor’s predicament tells us about this market (SMH)

167: Jeff Bezos 2004, VR & Gaming, Apple, The Trade Desk + Connected TV, Differentiated Pricing, (Liberty)

How Much Has the Market Benefited from Investor Optimism? (Morningstar)

How Amazon Works (Tanay)

Stock Dividends – The Gift of Nothing (DGS)

Where To Look As A Value Investor – Bruce Greenwald (WS Investor)

Chris Davis – Semi-Annual Review 2021 (Clipper)

First Eagle – Views from Global Value Team (FEIM)

Royce Semiannual Letter: As the Economy Accelerates, the Market Loses Steam (Royce)

Berkshire Hathaway Q2 2021 Report (Berkshire Hathaway)

Third Point Second Quarter 2021 Investor Letter (Third Point)

This week’s best value Investing news:

The Opening Ceremony of the Value Recovery (Oakmark)

Value Investing and the Role of Intangibles (Alpha Architect)

Investing Like Ben Graham (Forbes)

Value stocks safeguard portfolio against inflation (AFR)

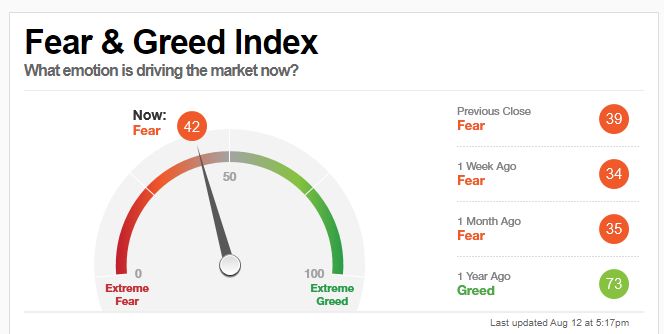

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Stanley Druckenmiller on What Makes a Great Investor, Bitcoin & His Biggest Trades (My First Million)

Omri Velvart: Value Investing At The Age of Acceleration (Value Hive)

Combining Growth and Momentum Investing with O’Neil Global’s Randy Watts and WisdomTree’s Jeremy Schwartz (Excess Returns)

#117 Kat Cole: The Power of Possible (Knowledge Project)

Sridhar Ramaswamy – The Past, Present, and Future of Search (Invest Like The Best)

329- From the Vault: Investing in Commodities (InvestED)

TIP367: The Current Macro Landscape w/ Luke Gromen (TIP)

Episode #339: George Davis, Hotchkis & Wiley, “We’re In Unchartered Territory Right Now” (Meb Faber)

Greg Jensen – Bridgewater Associates (Manager Meetings, EP.06) (Capital Allocators)

Ep. 187 – Real Estate: It’s Not 2008, But Let’s Talk with Jason Greenwald (Planet MicroCap)

Shorting Bubbles with Low Moats (Zer0esTV)

Russell Korgaonkar – Optimizing the Research Process (S4E15) (Flirting with Models)

Sandy Rattray on Strategic Risk Management (MIB)

‘Currency War’ with Lawrence Lindsey (Stansberry)

Michael Munger on Free Markets (EconTalk)

The great startup delusion (Grant’s)

Massimo Marinelli — Premier League Economics & Sports Investing (EP.60) (Infinite Loops)

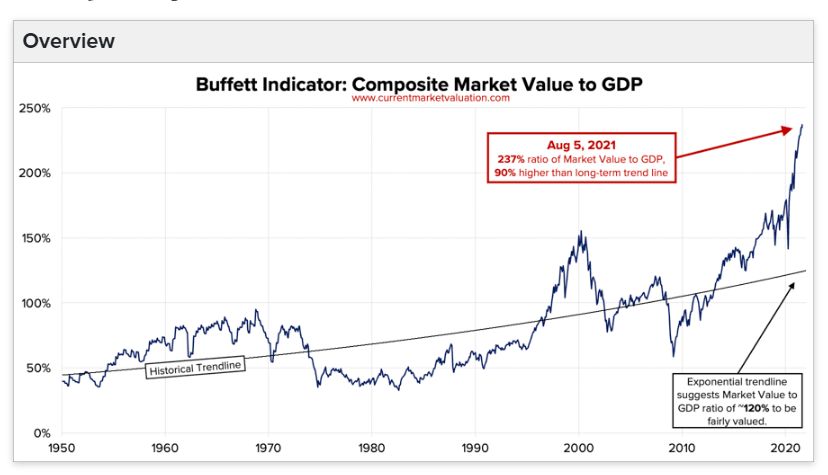

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

Relative Sentiment and Market Returns (AlphaArchitect)

Fama- French factors – The easy money has been exploited (DSGMV)

Searching for the next Swensen (All About Alpha)

Is the Alt Season Emerging? (AllStarCharts)

Meme Stocks and Systematic Risk (CFA)

Long/Short With Extreme Overbought/Oversold Equities (PAL)

This week’s best investing tweet:

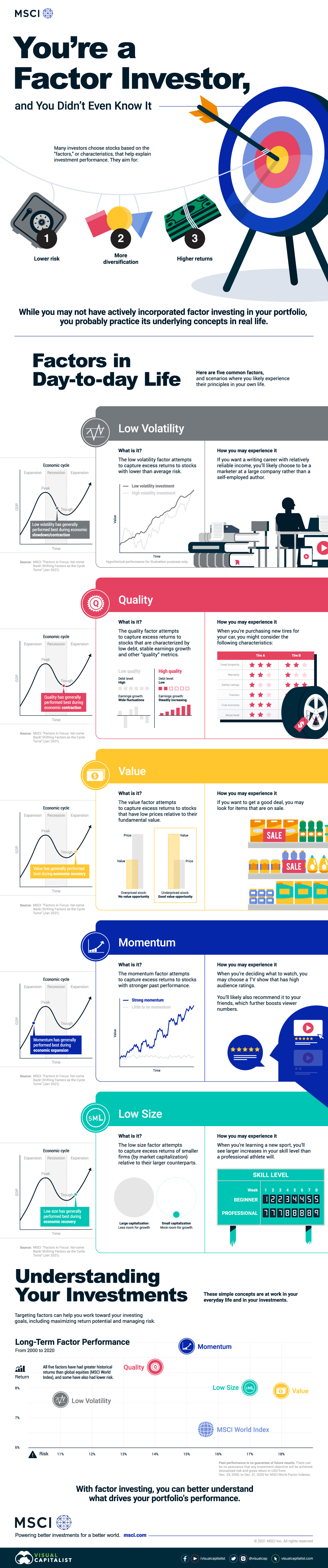

This week’s best investing graphic:

How Factor Investing Works, Using Everyday Examples (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: