In his latest Q1 2021 Shareholder Letter, David Einhorn discusses the Fed, performance drag on the short side, what fuelled the GME short squeeze, and indications that the tide has turned from growth to value. Here’s an excerpt from the letter:

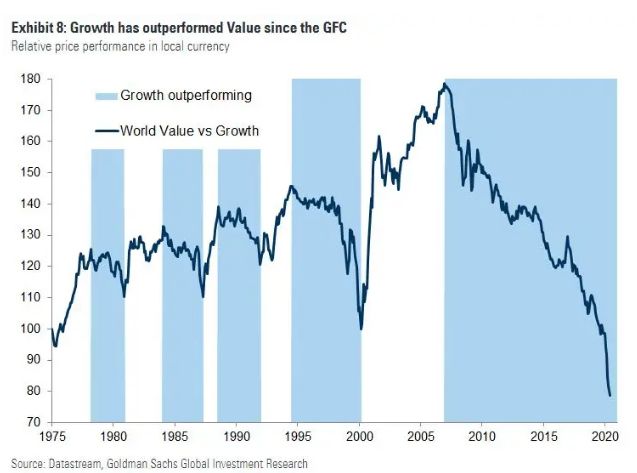

Has the tide turned from Growth to Value? After a very tough decade, we have only just begun a recovery as shown in this 45-year chart from Goldman Sachs research:

Part of the shift from growth to value may be coming from higher inflation and inflation expectations. As measured by the inflation swap market, 10-year inflation expectations fell from 2.9% in September 2012 to 0.8% in March 2020. The only significant intervening bounce came in 2016, when expectations jumped from 1.5% to 2.3%; notably, that was the only year in the last decade in which value outperformed growth. After bottoming in March 2020, inflation expectations have recovered to 2.5%. The trend became clearer in the middle of May, and value started outperforming growth then, and especially since the middle of February.

Since May 15, we have returned 80% of the S&P 500 index with half the net exposure. When the time comes, we will have to figure out how to perform better in deflationary periods. But for now, we believe inflation is only going one way – higher – and we are optimistic about our prospects. The wind is now at our backs.

The economy is in full recovery mode. Household balance sheets are stronger than they have been in a long time and household income growth was up 13% in February compared to last year. And this is before the latest $1.9 trillion – with a “T” – pandemic relief stimulus. Corporate capital spending is booming. There are shortages and bottlenecks everywhere. Last month nearly one million jobs returned. There are signs of an emerging labor shortage.

You can read the entire letter here:

Greenlight Capital Shareholder Letter Q1 2021

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: