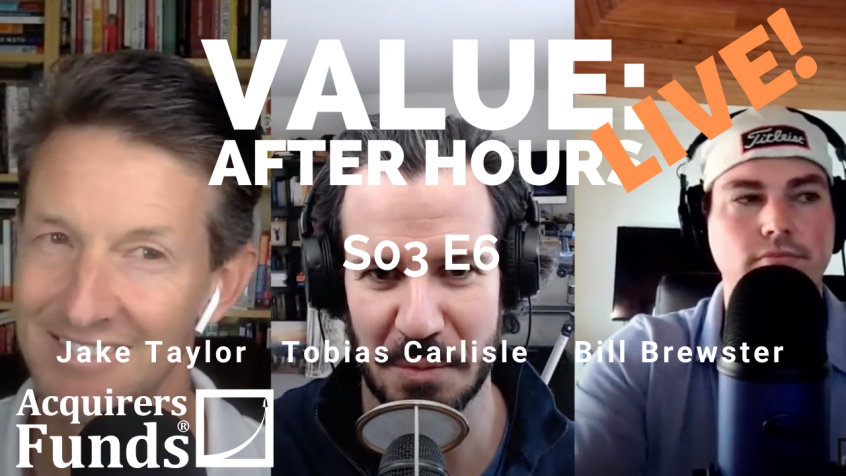

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about:

- $TSLA Buys $BTC

- ARK’s Presentation On The Future

- Musk vs Buffett

- Robinhood Should Invest In Customer Service

- The Best Way To Get Right Tail Is Not To Sell

- Undervalued Anthony Deden

- We’re Late Cycle

- David Gardner

- Cyclical Value Plays

- Covid Changed The Need For Office Space

- Stimi Punting On The Market

- The Link Between Inflation & Demographics

- Lacy Hunt

- Economist Russell Napier

- We Need A Bigger Boom

- Dividends – The Difference Between Positive And Negative Performance

- Video Games Recurring Income

- Look For Special Situations When The Market’s Expensive

You can find out more about the VALUE: After Hours Podcast here – VALUE: After Hours Podcast. You can also listen to the podcast on your favorite podcast platforms here:

Full Transcript

Tobias: Hello, folks. It is 10:30 AM on the West Coast, 1:30 PM on the East Coast. It’s 6:30 UTC, I’ll get it right in the tweet at some stage, maybe not next week, but fingers crossed. That means it’s 6:30 AM Australian Eastern Standard Time. If you’re awake, and you’re listening to us, hats off, good for you, you must have little kids. How are you, fellas?

Jake: [chuckles]

Bill: I’m all right. I got to start off the pod with a bit of an apology. I was listening to my rant, when I said, “However you pronounce his name,” I apologize for how that came off. That didn’t come off right to me when I heard it. I apologize to the listeners out there. My wife’s an immigrant. I’ve got an immigrant father-in-law that didn’t speak English when he came to this country. I understand how that stuff can sound and I’ve lived with some of it through her, so I do apologize for that. Other than that, I’ve had a good week other than a shit sandwich from Robinhood with the news, but, hey, everything else is great. Stocks are up. What’s new?

Jake: [laughs] Yeah, I’m doing well too. I’m back home now, obviously. That’s kind of bittersweet, but yeah, feeling a little recharged. A little bit of a repose after a long 2020 for, I think, most of us.

Tobias: You had that nice Zoom background, the nice Skype background, the blue content producer in the content house this– [crosstalk]

Jake: Yeah.

Bill: Yeah, that’s right.

Jake: That was better. You’re right. It’s also better to just go surfing right after the podcast as opposed to, I’m not sure what I’m going to do here. It’s gloomy outside. [laughs]

Tobias: Yeah. Welcome to California. What are we talking about today, fellas?

Bill: I was just thinking about how not that long ago, I was naked in a pool. You’re welcome for that folks, like literally 10 minutes ago. But it’s not heated, so that was cold.

Jake: Hmm. Well, shrinkage. I’ve got–

[laughter]Bill: It’s true.

Jake: I’ve got a little back-of-the-envelope math on ARK Big Ideas 2021 slide deck.

Tobias: Oh, good. That should be exciting.

Jake: We’ll see.

Bill: Is it possible for something that’s really small to shrink? I’m just asking for a friend.

Tobias: Of course. Micros can become– [crosstalk]

Bill: Here I come again, I’m not sure what I’m going to talk about. I’ve had a hectic week, so I apologize, guys, but we’ll riff on something.

Jake: What do you got, TC?

$TSLA Buys $BTC

Tobias: Yeah, I’m going to I’m going to do more of the no structure, no topic, although I did see Tesla bought bitcoin. I know that everybody’s sick and tired of hearing me rant on Tesla. What it will do is it will complicate their accounts further because they won’t be able to recognize any upside in bitcoin. They’ll have to write down any downside in bitcoin.

Any reasonable security analyst is going to have to back that out of their accounts, which should make them further indecipherable. I’ve just got a quick question for you guys. The ostensible reason that they’re doing this because they’re accepting payments in bitcoin. If you’re going to be hedging something like that, how would you go about hedging incoming bitcoin position?

Bill: Well, just taking a step back. If you’re going to accept bitcoin, I’m not sure why you need a bunch of bitcoin on your balance sheet.

Tobias: That’s my question. That’s the Texas hedge, where you just get longer the thing that you’re going to hit?

Bill: Yeah, so you just come out and say, we think bitcoin is going up, so we’re going to buy bitcoin.

Tobias: Yeah, that’s how I saw it too.

Jake: I can’t believe that bitcoin is a better use of funds than a takeover of Fiat [crosstalk] balance sheet.

Bill: Well, let’s just assume it is.

Tobias: They’re going after Fiat just in a different– [crosstalk]

Bill: This goes to the old like, “Well, why wouldn’t GameStop just buy shares in Amazon?” The thing I don’t understand is, if I’m a Tesla investor, and I like bitcoin, just go buy bitcoin. What the hell does Elon Musk buying bitcoin have to do for me? I think the answer really is that if he is the trendsetter on bitcoin, then other companies will start to flow funds to bitcoin because he’s deemed some visionary and therefore you get this perpetual sort of cycle going, which if you’re a bitcoin bull, I understand getting excited about that. But I only understand getting excited about it if you’re long bitcoin. If you’re long Tesla, I don’t understand why you would want this or care about this move.

Jake: I would say the best hedge if you wanted to try to hedge this for Tesla would be Elon’s Twitter account and you pump before the end of a quarter, you pump– whenever there’s going to be an accounting, you start pumping.

—

We’re Late Cycle

Bill: Yeah, I said I didn’t have anything to say today, but I really do. This exact topic dovetails into what I’ve been thinking about for two days now. I just think that it is probably always been true that visionary leaders get idolized in a way that other people don’t. What I see going on with people that are VCs on Twitter that are like– If I was a VC and I was early on Robinhood, I would take that off of my profile. That’s how embarrassed I would be. Yeah, you’re going to have the money, I get that. But you’re proud of that right now? That’s disgusting.

They have such problems at the core of that business, I don’t understand being proud of that. If you’re Elon Musk, you’re pumping whatever the heck that’s called, Dogecoin or whatever. I get that it’s funny. I guess that meme is a mockery of the economy and whatnot, but you’re talking about a guy who objectively had securities manipulation with a lie of a levered buyout, and now is pumping cryptocurrency while he’s buying in his company, where the fuck is the SEC and what are our agencies doing?

Chamath is out there allegedly taking a company public via SPAC and not disclosing that they had a DOJ investigation. Where in the hell are we as a society? I think the answer is late cycle. I’m going to officially say that we have moved past the third innings. I don’t know what inning we’re in.

Tobias: How close are we–? [crosstalk]

Bill: I don’t know, but my boy that trades baseball cards is literally forexing his baseball cards in six months and laughing as he’s selling them to people. I’m getting inbound texts saying, “I’m sending this to some sucker in Kansas.” The classic car market, ripping. All these crazy cryptocurrencies, ripping. Anything speculative, anything with a story is ripping. The idea that this is fundamentals is insanity. I don’t know where we’re at. I don’t know if all of this– let’s say that people just take sane pills for a second. I don’t know how that filters through the rest of the evaluations. I think that if reflexivity works one way, you can argue it works the other. I don’t know what the hell to do with this information. It’s why I think Druckenmiller says go 25, 25, 25, 25 on cash, bonds, gold and stocks [crosstalk] confused.

Tobias: You just don’t know, yeah.

Bill: This is crazy.

Tobias: Well, nobody wants all cash.

Bill: I don’t know where our government agencies are. Where are our government agencies? Do something.

Tobias: They’re pumping it.

Bill: Anyway, that’s my topic for the week, and I’m out.

Jake: How about a board of directors too? What are they doing? What’s Tesla’s board of directors doing?

Bill: Look, there’s a couple companies, I think, that have bought bitcoin, and one was really early on it, but the guy’s honest about it. The answer isn’t, “Well, we might start to take payment in bitcoin. Therefore, we went out and bought bitcoin.” He just said, “I think I’m bullish on bitcoin, so I’m buying it.” At least the shareholders– maybe Tesla shareholders know, and maybe some people, it’s a Berkshire to them. It’s a holding company run by a genius, and I could care less what he does. I get that, but I don’t understand as an investor, why that would be something that you would like, because you can just go buy it yourself.

Tobias: I think that explanation is the right one. Well, I’ve got I’ve got a little comment up on the screen that said, “If companies use bitcoin for treasury cash, making payments in lieu of FX makes it a low-friction process than dealing with all the FX nonsense.” Possible–[crosstalk]

Bill: You’ve got to have international sales.

[chuckles]Tobias: They have some.

Bill: Not much. Maybe they will in the future. If you want to say that they’re using bitcoin as an intercompany FX hedge, that’s a cute argument. I think you’re forcing an explanation. I don’t think that’s reality at all. I think that’s like one step too smart.

—

Musk Or Buffett

Tobias: What about this view that Musk is this incredible industrialist that he’s Tesla’s Holding Company of all these different business lines and just buying some bitcoin is Buffett going and buying a big pile of silver? Did he buy that in Berkshire? Did he buy that in the PA?

Bill: He bought that in Berkshire, I think. Yeah, that was in Berkshire. Look, the difference is one of those guys knows how to generate cash. Oh, no, that’s not fair. PayPal was a legit success and continues to be.

Tobias: One of those guys is the richest man in the world. The other one is just on the ladder there.

Jake: Barely hanging on.

Bill: You know what? Just because the people think one is washed up old man, doesn’t mean that it’s true. Though he is a little past his prime. Shoutout to the Buff Dog, thanks for listening.

Tobias: I still hold some BRK. I picked up some on March 23 last year, pretty happy with that.

Bill: My biggest position right now. It’s back.

Tobias: Yeah, I’d own more of it if I could. Downside is close to zero there.

Bill: Look, I do understand owning an entity and saying, like, “I’m going to bet on this guy.” I get that. To the extent that that’s what people are doing with Tesla, fine. I just think it’s rich.

Tobias: That’s because you’re using fundamental metrics.

Jake: Yeah.

Bill: [laughs]

Jake: Well, it’s a parimutuel game. Even if you think that Buffett is inferior to Musk, what is the price implied? What are the odds that Musk is that much better? I would say that even if you think he’s heavy favorite, doesn’t mean it’s always the right way to bet.

Bill: Well, he’s younger. He’s got more runway. It’s hard to look at the greatest industrial company that’s been built over the smartest man’s lifetime trade at 550 billion and look at Tesla 800 billion and think it’s going to compound going forward. Maybe it will own all of the economy and all of industry. Who knows? Maybe that’s real.

Jake: I have some answers for that. Actually, ARK has some answers for that.

Tobias: That sounds like a good segue. I thought you’re going to say Bezos. Bezos has got to be the man, hasn’t he?

Bill: Yeah, that’s right. Sorry to my man, Shomik. Is it an homage[?], what is it?

Tobias: Offense?

Jake: Umbrage.

Bill: He wasn’t offended. He just was like, you guys way overly discounted Bezos in your conversation, which is fair, we were just talking to each other.

Jake: When did we say–?

Tobias: Do you mean in–?

Bill: No, that was Toby and I.

Tobias: I’m a Bezos fan.

Bill: Yeah, no, we didn’t speak negatively about Bezos.

Tobias: We just didn’t like him enough.

Bill: Correct.

Tobias: Okay. I prefer Buffett, but I like Bezos, too.

Jake: [laughs]

Robinhood Should Invest In Customer Service

Bill: Well, I don’t know who I prefer out of that. What I do know is the difference between Musk and Buffett, and a lot of what I see today that offends me, and Buffett and Munger, is Buffett and Munger have always talked down their stocks. They have tried to look out for the small guy and say– you can go back in history, they will say like, “We think our stock is a bit rich.” They’ll go back and they’ll say like, “I wouldn’t buy my stock,” and above– within this band.

They’ve tried to keep their stocks somewhat connected to fundamentals. There has been some legitimate trust between them and their minority shareholders. I think that what I find so offensive, and part of what gets me so mad about Robinhood too, is it’s like, Buffett and Munger if they were building Robinhood, and they thought they had a better mousetrap, you think that they would not have customer service reps? You think they would under-invest in customer service?

Or, do you think that they would build out an organization and scale the cost structure first so that they could actually ramp into the growth, and actually take care of their customers, rather than screwing over their customers and letting all of the externalities flow to society and then saying, “Oh, who could have foreseen?” No, you guys are pieces of shit and they are not and that’s the difference.

Jake: They’re not screwing over their customers though. Their customers are Citadel and their funds.

Bill: Yeah, that’s fair. For those that don’t know, I just found out this fact pattern from my cousin’s case. He got an email that said, “Please bring $170,000 in cash to the table.” He wrote back, “I think there’s been a mistake,” no one answered. Think about how much happened to people in GameStop last week. If you want to know why I was so concerned during last week? It’s because they don’t answer the phone. I can’t respect these VCs that back them and are proud of the investment that they made. The reason is I pray to Buffett and Munger. Those guys have made me what I am, and they would be disgusted by that.

Tobias: And he was 20. [crosstalk]

Bill: Yeah, and most of these consumers are young. I wish I could talk to Munger about that stuff. Oh, he would let it rip.

Jake: Well, we’ve got a chance coming up here at Daily Journal meeting.

Bill: No, he won’t do it in public. I mean, what a [unintelligible [00:15:38].

Jake: Uh, one on one.

Bill: In private, just off the record. That’s what I think that the core value investing to me, and maybe it’s unfair, but that’s why those guys are my church, just the way they go about it. I know that some of the things that they do is messed up, and I understand why people have problems with them. I get that they benefit from bailouts, and whatever. They’re not perfect, but I have never seen anything that’s made me think they don’t treat their minority shareholders the right way. I’d argue Markel is the same way. I think the guy’s ethos over there is very similar, and that’s why I defend those guys.

Undervalued Anthony Deden

Tobias: I saw a comment today, which I 100% agree with about Tony Deden saying that if you– because Tony Deden is another guy who’s in that class of guys like Buffett and Munger. There’s a group of guys out there, Markel, I probably put in that group too. They say, if you recognize what these guys are doing, and you recognize the way that they go about conducting their business, there is this little club in there who– and then they’re looking for other people like that. That’s the reason that I want to write the book, The Invincible Industrialist book, is because I think I’ve worked out– not that there’s any great secret to it, but I’ve just identified and I just think it’s an interesting approach to the market. You may not do as well as everybody else in this type of market, but you’re still going to be here in a decade, two decades, three decades, five decades, and that’s what I’m trying to achieve.

Bill: Dude, you’re going to die with honor. That may not matter to people anymore. Like I said, read The Snowball, if you want to read about his words, but that dude is always going to have a special place for me. They helped me become a man. These fucking promoters today disgust me. I don’t care about your bank account. A billion is not big enough? You’re sick, you got problems. You’ve got to post your own body on the internet? Get out of here, dude, or do it on Instagram. That’s insecure. That’s nothing to be proud of. That’s sick.

Jake: Couple things. One, in fairness to Elon, I think in 2018, he did say that his stock price had gotten too far ahead of itself.

Bill: Yeah, that’s true– [crosstalk]

Tobias: How long ago was that? It was more recent than that, wasn’t it?

Bill: Thank you for that. That’s a good comment.

Jake: Number two, I do think you’re right. Even if you were purely cold, hard calculation economic, taking the high road and having a good reputation is economically valuable. The deal flow that Buffett gets today is one of a kind because of that reputation, 50 years’ worth of doing the right thing and not screwing people over. Even if you were just very cynical and just economic calculus, it’s the right thing to do. On top of that, having a– dying with honor, as Bill would say.

Bill: Also, by the way, if you are going– I don’t know that these are true. I haven’t done my own research, but this is what the short sellers are saying. If you’re going to go out and say short sellers are unamerican, you better not take a SPAC public that’s under investigation by the DOJ and not disclose that. That’s some messed-up stuff. If the short sellers are wrong–

Tobias: I think they said it wasn’t material–[crosstalk]

Bill: -you should probably be able to sue them for libel.

Tobias: There’s some materiality thresholds with those what you disclose. You don’t have to disclose everything, you only have to disclose material things. I don’t know, necessarily that they’ve done that– [crosstalk]

Bill: You lukewarm about that?

Tobias: I’ve seen some commentary from someone who was a prosecutor who went through the short report, and they were pretty underwhelmed by the claims of the shorts in that instance. So, they thought it might have been a little bit aggressive, might have been active as short rather than– that’s me conveying somebody else’s views, so take it for what it’s worth it.

Bill: No, you’re a smart dude. No, you’re an attorney. I respect what you have to say there. See, this is good. This is why we all get along.

[laughter]Tobias: Let’s do ARK ETFs.

ARK’s Presentation On The Future

Jake: Okay. After a decade of sucking my thumb apparently, I’ve been working on having more right tail consciousness. Think about how things can go well, not just how things can go wrong. I’m trying to re-bias a little bit maybe towards appreciation to the right tail, which I think is a healthy thing to do if you’re a value guy who’s predisposed towards the left tail, like I am. I thought, well, let’s look who’s really been killing it with the right tail kind of thinking, especially raising money from a right tail thinking. ARK has just been insane the amount of money that they’ve hoovered up. They’re challenging Fidelitys and Black Rocks, and huge, huge institutional money that is just unbelievable. I think a lot of it is retail coming into ARK. I don’t know that for sure, but that’s my understanding.

Bill: Hello?

Jake: Bill’s on a lag here. They have a 2021 Big Ideas slide deck. It’s 112 slides, all about disruptive innovations that are coming. I go through it and there’s a ton of cool stuff in there. It’s AI chips, GPUs, augmented reality, electric vehicles, automation, ride-hailing, drones, satellites, hypersonic flight, 3D printing, gene therapy, oncology, like it’s all this stuff that’s super cool.

Tobias: Wasn’t that in the 1990s? Wasn’t that stull all in the future in the 1990s? Sorry, [crosstalk] didn’t mean to derail you.

Bill: To be fair, it might be here now. [crosstalk]

Tobias: It is all cool stuff.

Bill: Well, just real quick, she has been around since then. She may have followed these trends and thinks now is the time that the inflection point’s there. I mean, that’s fair.

Jake: Could be. Especially on a nonlinear trajectory, it looks like nothing at the beginning and then all of a sudden, it’s making huge strides. Anyway. I’m looking through this deck, and the first thing I notice is, they say the word ‘could’ 62 times in the deck. They’re just talking about, like, “Well, this could turn into this much.” ‘Believe’ is in there 40 times. Where, “They believe that this could happen.”

Tobias: That’s compliance.

Jake: Yeah, it’s compliance, but it’s also just how much of it hasn’t come to pass.

Tobias: Yeah, fair enough.

Jake: There’s a lot of assumption there. That’s fine, I guess, if you’re doing these projections, but I’m looking through and most of their timelines, they either put on 2025 or 2030. I thought– Well, just back of the envelope, I threw it all into a spreadsheet just to see all these cool technologies, what is the sort of TAMs that they’re talking about here that they expect? I added them all up, and this is just from the ones that they cited in their spreadsheet. We’re not talking about anything outside of this, but their TAM for 2025 for all of their disruptive technologies, $3.2 trillion. TAM for 2030, $6.6 trillion. I’m like, “Okay.”

Bill: That’s good growth.

Jake: That’s a fair amount of growth off of probably much, much smaller basis. They didn’t cite all of them where they started from, so I didn’t back into what’s the assumed CAGR of 2030. I did look to see, all right, 2020, what was the total revenue of the 18 largest tech companies? That ended up being $1.8 trillion. This includes Apple, Samsung, Foxconn, Google, Microsoft, Huawei, Dell, Intel, Facebook, Tencent. These are name-brand massive companies, huge revenues, all the growth rates that we would have never expected to materialize 10 years ago. That’s 1.8 5 trillion for all of those companies. To get to even by 2025 basically doubling that in disruptive, not just like, “Oh, well, Apple’s going to double revenue in the next five years or 10 years.” This is the disruption, which to me means like coming from out of nowhere.

Okay, well, I think that it’s illustrative to look at one of them in particular, and this is the ride-hailing one. I think it’s a super cool idea. It’s stupid that most of our cars sit for 90% of the time. It’s pretty wasteful, environmentally. If you could have on demand on your phone, a deep enough network where you just walked out and grabbed a ride and it was super cheap, especially because autonomous, like you took the human element out of it, all right, I can get into that. That’s cool. However, they’re projecting at $1 trillion per year profit pool for ride-hailing in 2030, $1 trillion.

Bill: Profit profit? Or, like revenue profit?

[chuckles]Jake: Net income.

Bill: Wow, that’s a lot.

Jake: I like look back at Uber and Lyft’s financials and I’m like, “Okay, nothing but red ink here. Something’s going to have to really hit a serious inflection point to get out of this hole.” I’m looking to it, okay, Apple, the last 15 years, they had arguably the greatest consumer product of all time. The iPhone, unequivocally just an absolute lightning in a bottle that they caught. Cumulatively for the last 15 years, Apple’s net income is just a little under $500 billion. That’s cumulative for 15 years of the best product, the best company, and we’re at half of what they’re saying is going to be available every single year from ride-hailing? [sighs] All right.

Tobias: That’s really limited thinking, Jake.

Jake: -I want to get there [crosstalk] cool stuff.

Bill: It’s software margins– [crosstalk]

Jake: Back of the envelope, I can’t even get in the neighborhood.

Bill: Look, I’m just being devil’s advocate. They’re talking about software margins. They’re going to talk about some tax, but profit seems high. I mean, you could maybe argue that’s like a 40% profit margin. I don’t know.

Tobias: What was the number? Was it a trillion?

Bill: I don’t even believe it.

Jake: A trillion-dollar profit on– I think they said like $6 to 7 trillion of revenue available TAM for ride-hailing.

Tobias: Is that every human being on a planet, 7 billion people spending?

Bill: Oh, I guess Oracle Brouhaha says, “I think that profit pool includes a lot of things like telecom, semis, ride-hailing, fleet maintenance, and OEM sales.” I guess it’s all a matter of definition.

Jake: Well, there’s going to have to be limited, limited competition in all of those to get you to a trillion dollars of leftover of producer surplus.

Tobias: What do we spend on cars globally? Like, what’s our transportation budget globally?

Jake: I don’t know the answer to that.

Bill: I don’t know either.

Tobias: Trillion dollars seems high. We’re going to start spending more on transport?

Bill: I don’t even know what a trillion is anymore. You’re talking about numbers that just make my brain say that, sounds like a lot.

Jake: Fugazi. [crosstalk] [laughs]

Bill: Yeah, Fugazi, indeed.

Jake: Well, anyway, the moral of the story here for me is, I want to get into this, I think it’s cool stuff. The numbers to me, I can’t get into the neighborhood still, even though I’m trying.

Bill: Analog chips. It’s a good thing to look at.

The Best Way To Get Right Tail Is Not To Sell

Tobias: This is a total left turn. As an investor, I think the best way to get the right tail is just to not sell.

Bill: Yeah, that’s fair.

David Gardner

Tobias: I think you try and find these things that are invincible, like limited downside, almost no chance of having a donut, and they earn extra returns on equity and they’ve got very fat margins that they can sustain. Then, you buy them when they stubbed their toe, and you hold on to them, and you just — it takes 20 years before you get to that point, and then having never touched them, that’s how you get the big right tail. It grows to some gigantic portion of your book, but that’s the only chance that you’re ever getting it. You buy a few of these every year and you just never sell them. I do think that’s one thing that I can take away from the Motley Fool gentlemen, which Gardner is it?

Bill: David.

Tobias: David. I finally found him on Twitter. He’s got a very small Twitter following. He may have recently joined.

Bill: Yeah, [crosstalk] underappreciated.

Tobias: There’s no blue checkmark either. I wasn’t sure whether it was him or not. Yeah, he’s worth following, I think.

Bill: Yeah, I mean, I don’t know the answers to these things.

Tobias: I don’t think it’s projecting [unintelligible [00:29:21].

Bill: I think you got to buy them small.

Tobias: Yeah, I don’t think you necessarily have to buy them small. I just don’t think that it’s really ever been people making these heroic projections ahead. Then positioning themselves to capture them. I think businesses that have been solidly delivering for extended periods of time, people just forget how good they are. Now, they get their heads turned because there’s a whole lot of shiny new stuff in the market. Or, we go through some sort of drawdown, and you get your opportunity to buy the good stuff and you just tuck that stuff away and you never touch it. It gets to the point where it just keeps on growing and that’s how you do it. That’s how Buffett has done it.

Bill: Yeah. Gardner, he looks for stuff that he really likes when people say that a stock is too expensive, that’s what he’s looking for. But then, he’s–

Jake: [crosstalk] -all kinds of opportunities.

[laughter]Bill: No, he does. I mean, he does. It’s true, but then I think what he does, and I would need to clarify this, but I don’t think he’ll add to loser. I think he buys higher. There is something to the winners win. That’s real, but I don’t know.

Tobias: At what timeframe? We’re talking different timeframes here. When you say winners win, this is like add something more to something that’s been working for a few years. Not like you bought it three months ago, you’re down, I’ll throw that one up. The one that’s up, that’s the winner. There’s a little bit more to than that.

Jake: I bought Amazon at $20, but I’m adding to it at $3000.

[laughter]Bill: Yeah, I bet the answer to that is that they would watch the business results. When the business results improve, that’s when they would buy more regardless of this. I almost don’t even know that company does much valuation work, which is maybe unfair. They may do 10 years out, this is where we think margins are and this is how we think it all falls out. I wouldn’t be shocked if that’s what goes on, but I don’t think that they do much valuation on today.

Tobias: Is he doing the same thing that Jake is talking about here where they just work out– This thing could be a $6 trillion– There could be $6 trillion in profit, we’re going to stick a sensible multiple in there, we’re going to stick like a 30-multiple on it ?

Bill: Yeah, I think they do.

Tobias: Is that in quadrillions now? Then you just DCF that back?

[crosstalk]Bill: I actually don’t think that’s that far off from that mentality. I guess that I would just say that both things can work. I just have a sense that one of those approaches right now has a lot fewer followers than the other, and I’m not sure that now is the time to be all galaxy brainy on the growth. I was talking to my boy, Francisco, today. I had a chat with Andrew Walker, inspired by your Acquirer’s Podcast, when he was talking about SPACs. SPAC mania. What Francisco had said to me is, much in the same way that I say I don’t want to turn my brain off to the overall market valuation or say the market’s too high, because I’m afraid, like, my brain will turn off. He was like, “Look, I don’t want to just like throw all SPACs out as a mania because one of these is going to find a company that’s not quite ripe to come public, didn’t make sense to go through the IPO process, but could find a good asset.” I think that he’s got a real point there.

But, oh, man, on average, that’s not going to work out very well right now. That’s how I think a lot of this growth stuff is not going to work too. Some of these are going to win. I don’t know which ones. I think right now everyone is looking in that exact same spot. That seems to be the tougher place to play to me. If you believe in zigging and zagging, seems like you’re just sprinting with everybody else right now. Running with the bulls, if you will.

[chuckles]Bill: Hey, [unintelligible [00:33:40].

Tobias: I’m an advocate of ignoring them. I talked about it last week. I sort of think of it as being distinct from what I’m doing in some sense, because I’ve already got my– the way that I’m shaped in the market, I’ve got my position long and short in the market.

Jake: [crosstalk] -bent over.

Tobias: [chuckles] That’s the way it is at the moment. [laughs] Yeah. I think about the market as being like– it’s just some sort of curiosity that’s there that I’m interested in watching it. Everybody knows now that I think it’s really expensive. Equally, you’ve got to be careful with that analysis, because you find yourself in a 2000-type scenario where unequivocally the market was as expensive as it’s ever been, 44 times on the CAPE.

At the same time, you had this unusually good crop of unusually undervalued companies and if you ignored the market and bought those undervalued companies, you had a few years just being long only where value went up while the rest of the market went down. I don’t know if that’s going to happen this time around because I don’t think they were quite as high quality and they seem to be a little bit stretched, but I still think that you’re better off– whatever’s going on in the market, you’re better off just ignoring it and focusing on your own little– Where do you think you have an edge, is it undervalued stuff, play there.

Jake: Yeah.

Bill: Anyway, all I’m saying is I like the idea of being– Something that we came up with is– and we, I mean, was just like, battered around on Twitter today. Let’s say the market is actually forecasting a really big economic expansion. Nat Stewart actually popped in and said, like– this isn’t genius, but it’s a smart thought too. “You’ve got to think about which stocks win in that environment.”

—

Cyclical Value Plays

Building this house that we’re looking at building, the cost of it, it’s not cheap, it’s not easy to get the labor right now. There is a huge pent-up demand. To the extent that housing is the economy, there’s a real argument for a boom to be made. I think that the stocks that are going to really win out of that are probably like these more cyclical value-y plays, as opposed to sort of what’s rich today. That’s how I think. We talked about the jaws all the time.

Tobias: Well, Home builders are cheap.

Bill: Yeah.

Tobias: Home builders are cheap, steel’s cheap. I think there’s a lot of cyclicals that are cheap.

Bill: Yeah, because that’s a good– I don’t know, that’s the thought that I’ve been having. I’m sorry if I got you in trouble with compliance. I’m an idiot.

Tobias: I’m not in trouble yet. [laughs]

Bill: All right. Well, then we won’t talk anymore.

Tobias: I will be in trouble soon.

Bill: No.

Covid Changed The Need For Office Space

Tobias: You’re fine. I think that part of the issue is that there’s some sort of movement going on. I don’t think that everybody is going to be going back to the office. If you run a business, HQ is expensive. It’s expensive having lots of people coming in and working in your office. You’ve got to pay for that floor plate plus their equipment. It’s much, much cheaper just to give them a computer and have them work from home. It turns out, everybody works much harder when you have them working from home because they don’t get to switch off for the commute. They don’t get to go out for drinks after work. They don’t talk to their compadres at work and waste time.

They’re just sort of bolted onto their terminal and working when they’re at home. That means that it’s going to be a lot more distributed work. Then, if you don’t have to live within commute of your office, you live anywhere that you want, all of a sudden, you want to be probably out in the burbs because the inner cities are looking a little bit scary at the moment. What does that do to house prices?

That makes people want to buy houses that are bigger and further away from the downtown office. I think that’s probably there’s a little bit of that going on at the moment I’ve seen, housing has exploded everywhere. Housing’s up as strong as it’s ever been, because people are like, “Well, if I’m going to be here 24 hours a day, I might as well live in a nice house. I don’t have to have it close to anything.” Buy some cheap land and put a nice house on it.

Bill: Yeah, I think that could be right. The other thing that I think is an interesting dynamic that we may have talked about before on this pod, but I was talking to a buddy where I moved from, and he was interviewing with a firm that was going to move him to Atlanta. He was like, “Well, can I just stay in Chicago rather than moving because my family’s here?” They said, like, “You can do whatever you want, but we’re paying you Atlanta prices.” It’d be interesting to see whether or not that sort of like, okay,–

Tobias: Facebook has done the same.

Bill: Well, you can live in a big city if you’d like, but you’re getting the [crosstalk] secondary or tertiary market pricing, that would be interesting to watch.

Tobias: I think they’ll set a price for the job, won’t they? It’s not going to be where you live. The consulting firms do that. Well, the consulting firms actually, they pay based on where you live, they do pay based on where you live, but I don’t see why they wouldn’t anymore. They say, “This is what the role pays. You live wherever you want to live.”

Bill: Yeah. I guess that’s that could be where we’re going, that would not be good for some of the blue states, generally speaking. Although–[crosstalk]

Tobias: We’ve definitely already seen it. There’s a huge move from Los Angeles and California to Austin and other secondary– Not that it’s a secondary market, just cheaper markets. I don’t think that people in Austin have particularly loved it because it’s pushed up the prices and there’s a lot of cars, there’s some homelessness and so on, but it’s sad for LA. I see everybody’s moving away. I lived in a building here when I first came in, and there were a dozen finance guys in that building, and there are two of us left in Los Angeles, everybody else’s left.

Bill: Yeah, that was my experience in Chicago. Some of that’s just that I became an old man and people raise kids elsewhere, but you look at the-

Tobias: That’s part of it.

Bill: -net migration, it’s not great. I really don’t know. All I know is there’s some crazy stuff going out there.

—

Tobias: There’s a lot of movement. There’s a huge amount of movement. I don’t know whether it’s COVID related, or whether it’s just about coming due because the tools are so much better. Zoom is fine. Skype is fine. You can just about do what you need to do. We’re like the last people doing a podcast on Skype. We might have to get a Zoom next time and broadcast it.

Bill: Why?

Tobias: Because everybody’s doing it. It’s the same way I invest.

Bill: I’m not going on Zoom. I’ll strike before I go to Zoom. I’ve got a bet.

Tobias: All right, we stay on Skype until you until your bet– [crosstalk]

Bill: Dude, you’ll go on Zoom, you’ll just see a big rat, like a blow-up rat. I’ll be on strike.

Tobias: When’s your bet run out?

Bill: Oh, it’s like two years from now, man.

Tobias: Oh, is that as long as that? Smart.

Bill: Yeah, it was a long-term bet. I don’t think Zoom’s any better than Skype from what I’ve seen. I would be open to moving to like a legit recording studio. But other than that, I think Skype and Zoom are pretty the same.

Tobias: You’re going to have to build one at your own house.

Bill: No. I meant like one that records locally, because sometimes we do get chopped up on the internet connection. The replay could probably be cleaner if we were on a different platform, but if some of the fans want to pay, then we’ll do it.

Tobias: [laughs]

Bill: Till then, we’re still trying to get this tootsie roll.

Jake: Yeah. One would think that with housing uncertainty, disruptive innovation up out the ass, all of this uncertainty, you would expect that you would demand maybe a little bit less Herculean valuations with so much uncertainty in the world.

Bill: Dude, you’ve got no alternative. What are you going to do? That’s the thing. If you have to generate income with your money, what do you do? You’re going to put it in bonds? Junk bonds are now below 4% or whatever, like the index, I read. You’re not going to put it in corporates. You can’t get it in treasuries.

Tobias: What do you buy? Altria.

Stimi Punting On The Market

Bill: Yes. Well, I have owned it. I feel a little sick. Also, it’s got good dividend yield and the stimi checks are coming, so people are probably going to end up buying cigarettes.

[chuckles]Bill: What happened in the pandemic–

Tobias: Didn’t they punt it? Didn’t they put it in the market?

Jake: Robinhood.

Bill: Uh, some did, yes. That’s true.

Tobias: It’s amazing–

Jake: [crosstalk] -got some questions.

Tobias: Shoot your questions in. It’s amazing the run that the market has been on since the vaccine came in, it’s funny that it’s hit– it’s not really been a reopening trade. It’s not like airlines have benefited from that. It’s been speculative stuff.

Bill: [crosstalk] The enterprise value of airlines, I think, is higher than it was going into the pandemic, so I think they may be have benefited. It’s just kind of a lot of debt.

Jake: Yeah, you got pushed to the back of the line if you were an equity holder before that.

Bill: I probably should have bought back in them, but I don’t really want to live that life again.

Tobias: What about cruise ships? I say the cruise ships are– they’re equally beaten up.

Bill: They’re not. Their enterprise values like the same too.

Tobias: Well, that’s right. The enterprise value is the same, that’s right.

Bill: I do think it’s funny, if people listen to my podcast tomorrow, I think we’re going to drop the Andrew Walker one, but they’re going to hear me say the exact same thing. I got mad at this guy for suggesting to my mother that she should buy cruise ships in March. First of all, the bailouts and whatnot were still not baked. Second of all, my mom doesn’t have the risk, the money to go gamble. One of the things I’m most proud about that Qurate trade is, I made my mom like 20 grand and that actually changes her life a little bit. That’s her financial situation. This guy’s saying buy cruise lines in March. I’m like, “You may need liquidity. You sell real estate. I don’t think that you should gamble not knowing what’s coming.” I maintain– [crosstalk]

Jake: Were they all out of scratchers at the–?

[chuckles] [crosstalk]Tobias: Probably.

Bill: That’s what I’m saying. I maintain that guy gave her bad advice. Long story short, the call was completely correct, and the cruise lines had definitely ripped. I’d argue he’s right for the wrong reasons. Even if he was right for the right reasons, that’s the wrong client, but I don’t give financial advice.

—

The Link Between Inflation & Demographics

Tobias: I’ve got a question. This is something I’ve been thinking about, too. I don’t really have a good answer, but I’m interested because I do think that a little bit of inflation. The two things that I’ve been watching, inflation has ticked up, inflation expectations are over 2%. Highest in the last five years. I think that’s– I have no idea how much the 10 year reflects the market and how much the 10 year is just the Fed with their foot on it, just controlling where they want it to go.

I honestly have no– I just don’t know, but 10 years now popped up over 1%. It was like 1.16% last time I looked or something like that, which is still historically very, very low, but it really got crushed in March 2020. I think it could have got down to like 60 bips or something like that, something crazy. It’s almost doubled from there. Do you guys have any view? Any thoughts on inflation? Are we going to see some?

Bill: Dude, we are seeing some.

Jake: [crosstalk] Lord Jesus.

Bill: Yeah, one of the reasons I like listening to Quote The Raven is, I love when that guy rails about inflation [crosstalk] really is true.

Tobias: What’s he saying?

Bill: He’s like, you’re looking at 5% to 10% cost inflation on anything that you actually like and need. Whether it’s healthcare, or your housing, your HOA fees. It does feel like yes, I can buy a cheaper television, but anything that other people want– if you’re playing on anything that wealthy people buy, whether that’s concert experiences– I guess plane tickets seem to just get competed away. But anything that can capture any of the value, the prices are going through the roof. Lumber, look at the price of lumber, it’s crazy.

Tobias: Yeah.

Bill: Cars. Think about how much a car used to– I get hedonic adjustments and whatnot, but you can’t buy an entry-level car, for anything close to what you used to be able to buy an entry-level car and have it be meaningful. Then, by the way, when you crash it, it’s going straight to Copart. Now, your insurance goes up, because they’re so expensive to fix. It’s crazy.

Jake: Here’s one take that I haven’t heard a whole lot, but I think it might be interesting. I would say that it’s possible that there’s a dead band, where we wouldn’t see any inflation. What I mean by that is, if we got 4%, I would say it would take us right to 10% because the velocity would pick up so much with the expectation changes, the psychology changes.

If we actually started to see it, it’s going to come harder than what you would expect just purely because of the reflexivity of the psychology. I’m not sure anyone’s ready for 10% and treasuries at 5% or 6%. Do we have the will in any leadership position to actually raise rates again up to a 6%, 8%, 10%? I don’t see Volcker around anywhere in my estimation.

Bill: Do we have the political will to actually close the wealth gap by pushing it some of the pain to the rich, and maybe some of that flows down to the board? No, we don’t have that. That’s been demonstrated for a while now.

Jake: Hard pass.

Bill: Yeah. You mean, a scenario where the economy does well, and the stock market doesn’t? No, we don’t have that. That’s not America anymore.

Tobias: Is this something sort of inevitable about it in the sense that Japan which has the oldest population got their first to the zero bound with no inflation that they measure, that they can find– just can’t find any inflation anywhere, the economists. And then Europe is comparably getting there, and Europe’s now done the same thing, like, negative interest rates, no inflation as far as anybody can see. The US had the youngest population of the bigger economic areas and now the US is getting there, too. Is it just an inevitability that as the population ages, you get negative interest rates and low inflation?

Bill: I don’t know. Somebody smarter than me– What’s Value Stock Geek think? I bet Value Stock Geek knows the thing. Also, shoutout to Corey Hoffstein. What’s up, man? And boy, Mike NonGAAP is on here, hey, to you, too. Everybody, hello. Hello, all the fans. Hello, how are you? We love you.

[laughter]Tobias: All 10 of you.

Jake: Jesus.

Bill: And time. Shit, what was I saying?

Tobias: Inflation.

Bill: Ah, I lost it.

Tobias: Something about inflation.

Bill: Oh, yeah. I do think that there’s potentially more political will for onboarding now and if you sort of onshore some of manufacturing and then housing heats up in the way that we’re talking about, I can see a credible case for inflation coming back. I think that you need to keep letting– like, net immigration, I think we need to continue to let in for this scenario to play out. I do think you need to have your population growing over time and having young labor. There’s that. This is Marcelo P. Lima’s, he talks about this a lot. Is tech just so deflationary, that you can’t have inflation again? Maybe, but I think–

Jake: That’s Jeff Booth’s argument, too.

Bill: No, Marcelo invented it.

Jake: Uh, I don’t know, maybe.

Bill: [laughs] I don’t know. I’m just crediting who I’ve seen made it. It’s not my own thought.

Tobias: Here we go. VSG says, “There’s a link between demographics and inflation. Demographics tend to drive velocity.” Velocity’s fallen off a cliff. What’s that about?

Bill: Yeah, well, what now or–? [crosstalk]

Tobias: This is value guys talking macro. We’re way of off our skis.

Jake: Next.

Bill: Well, if the wealth gap increases, there’s only so much the rich can spend. wouldn’t it be a logical conclusion that as the rich exceed the amount that they’re willing to spend that velocity in aggregate would slow? Whereas if those dollars were going to people that actually needed them and could actually use the dollars, velocity could actually speed up? This is why I think– Real Vision did something with the guy. I don’t know, but he was always deflationary, and he just flipped to inflation because he’s like, “This is the first time that we’re going to start putting checks in people’s–

Lacy Hunt

Jake: Lacy Hunt.

Bill: Is Lacy Hunt on the inflation train?

Jake: Thinks, not 100%.

Tobias: What’s he going to do?

Jake: I thought it was– Was it Van Hoisington?

Tobias: What’s he going to do?

Economist Russell Napier

Bill: It wasn’t them. I would have remembered. I think it’s a European guy. Anyway. Yeah, I think that you put money in people’s hands and spend it, and then you’ll see velocity go up. I just think the rich have–

Jake: It might have been Russell Napier, now that I think about it.

Bill: Yes. Correct.

Tobias: Is he the [unintelligible [00:52:28] I see horsemen. Is that Russell Napier? No.

Jake: No. He is a Scottish economist.

Tobias: Just one those accents.

Bill: Somebody earlier said that I was getting a little too heated. If you want to know why I get heated about Robinhood, go to my Twitter feed right now. It’s @Bill BrewsterSCG and you’ll figure it out pretty quickly. I have a pretty vested interest in why I’m so heated about that particular name. Just saying.

Tobias: The first round of stimi checks, they didn’t go into the market. You don’t think, via Robinhood?

Bill: Yeah, I think some of them did. That’s what Barry Diller said on CNBC today. I think there’s a reasonable argument to be made that it just went to gambling.

Tobias: Don’t give it to college kids. Give it to people who need to eat.

Bill: Dude, savings rates went through the roof too. We really are primed for a boom here. I know that that’s counterintuitive. Morgan Housel wrote a really good article about that. There’s really credible arguments to be made that the economy is going to do just fine in a couple of years or maybe next year. We’ve just got to get over this whole virus thing first.

Tobias: Scotty Jackson–[crosstalk]

Bill: There we go. Google demonetized us.

Tobias: He says, “Lacey is long treasuries.”

Bill: Oh, shocking.

Tobias: Hoisington’s still long treasuries. They’ve been on that trade since 1995. Yeah, I’m sure they still long treasuries.

[crosstalk]Tobias: Yeah. That’s been the best– [crosstalk]

Jake: Even equity.

Tobias: You didn’t need to do anything else. That’s it. You just needed to be leave it long treasuries and just let it ride, let it ride.

Bill: If Robinhood was built or bought by IAC, would I change my mind? No. I don’t know. If you know what I went through with that company. There is nothing that will make me change my mind. That’s the answer.

We Need A Bigger Boom

Tobias: Yeah, “Is the boom priced in?” That’s a good question.

Bill: Yeah, probably.

Tobias: I think this boom and the next one are already priced in. I don’t know.

[laughter]Jake: We’re going to need a bigger boom.

Tobias: Yeah, I think that’s true. I slightly changed my methodology. I’ve been running my market estimate–

Bill: [laughs] Bigger boom, that’s just hippie.

[laughter]Dividends – The Difference Between Positive And Negative Performance

Tobias: The estimate that I’ve been running it back to the median CAPE over the last, like 170 years, so I change it to the mean CAPE, which is a little bit to the [crosstalk] it’s about 15 point. Mean is currently about 16.7. If you assume, we go from here, back to the mean over a decade, you’re still negative. You’re still negative on the index, but if you include the dividends, dividends will be the only thing. Dividends are going to be the difference between negative and positive performance in the index over the next decade. Plus, depends on how long it takes to get back to long run. Maybe we never go back to it, maybe we stay at 35 times forever, in which case, you’re going to earn like 3% or 4% a year.

Jake: That trillion-dollar profit pool and I’m getting trillion dollars in Uber dividends.

[laughter]Jake: Makes it, you’re there.

Tobias: Well, I think to be fair, once you’ve got the platform built out, you’ve got to update it a little bit. There’s not much to do.

Jake: Once you get to $6 trillion TAM, once you’re scaled to that, I don’t know what you spend money on.

Video Games Recurring Income

Bill: It is super interesting these business models that have come up. Again, my buddy, Francisco, is talking to me about– Take-Two, and how they have, and I should not just credit him because, my boy, Alex, has been saying that, too. Anyway, how recurring the revenue stream has become within video games. If you watch your kids play video games, they got to buy everything now. The amount of personal beef that comes into my house, me and my oldest, he’ll hit like inning two in his baseball game, and will start crying because he can’t play more innings, then I’ve got to go buy more innings. I’m like, who sells a baseball game like this? I don’t know, it’s interesting to see how that industry is sort of evolving. I’m not sure I like it very much, but there’s nothing I can do about that.

I do like Oculus. By the way, Apple, I think is going to crush Facebook in that, because I think that the big thing that with Oculus is, like, the resolution just isn’t quite crisp enough. I think that’s right in Apple’s wheelhouse.

Tobias: It’s early, though. It’s early.

Bill: Yeah. That’s why I think they’re waiting to drop it.

Tobias: The first VR that I saw was just garbage. You turn your head, and the thing was like slowly– [crosstalk] Yeah, that was the idealized version that you saw on the screen, not even– the real thing was just awful. It’s amazing how far it’s got. If the resolution is going to get better over time, that’s the killer app. You’re not going to need any other app. If you can stick your glasses on, there you go. You don’t need a laptop. You don’t need a desktop. You don’t need your phone anymore. You just need whatever powers those glasses.

Bill: I think that’s a problem with the Nintendo idea. Nintendo’s always been a hardware-software thing. I just don’t know that I think that they’re going to pivot to somebody else’s platform. If they do, it could be sweet. It’d be wild if you’re Super Mario and you’re just running around your house jumping up like this and stuff, that’d be fun.

Tobias: How hard really is it– I say, how hard it’s– [crosstalk]

Bill: Well, it’s a willingness.

Tobias: Okay. Even if they’re [crosstalk] they’ll get there.

Bill: I don’t know that they have the willingness. Yeah, maybe, I don’t know.

Tobias: There’d be lots of competing.

Jake: Yeah. [crosstalk] The story Nintendo has always been though is that they run substandard or sub cutting edge technology, but it works really well and they have engaging content that’s well placed for the demographic that they’re aiming for.

Bill: That’s fair. I can’t get my kids the Oculus to have them play Superhot and pretend to shoot like actual people. That’s crazy. That game is crazy. Crazy.

Tobias: Superhot.

Bill: Yeah, dude, it starts to move when you move. That’s how you start the game. You start doing this, and then people shoot bullets at you. The bullets don’t move until you move your head, you can watch them go by you. It’s like being in the Matrix. It’s crazy.

Jake: Oh, really? Like bullet time? What was that game? Max something? Max Payne, did you play that one?

Bill: I did play Max Payne.

Jake: That was pretty sick.

Bill: Sort of different. It’s really weird, but it’s cool.

Look For Special Situations When The Markets Expensive

Tobias: All right, I’ve got a good question. This might be the last one. Is it reasonable to focus on special situations, arbitrage opportunities in this kind of market, given where valuations are? Is it just a bit risky? I would say it’s the other way around. Special situations are the thing that you probably want to be doing. This is what Buffett used to do. When the market got really expensive, you do market-neutral special situations that don’t depend on what the market does. That doesn’t matter about the multiple you’re going to get paid depending on what happens in the special situation, which is why I like the Qurate transaction that Bill and Michael Mitchell put on, because you get your money back and then it doesn’t matter what the stock does after that. It’s a free hit.

Bill: Yeah. I think if you can find special seats right now, that would be a fertile ground that I would enjoy, at least with the part of my portfolio.

Jake: I think they’re under– It’s in a capital cycle theory way as well, where I think a lot of money is left the arb space because it’s just been anemic. There’s just hasn’t been the spreads and it’s too efficient, not enough deal flow for that. I think there could be some interesting things going on there potentially. It just might be a new heyday for that style.

Bill: Yeah. One reason I think you can follow SPACs is there’s going to be busted SPACs, like you know that.

Jake: Pre-busted, before it’s even closed. [laughs]

Bill: Yeah, that’s right. You might be able to arb some of that. There might be one that goes[?] and bust. There’s things to pay attention to, I just don’t know that there’s things to do, if that makes sense.

Jake: Yeah, agreed.

Tobias: That’s it, folks. That’s time. Thanks so much. We’ll see you next week.

Bill: All right.

Jake: Cheers, everybody.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: