Here’s a list of this week’s best investing news:

The Best Macro Indicator (Verdad)

Fierce Nerds (Paul Graham)

Fear is the mind-killer: secular growth stocks are becoming increasingly attractive (Gavin Baker)

2021 Virtual Value Investing Conference | Conversation with Tweedy, Browne (Ivey)

Why the Apple Store Will Fail… (Barry Ritholz)

Mauboussin: The Economics of Customer Businesses (MS)

Howard Marks Laments ‘Not Having Great Things to Buy’ Amid Low Distress (Yahoo)

Bill Miller Roars Back with Amazon and Bitcoin (Validea)

Wise Words from Lou Simpson (Novel Investor)

Refining Our Dividend Value Approach (Royce)

OakTree: Performing Credit Quarterly (OakTree)

2021 Student Investment Fund Annual Meeting Keynote by Stanley Druckenmiller (Vimeo)

An Epic Set Of ‘Alligator Jaws’ (Felder)

Medallion Fund: The Ultimate Counterexample? (Cornell)

Bullish, Bearish, Expensive, Cheap (Epsilon Theory)

S&P 500 CAPE ratio says the US index is in an epic bubble (UK Value)

The Optimal Amount of Hassle (Collaborative Fund)

A Marwari Mental Model to Make Quick Decisions in Life and Investing (Safal Niveshak)

The Golden Age for Bonds Is Over (Compound Advisors)

U.S. Approaches Adult Herd Immunity (GMM)

Distribution and Demand (Stratechery)

The Case Against Bitcoin (Bari Weiss)

Pzena Highlighted Holding – Michelin (Pzena)

How can we explain momentum returns? (Larry Swedroe)

Is Forecasting Futile? (DGI)

How investors make their forecasts (Klement)

The Draw Of The 200 Day Moving Average (Howard Lindzon)

Options Trading for Value Investors (OSV)

Ian Cassel on Micro-Cap Investing and Discovering Long-Term Compounders (Premium) (MOI

Dividend Investors Should Focus On Stocks, Not The Market (DGS)

Getting Back to Zero – Well, Sort of (Brinker)

The Founder Strikes Back (Greenwood)

Advice for Young Scientists—and Curious People in General (Farnam Street)

GMO Q1 2021 Letter (GMO)

Tobias’ Daily Book Quotes & Latest News On Instagram

Get daily quotes from Tobias Carlisle’s best selling books, plus video clips and latest updates on Instagram here: instagram.com/acquirersx/

This week’s best value investing news:

Are Ben Graham’s Disciples Value and Quality Factor Investors? (Alpha Architect)

Why the current value rotation will enjoy a long runway (Hosking Partners)

Spring Has Sprung For Value Investors (Robeco)

Value’s Turn: Eerie Parallels To 1999 (GMO)

“Room to Run” with US Small-Cap Value Stocks? (Bridgeway)

The Big Shift To Value Investing (investing.com)

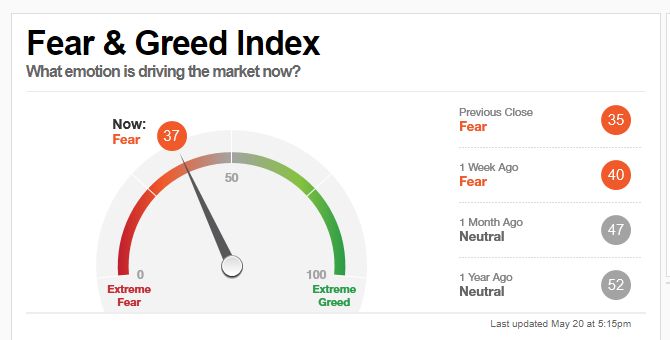

This week’s Fear & Greed Index:

This week’s best investing research:

To Invest Internationally, or Not — That Is the Question (CFA)

Currency investing, mean-reversion of real effective exchange rates (REER), and portfolio flows (DSGMV)

Crypto Crashes. Now What? (All Star Charts)

Inflation could be 20% in the next three years: Wharton’s Jeremy Siegel (CNBC)

This Typically Occurs At The End Of Expansions (UPFINA)

“Ephemeral Inflation (Macro Tourist)

A Good Market Timer is the Best Passive Investor (PAL)

Implementing a Data Strategy for Private Markets (All About Alpha)

Always Watching (Slack)

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

Joel Greenblatt: Investing Made Simple (The Knowledge Project)

Deep value quantitative investing, podcast with Tobias Carlisle (Rask)

Daniel Kahneman on Behavioral Economics (Podcast) (MIB)

Episode #313: Rob Arnott (Meb Faber)

Brian Feroldi – Man or Machine?! (Business Brew)

The Ultimate Inflation Hedge (EP.150) (Rational Reminder)

Equity-Like Returns With Less Than Stock Market Risk (WealthTrack)

TIP349: Why You Should Be Investing In Art Shares w/ Scott Lynn (TIP)

Persistence of Market Cap Leaders Over Time | Inflation: Transitory or Not? (Intelligent Investing)

Brent Beshore – Learnings from a Year of Unexpected Events (Invest Like The Best)

Ep. 175 – How to Actively Seek Out Why My Thesis is Wrong (PlanetMicroCap)

The Utility of ESG Scores in the Investment Process (Pzena)

317- The Best Munger Quotes! (InvestED)

How Should You Approach Your Withdrawal Rates? (Morningstar)

Cameron and Tyler Winklevoss (Coffee with the Greats)

Top TSLA Bear Arguments w/ Emmet Peppers (Ep. 347) (Dave Lee)

A Safety First Approach to Retirement Planning and the Problems with the 4% Rule with Wade Pfau (Excess Returns)

Dan Ariely – The Human Capital Factor (Capital Allocators, EP.195) (Capital Allocators)

Tren Griffin — Flipping The Script (EP.48) (Infinite Loops)

EP 311. Analyzing and Investing in Holding Companies (Focused Compounding)

David Fauchier – Paranoid Crypto Cowboys (S4E3) (Flirting with Models)

Donald Kohn & James Lebenthal (Behind The Markets)

This week’s best investing graphic:

The Bitcoin Crash of 2021 Compared to Past Sell-Offs (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: