Here’s a list of this week’s best investing news:

Taxing Speculation (Jamie Catherwood)

Do Treasuries Still Work? (Verdad)

Investing At The Later Stage (Collaborative Fund)

Legendary Value Manager Charles de Vaulx Found Dead (Barron’s)

What The Boom In Fraud Says About The Current Market Environment, Part Deux (Felder)

Nassim Taleb calls bitcoin an ‘open Ponzi scheme’ (CNBC)

Spawners 101 – Mohnish Pabrai’s Fifth Way of Finding Multi-Baggers (Canadian Value)

Famed Investor Bill Miller Is Roaring Back With Amazon, Bitcoin, and GM (Barron’s)

Blowout earnings from Alphabet and Facebook (Whitney Tilson)

How to Minimize Shocks from the Unknowns and Unknowables of Life (Safal Niveshak)

Jason Zweig on the risks of emotional investing (CNBC)

Constellation Software’s next step: expansion through larger takeovers (Globe & Mail)

The Hot-Hand Fallacy Fallacy Fallacy? (Albert Bridge)

$4 Trillion Economic Stimulus (Barry Ritholz)

Why even Buffett has been buffeted by the index (EB Investor)

The Scarcity of Money Myth (PragCap)

Dow 36,000? Dow 148,000? (Brinker)

2021 Virtual Value Investing Conference | Keynote Speaker: James Grant (Ivey)

Transcript: Jack Brennan (MIB)

Straight Talk (Humble Dollar)

In Praise of Bitcoin (Epsilon Theory)

What happens when SPAC deals start failing? (YAVB)

A “Toolbox” View on Long/Short Equity (Weitz)

The Ones That Got Away… (DGI)

Just In Case You Think The Fed Has A Clue (GMM)

New Lessons from Market History: Sometimes Bonds Win (ssrn)

Investing in Greenlight (Andreessen Horowitz)

Dan Loeb Outperforms (WTI)

The Century Club (Woodlock House)

What is Your Investing Risk Score? (Howard Lindzon)

The Next Great Company (DGS)

Tomorrow’s News Today (Compound Advisors)

World Building and Antifragility (Alex Danco)

Running of the Bulls (Dr Ed)

Taleb MINI-LESSON, 2. Fat Tails, a Very, Very Introductory Presentation (NN Taleb)

Programmatic SEO, the long tail and customer acquisition (Tanay)

We don’t “need” inflation (Klement)

The Boyar Value Group 1st Quarter 2021 Client Letter (Boyar)

Laughing Water Q1 2021 (Laughing Water)

Horizon Kinetics Q1 2021 (Horizon Kinetics)

Meridian Fund Q1 2021 (Meridian Fund)

FPA Crescent Fund Q1 2021 (FPA)

This week’s best value investing news:

The Awakening of Value: The Lakonishok Strategy (Validea)

What is Value Investing? (Morningstar)

Value Stocks Paying 3+% Dividends: Yes, They Exist (Forbes)

Why Warren Buffett invested in Coca-Cola and its lesson (Yahoo)

Value investing: Is this the biggest opportunity since the tech bubble? (BNP Paribas)

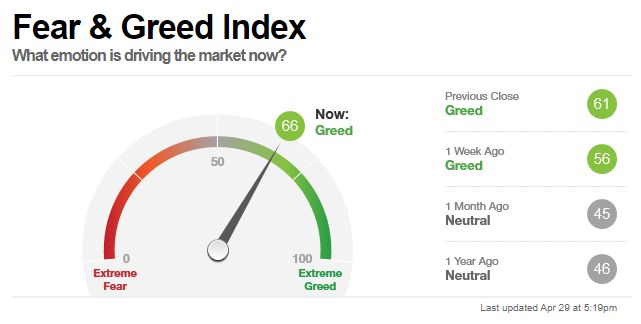

This week’s Fear & Greed Index:

This week’s best investing research:

Market Timing Using Aggregate Equity Allocation Signals (Alpha Architect)

The Outperformers (All Star Charts)

SPACs: An Uncorrelated Asset Class? (CFA Institute)

Break-evens vs real rate changes tell us about market regime (DSGMV)

The Amazing Small Edge of the Stock Market (PAL)

Expected Profit Margins Are Very High (UPFINA)

Culture Eats Sharpe Ratios for Breakfast (AllAboutAlpha)

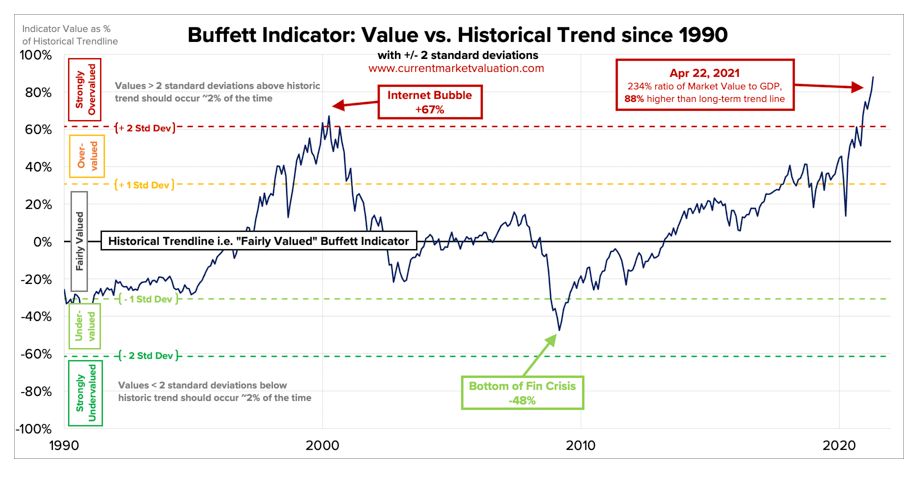

This week’s Buffett Indicator:

This week’s best investing tweet:

This week’s best investing podcasts:

TIP346: Masterclass in Valuation w/ Chris Bloomstran (TIP)

Josh Buckley – Identifying Legendary Start-ups (Invest Like the Best)

Jim Rogers (Real Vision)

Jesse Livermore – What Now? (EP.45) (Infinite Loops)

Emerging vs. Established Quality | Highest-Returning Stocks of the Past Decade (Intelligent Investing)

Jack Brennan on Succeeding the Legendary John Bogle (MIB)

Episode #306: Jeff Seder, EQB, “We Ended Up The First Triple Crown Winner In 37 Years” (Meb Faber)

New Currencies: Investor Implications (WealthTrack)

What’s Berkshire Hathaway Worth Today? (Morningstar)

Kyler Hasson: How To Not Get Bored Buying Quality Compounders (Value Hive)

Investing in Freedom in Emerging Markets with Perth Tolle, Founder of Life + Liberty Indexes (Excess Returns)

314- Don’t Fear Market Drops! (InvestED)

After the Meme-Stock Gold Rush (What Goes Up)

Carson Block’s Solutions 30 Follow Up (Zer0es TV)

Inflation vs. Reflation: Why Risk Asset Prices Hinge on the Difference (Real Vision)

Corey Hoffstein – More Than A Model; Idiot (Yes, that’s a Zoolander Reference) (Business Brew)

Warren Buffett and the “Money Mind” (Take 15)

Inflation Obsession (guest: Vincent Deluard) (Market Hurdle)

EP 309. Capital Allocation, 1975-1977: Buffett Buys Cypress, Waumbec, and K&W Products (Focused Compounding)

Brian Bares – Qualitative Concentration at BCM (Capital Allocators, EP.188) (Capital Allocators)

Where are the Lumber Trend Followers? (RCM)

CMQ Podcast: Warren Buffett’s Biggest Investing Mistakes (& Lessons Learned) (CMQ)

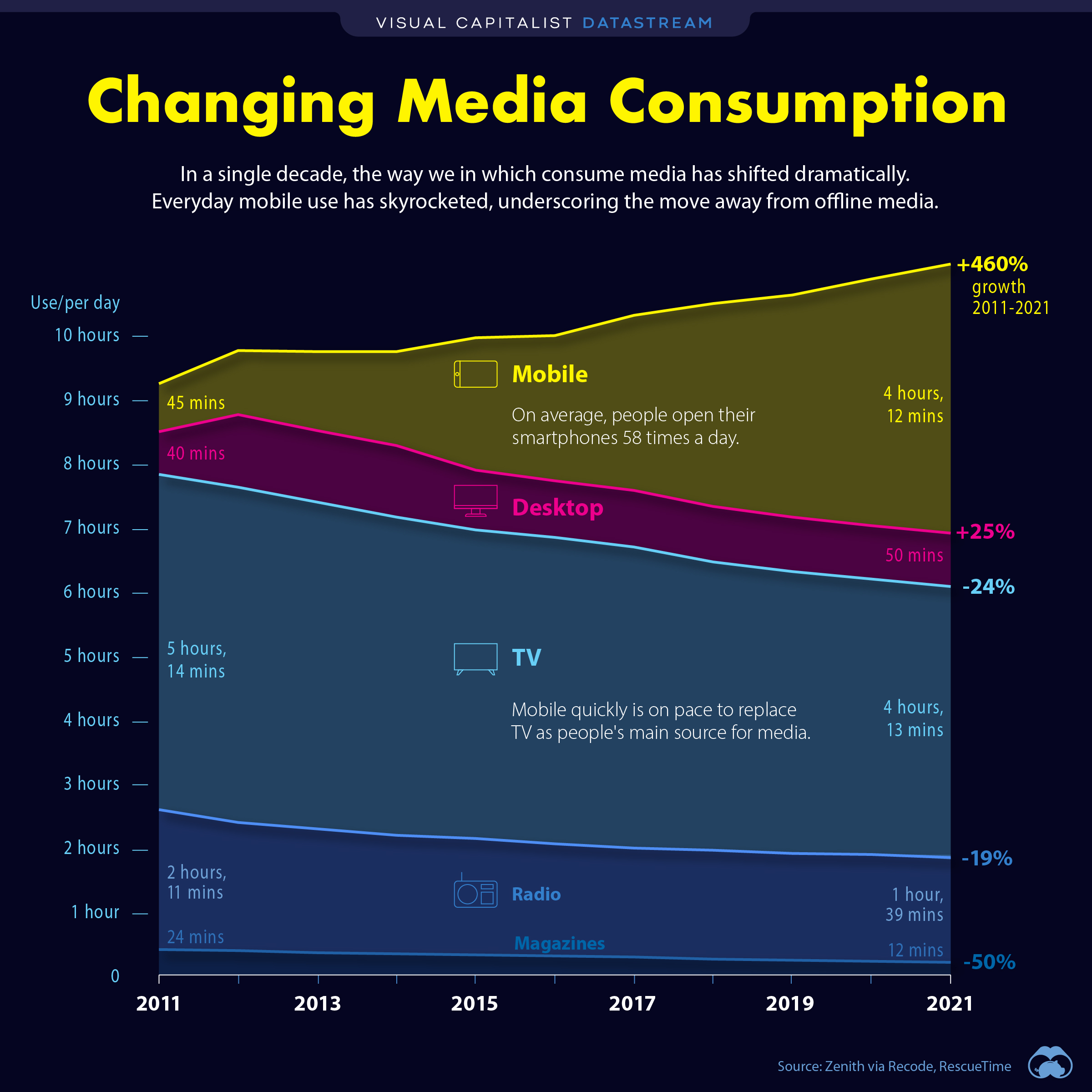

This week’s best investing graphic:

How Media Consumption Has Changed Over the Last Decade (2011-2021) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: